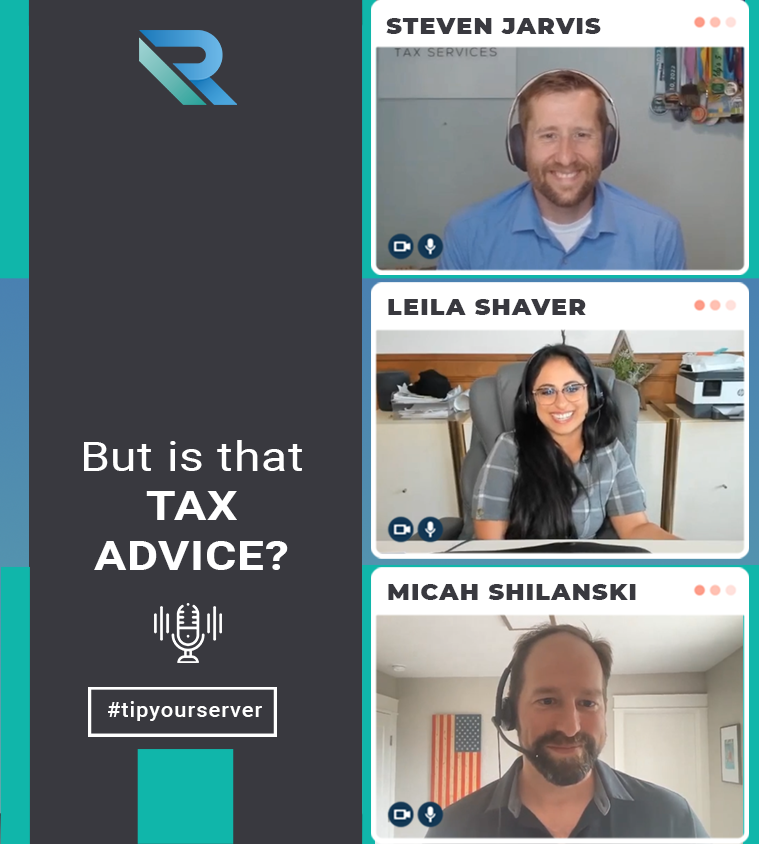

But Is That Tax Advice? With Special Guests Leila Shaver and Micah Shilanski

Financial advisors are generally not qualified to give tax or legal advice when helping out clients. However, these are both important steps in the financial planning process. So, what advice can advisors give without crossing any lines—while still providing the most value to their clients? Micah Shilanski, CFP, and attorney Leila Shaver join us on this episode to discuss what is okay (and what is not okay) to talk about with your clients as an advisor.

Listen in as they explain who is actually allowed to give specific advice around certain subjects, as well as the importance of working with your compliance department to avoid getting into trouble. You will learn how to lower your risk of penalties, how to differentiate interpretation from application, and why you shouldn’t use your lack of knowledge as a crutch for not giving your clients specific advice.

Steven and his guests share more tax-planning insights in today’s Retirement Tax Services Podcast. Feedback, unusual tax-planning stories, and suggestions for future guests can be sent to advisors@rts.tax.

Are you interested in content that provides you with action steps that you can take to deliver massive tax value to your clients? Then you are going to love our powerful training sessions online. Click on the link below to get started on your journey:

Retirementtaxservices.com/welcome

Thank you for listening.

We’re not overpaying. No, we’re not overpaying. We’re not overpaying anymore. The tax code’s complicated, boring, and overrated. You don’t want that, you want a pro. One thing that you should know: this is a radio show. It’s not tax advice, don’t take it that way.

Steven Jarvis: Hello, everyone, and welcome to the next episode of the Retirement Tax Services podcast, financial professionals edition. I am your host, Steven Jarvis, CPA, and I’m really excited for this week’s episode. We actually had recorded it previously, as I was a guest on The Perfect RIA podcast with Micah Shilanski and an attorney, Leila Shaver, and we’re just going to go ahead and play that episode. There’s some great insight there related to tax advice, versus tax planning. So, here we go.

Micah Shilanski: Welcome back to another amazing episode. I am your co-host, Micah Shilanski, but not with me today is not Matthew Jarvis. In fact, we replaced him with two amazing guests. One of them, you guys know from previous, is our good friend, Steven Jarvis, with Retirement Tax Service. Steven, how you doing, sir?

Steven Jarvis: I’m doing really well, Micah. I’m glad to be here.

Micah Shilanski: Excellent. And we actually have another special guest that has not made an appearance on our podcast yet. But if you don’t follow her, you should; Leila Shaver, who is an attorney who’s going to answer all of our complex SEC and FINRA questions. Leila, how you doing?

Leila Shaver: I’m well, Micah, excited to be here.

Micah Shilanski: Yes. Now, quick little plug for Leila is years and years ago, I had a buddy that had a play go against him in the BD world, and it was a BS one. It was from a friend of somebody wasn’t even from a client that had submitted this. And the BD was requiring him to report it and to go through all of these complicated things.

So, he ended up shooting over to me. I’m like, “This is BS, this isn’t a complaint. Here’s the rules, here’s how it reads, et cetera, et cetera.” Ended up calling a handful of attorneys and all of them kind of across the board said … didn’t even know what the rules were. They were kind of making it up on the fly. So, I was getting kind of irritated looking for a good SEC attorney.

And I ran across Leila, and she was the only one that on the fly could answer the correct rules about what complaints were or what they were not. So, that is what had us impressed.

So, Leila, don’t disappoint. I’m just saying I’m building up here. So, really expect some high performance today.

Leila Shaver: I’ve never had any complaints.

Micah Shilanski: Perfect, perfect. We’ll go with that. Alright. Well, we wanted to have you two on the podcast, because one of the things we hear about so much from our listeners, as you guys know, we are huge into tax planning. We’re huge into estate planning, which gets into the legal side as well.

But we get this feedback all the time from advisors that says, “Well, I can’t give tax advice. I can’t give a legal advice.”And it’s like, well, news flash, neither can we. I’m not a CPA nor am I an attorney. So, I can’t give advice in those areas. But where’s the line?

And then we get our BDs that can push back on us that says, “Well, you can’t talk about Roth conversions because of this. You can’t talk about estate planning documents because of this because you’re not an attorney, et cetera.”

So, I thought it’d be great to have us together. We got Steven, you, on the CPA side, Leila, we have you on the attorney and SEC side that can come in and says, “Okay, let’s dissect this a little bit, because sure, there’s a little bit of gray area, but there’s also some pretty solid grounds where advisors can give and talk about these particular things without crossing into giving legal advice,” or at least that’s my opinion. Hopefully, I’m not going to be wrong. Leila, what are your thoughts?

Leila Shaver: I agree. I think what prevents a lot of advisors from kind of going down these paths is they just don’t know. They haven’t been taught, they haven’t been told, there hasn’t been real clarity over the dos and don’ts.

And I hope this is an opportunity for them to take what we’re discussing today. And hopefully, they’ll feel empowered to go right back into their offices and start having these discussions.

Micah Shilanski: Love it. Now, Steven, you work with a lot of advisors on the retirement tax services side. So, you get this cool role that is not only helping advisors to understand taxes, but you actually get to communicate directly to their clients with them so they can avoid this whole tax advice issue that sometimes come up with BDs. But what do you hear from advisors?

Steven Jarvis: Micah, in my experience working with all these advisors, is that there’s this fear around tax advice. Whether it’s in the BD world or the RIA world, maybe it’s a spectrum. But it’s “I don’t want to give tax advice because some terrible thing is going to happen if I do give tax advice.”

But I honestly can’t tell you of any stories that people have told me about what that terrible thing is. There’s all this fear and anxiety, but it’s what is it you think is going to happen? What is worst-case scenario for you that you give this alleged tax advice and now what crazy thing is going to happen?

And no one ever sees it through to that end. They just kind of stop at, “Hey, this might be tax advice, so I better not do anything.” And so, as I work with advisors, I really try to focus on what are we trying to help the client do. And then, how do we get there?

Micah Shilanski: So, as the advisor side, and then Leila, I got a question for you, ma’am. As the advisor side, when I was back at a BD, here was my concern that would come through.

I would give a tax recommendation to a client from a financial planning standpoint. Let’s just say it wasn’t even close to SEC or FINRA issues, but it violated the policy of my BD.

Now, I got some compliance dude that says, “You’re giving tax advice.” I say, “No, I’m not.” He says, “Nope, this violates our policy. You can’t give tax advice.” Boom, I got a 30-day letter and now, I get kicked out.

Which not so funny, I was talking to a guy yesterday who is at Wedbush, and he was just getting off the phone with a friend that that kind of happened to him, and he was a $900 million shop.

Yeah, so it’s not like he’s some low-end producer that went somewhere. He got a 30 day notice and it was so great the BD sent it to him. They’ve known about this issue for two weeks. They also knew he was going out of town to Israel for two weeks and they sent it to him the morning he was leaving. Isn’t that just outstanding?

Alright, so that’s the fear right now. I’m not saying that’s valid or what not, but from the advisor, that’s my fear going through this. So, Leila, help us out here. Let’s just focus on tax. I want to get to the estate planning and legal side too.

But let’s focus on tax and let’s make it super easy. I got a client that, in their situation, I think would make sense for them to do a Roth conversion. Tax rates are going up. Based on our current tax law, we just know that’s going to happen.

So, tax rates are going up, I think they should do a Roth conversion. What’s tax advice? What’s not tax advice from the FINRA SEC world? What am I allowed to say or not?

Leila Shaver: You can talk to your clients about different investment vehicles. You can talk about the implications of those investment vehicles. You are required, especially in the RIA world where you are held to a fiduciary standard — you’re required to talk about tax implications as certain of these investment strategies and products. Alright, so that’s the easy part.

Now, you’re talking about a recommendation on using a tool, to give them more advantageous tax circumstances. You’re allowed to talk about that. Now, I think where a lot of advisors get uncomfortable is because most advisors don’t have access to their client’s entire portfolio of investments. You’ve got these, oh …

Micah Shilanski: Stop right there. That’s going to be an action item. You need to fix that one right there. We’re going to get to that in a minute. So, sorry Leila, please continue.

Leila Shaver: But that’s one of the concerns is I’m giving advice on something that I may not know the whole picture, but I think that’s where you can provide disclosures. You have that CYA communication that you put in an email or a letter, but that’s what it is; “Based on what I can see and have access to, this would be an advantageous tax vehicle for you to do this, and this is why.”

And then, of course, you can always put in like that kind of catchall, “But talk to your tax attorney, talk to your CPA. If there’s something else that I don’t have access to, that may change this.”

But I think that’s something you absolutely should. I think you fail to meet your responsibility as a fiduciary if you avoid that conversation.

Micah Shilanski: So, and that’s just not on the RIA space, that’s a CFP. If you’re a CFP, then you’re supposed to be a fiduciary. Now, I can make fun of that all day long, but that’s a different discussion. So, you’re supposed to hold to those requirements.

I think Leila, one of the best disclosures I got from a BD when I worked with them was they wanted me to put a disclosure on giving tax advice and it says, “Fine Micah, you can say they should do a Roth conversion but you got to tell them to talk to a competent tax advisor.” Oh, you just said I was the incompetent. Do you know what that means?

Leila Shaver: Oh God, that’s something I could have fun with all day, like who’s considered competent. It’s the same way I say that just because you have a JD after your name doesn’t mean you’re a competent attorney. You have to also consider BD world’s a completely different beast.

You have regulation, best interest. You have firms that are large and antiquated, aren’t properly staffed in supervision or compliance. So, it’s simply easier to put together these policies and say, “No, don’t do this. And if you do, you’re going to get in trouble.”

With no basis in regulation, fact, law, whatever, it’s just a mere fact that they’re not well-staffed enough to deal with it.

Micah Shilanski: And keep in mind, let’s give them — and Steve, I got a question for you on the same thing in just a second, but let’s keep in mind how this is set up that their job is not to have the same education level that you have. They don’t, that’s not their role. Their role is fully to understand compliance and to protect the firm. That is their job.

So, when we’re working with compliance, it’s just that we’re working with compliance. They shouldn’t be viewed as an obstacle. Yeah, we can rag on them, we can do these other things, but we got to work with our compliance department if we want these things to go through.

In that particular case, if I had called up and called the guy a frigging idiot for calling me incompetent, he might have just dug in. And then what’s my recourse that’s there versus having a little joke about it, talking about it and saying, “Hey, I want to make sure we’re all protected. Is there another way that we could reword this? And let’s ask for some help as we go through this.”

Alright, Steven, same discussion. You are the CPA, I am not. I told a client to do a Roth conversion, regardless of whether you think it’s a good idea or not, would you be offensive and say “That man, Micah, as a CFP has now crossed the threshold” and from your perspective, I’m giving tax advice.

Steven Jarvis: So, Micah, whether I’d be offended or not probably depends on when I find out about it. Because honestly, it’s interesting you ask the question that way. When clients come to me, and like you said, I work with advisors all the time and shared clients — I’m not actually thinking in terms of, “Hey, was this tax advice or not?”

I’m just thinking about, okay, what are the tax implications? And are there anything else we need to consider? I’m not taking the time to evaluate whether you gave tax advice.

But why I started with when I’m finding out is because where a lot of advisors get this wrong is that they talk to their client about a tax topic, they put their disclaimer at the end of, “Oh, but you should go talk to a competent CPA if you can find one.” And then they just either assume that the client will follow through or they don’t care if the client’s going to follow through.

And so, what usually happens is that the tax preparer finds out about this in March on the tax return. And at that point, I’m maybe not offended, I’m probably angry that if there was something else we should have considered, I have no opportunity to do anything about it. And so, at that point, again, I don’t care if you gave tax advice or not, you didn’t set your client up for success.

And I’ve worked with advisors at some of the bigger BDs in the country who are doing tax planning with compliance approval, to your point, Micah, because they proactively, and as a partner, work with their compliance department.

And the ones I enjoy working with are the ones who come to me during the year. They come to me in July or August or September and say, “Hey, here’s what we’re recommending to our client. Is there anything else we should be considering?”

Because then, I don’t need to sit back and say, “Well, is this tax advice or not?” I can just say, “Okay, from my experience, are there other things we should be considering for this client in this situation?” And we get the client to where they need to be.

Micah Shilanski: Okay, so that would feel good about … I like that answer. And that’s all about proactive communication with your CPA. That’s what it is.

So, Leila I’m going to knock this one back over to you; what is tax advice that I could give as a financial advisor that would get me in trouble? Where do I cross the line?

Leila Shaver: That’s the hard thing to define as where the line is. But generally speaking, I think where you’re taking tax code and interpreting it and applying it to a client situation, I think that’s where you’re getting into tax attorney area, CPA areas is when you’re doing that.

But when you’re looking at, say, an insurance product, and that insurance product has been developed because it meets a particular tax savings objective, that’s different. That’s, I think a different kind of conversation.

So, it’s one thing to say, “Hey, our government passed this tax law, this is what it means. This is how it applies to your circumstances. And so, now, we’re going to do this.”

That’s a different conversation from, “Look, you’re heading to retirement, you have these tax obligations. These are different vehicles that we know have been structured to lower your tax circumstances or your tax. The amount tax you’ll have to pay …”

Micah Shilanski: Liability.

Leila Shaver: Yeah, thank you liability.

So, I think those are different conversations, because then you’re talking about an overall investment objective that they have, everyone wants to save money on taxes when you’re talking about established products and vehicles that are meant to do that. That is different from interpreting law and applying it to a set of circumstances.

Micah Shilanski: Okay, alright. So, I got a doozy question for you then. The IRS consistently gives us information why Congress passes the law, then the IRS has to go through and interpret however they’re going to do this. And they may or may not do that in a timely fashion.

Let’s take the SECURE Act just for fun, because unless something happened today, I’m still working under proposed regs, which may or may not be true. And so, the problem that I have as the financial advisor is now, I have a client in a situation that we have to make a decision on but I don’t have clarity out there from any party.

The IRS doesn’t have any clarity on it, it’s all proposed regs. Don’t worry they’re going to penalize me if we screw this up, but I got to make a decision this year for the client, what do I do?

Leila Shaver: Well, this is really a situation where I know we’re going to talk about things to do after they listen to this show. But I think this is one of those things.

You should have someone that you can call up on speed dial and get some advice on how to proceed. In these kind of circumstances, I always kind of advocate for taking a more conservative approach.

Take what you know, take what’s in law today, not what you think is coming down the pipeline. Leave that to the experts to give you guidance on. And sometimes, it’s one thing if you’re the owner of your own RIA and you have to figure this stuff out, but if you are part of a larger corporate RIA organization or broker dealer, this is a good opportunity to reach out to the higher ups and ask for input and advice as well.

What’s going to be okay in terms of your conduct within the scope of the company and their policy, and get that kind of guidance from there. So, I know it’s not a super clear-cut response, but you also want to mitigate any risk of litigation.

Micah Shilanski: Yep, on either end. And this could be an issue where you don’t even have a client complaint. But the BD, the RIA, the SEC takes adverse reaction to you because they don’t like the way you did it.

So, not every time you’re going to get an action against you from a compliance standpoint — has to initiate from a client complaint. Well, I’m making that up. Is that true?

Leila Shaver: That’s very true. We’re dealing more and more with legal advisors. We’re dealing more and more with advisors that are being terminated for cause for violating certain policies of the firm that don’t necessarily align with them having done anything wrong from a legal or regulatory perspective.

So, I think that this would be a really good situation to follow up with your firm. If there is a chief investment officer or someone within the organization that can provide that guidance. There are a lot of these larger firms that will take positions until they have an attorney that advises them otherwise.

Micah Shilanski: Most of the times, I would say the advisors who are getting terminated because of these issues, the first question, especially this one, I heard about just yesterday, this weekend; the first question I asked after I found out why he was terminated, I said, “Oh, who’d you piss off?” Because that was the real issue. You had already made somebody mad and they were looking for a reason to get rid of you.

Alright, Steven, from your perspective, the CPA, let’s just take the SECURE Act. We got proposed regs. We have no idea what it is. We have to make decisions to file on their taxes. You got to make one of these decisions with a client, with an advisor-client, direct-client relationships, etcetera, what are you going to do?

Steven Jarvis: I’m definitely going to take a similar approach to what Leila is talking about of when we’re dealing with proposed, and to your point, the IRS doesn’t have a good track record of setting up for success on these things. And they’re also not really big on logic or reason on a lot of things.

Leila Shaver: Amen, amen.

Steven Jarvis: So, yes, I mean, conservative is the word that comes to mind. I don’t know that that’s always the correct word for it, but I’m going to take a cautious approach.

I am going to take a wait-and-see approach for as long as I can, fully acknowledging that we still might get to a point where it is proposed regulations and we have to make a decision. And then I’m going to take the information I have and make the best decision I can for that situation.

I’m going to make sure it’s clear to the advisor and to the client that I’m going to say, “Hey, listen, we’re dealing with proposed regulations here. Here’s what I’m looking at and why I’m recommending this for your situation. And we’re going to keep looking at this, we’re going to come back and help you if this comes out differently.”

But if we can wait, I’m going to wait. But sometimes we’ve got to do the best we can with what we know right now.

Micah Shilanski: So, the way I’m going to do that from an implementation standpoint and let me know if you guys would have any better ways of doing that. If so, don’t worry. We will post-edit this thing so I don’t look totally bad.

Alright, what I do with a client is, I think Leila, to your point, you have to explain both sides of it. So, I’m going to come to the client and let them know, “Look, this is uncharted territory. The IRS has not made a ruling on this that any of us know. It could go either way. Here’s the reason we’re recommending this. Here’s why it could go but here’s the downsides if the IRS rules this other direction.”

Then what I want to do is I want to… actually, before that, I want to bring in my third parties, I want to bring in another financial advisor to look at this to say, “Hey, is there another area that I missed in this initial specialty?”

I also want to bring in another CPA; why do I go to another financial advisor first? (Sorry, Steven) They’re generally easier to work with and more educated on how this crap works. So, I want to bring them in first to this and say, “Hey, what am I missing? Give me some insight on this.” Okay, great, this other advisor agrees, perfect.

Now, I want to go to the CPA because now I’ve got two financial advisors when I go to the client’s CPA. Now, if I’m working with Steven, this is a piece of a cake, I can call Steven up. We have a great relationship.

I got a couple other CPAs that I have great relationship with. I have a bunch of CPAs that work with my clients that I don’t have great relationships with. I got to work on those.

So, as much groundwork in my favor as possible as I go through that, when appropriate, we need to bring in attorneys. I try to avoid attorneys. Why? Because they’re going to send my client a giant bill with no answer whatsoever.

I know. It’s not you, not Leila. That’s not how this works, but that’s the process I’m going to go. Then I’m going to document the heck out of it, and I want everyone to sign off on it, including the CPAs.

So, that’s the process we would go through if it was a really dicey situation like some of the things we’re seeing with the SECURE Act and not having to make decisions and not knowing what’s going to happen.

Steven Jarvis: Micah, I think that sounds great for an approach with the SECURE Act. I want to take a second, maybe I’m going off in the wrong direction here.

But for people listening, this gets to what Leila said earlier of interpretation versus application. When we’re dealing with proposed regs, we are very much in the realm of interpretation. That’s why there’s such an involved process to what you’re describing, but don’t take that and apply it to every other tax situation.

Micah Shilanski: Such a good point.

Steven Jarvis: There’s so much tax code out there. It’s law it’s been interpreted. We know in general how the IRS responds to it, whether we agree with it or not. That’s not relevant.

We know how it’s been applied, and so there is so much that advisors can do that is established tax code, it’s established tax strategies. And now, we’re just talking about how does it apply to this situation. And we can do that all day.

That’s where we’re making recommendations based on kind of established best practices, established policies and planning. Maybe the process isn’t quite so involved. We still want to make sure that we’re asking good questions and have a process for it. But there’s this whole ocean of tax planning we can do that is not interpreting proposed or existing tax law.

Micah Shilanski: Yeah, don’t use it as the crutch. I hear this from advisors all the time that don’t want to spend the time to learn about taxes or to learn about it. Their crutch is, “Oh, I can’t give tax advice. Oh, I can’t give legal advice. I can’t recommend they get a will because I can’t give legal advice.” That’s not legal advice.

Leila can correct me on this, but telling a client from a financial planning standpoint, they need a will, a healthcare director, a durable power of attorney, a HIPAA release form and potentially a trust, I don’t think that’s legal advice.

Now, if I’m drafting the trust, okay, I think I might have crossed a couple of lines.

Leila Shaver: Completely in agreement. Definitely talk about it. I think it’s important to talk about it. Because financial advisors are often the center of influence in a person’s life. They are the expert that clients come to and say, “Hey, who do you know, who can help me with this?” And they’re oftentimes going to rely on your advice and act on it.

So, absolutely, those are key things that you should be telling your clients you should do. Because let me tell you, probate is a pain in the butt. You want to shield your heirs from these crazy weirdos that show up in courtrooms, trying to find out what’s in the estate so they can manipulate the heirs into turning over or relinquishing their ownership of these different assets.

This is just one more step in protecting your client. So, absolutely you should have these discussions, whether it’s estate planning or tax.

Micah Shilanski: And depending on just like on tax or estate planning, or any area of the financial planning element, go to the conversation to the limit of your knowledge. Where you’re going to get in trouble is when you exceed your knowledge. When you start making stuff up, this is how I think it works, but I have no experience in that.

That’s when you’re going to start getting yourself into trouble. And that’s when you got to hit the pause button. And to our advisors out there listening, and I know you two know this; it’s okay to tell a client, “I don’t know, I’m going to reach out to an expert in this field and I’m going to get back to you with an answer.”

I have never had a client push back and get mad at me because I told them I need to hit the pause button because I don’t want to give them the wrong answer. They’re like, “You know what? I really respect that.” And then I can reach out.

The biggest thing with this is the follow-through. Do I actually do what I said I was going to do? Reach out to somebody else, get that advice, and then come back to the client with what that should be.

Alright, so on that note, so we talked about some simple things for like Roth conversions isn’t tax advice that’s going to be there. What would you say Leila is a great way that you should proactively work to find out … a lot of our advisors that have other BDs, other RAs, et cetera, they should proactively work with compliance to expand the line.

Let’s say they’re really limited, they don’t think you can do Roth conversions, they don’t think you can do tax sales harvesting. They don’t think you can do these other things – where do we help expand that line with our compliance department?

Leila Shaver: Sure, so let me start by saying this about compliance people; they’re for the most part, very well-intentioned people, but what I have seen and what our firm has seen is that compliance departments are severely understaffed and they don’t get enough resources for continuing education, keeping up with trends, keeping up with changes. And oftentimes, it comes down to what did a supervisor tell them? Yes or no?

I think that’s why so many advisors call them business prevention departments. Because I mean, it’s true because they just don’t know the why behind the yes or no that they’re giving. It’s someone told them this is a circumstance you say yes or you say no.

And again, it goes back to those staffing issues. When you have really big organizations that just cannot keep up with all of that. So, if you’re at that kind of firm, then I would say it’s not going to get any better. So, maybe start looking elsewhere.

Micah Shilanski: That is one solution. Alright, fair enough.

Leila Shaver: Listen, there’s a lot of consolidation happening in the marketplace. I mean, that’s just a reality. As firms get larger, they’re going to be able to spend less and less time with you one-on-one.

There are rare circumstances where there is a firm that you still have entryway into someone that’s in the higher up executive position. To the extent you have that access or someone in compliance that’s willing to listen in and fight your cause with you, then definitely go and make an argument.

Teach them, bring in your data, bring in your resources, be able to cite to whatever publication or law or whatever else that you’re citing to and make an argument. It’s worth your while to do so.

But then if you’re finding your firms just not open to it, there’s so many firms out there now that you can pick from. Don’t stay someplace just to stay someplace. You have a lot of opportunity out there.

So, go make the argument, pitch it. Depending on the response you get or the support you get, that’s either good indication that your firm wants to work with you and they may change their policy. Or they may just flat out be like, “No, this is not happening. This is our policy, that’s that.”

In which case, there are firms out there that will help you. So, maybe not the answer you were looking for, but I think it’s important. I will say a lot of advisors come to us to provide the expertise and to make that argument for them as well.

So, rely on outsourced providers that can come in and help you fight your cause as well.

Micah Shilanski: Well, this podcast is all about action items. We want to make sure that we’re giving our listeners something that they can do and implement right away so they can improve their practices.

Steven, I’d love to start with you; what’s the first action item that we should have for our listeners?

Steven Jarvis: Micah, one of the things you said that stood out to me was basically not planning with clients on things that exceed your knowledge. And so, one of the action items I want to recommend …

Micah Shilanski: That’s mine.

Steven Jarvis: Yes, I feel even better on my action item than if I took it away from you — is make sure you’re setting aside time to learn.

This is a great thing about having a niche that you focus on. You can take just a sliver of the tax code. And I’ll take this one step further to make sure you’re learning from other professionals. Be strategic about this. Learn from professionals you would like to have a great relationship with.

Call a tax attorney, call a CPA and say, “Hey, here’s an area that comes up with my clients on a regular basis. I’d love to pay for an hour of your time and get your thoughts on how to approach Roth conversions or whatever it might be. ”

You’re going to build a great relationship, you’re going to learn a ton. You’re going to set yourself up for proactively communicating with these people later on. You’re going to keep elevating what that level of knowledge you have is in that particular area.

Micah Shilanski: Steven, I love it. I just finished the book, Sustain Your Game. And that’s actually one of the biggest things they talk about, of the rock stars of the rock stars. Not the top 1%, but the top 0.001% of athletes are constantly looking at ways to perfect their fundamentals.

They’re constantly looking for ways to perfect what they’re doing and pushing those limits in those ways and never plateauing. So, I love that. Leila, what about you? What’s an action item for our listeners?

Leila Shaver: Well, you mentioned books and I was thinking about the book Relentless. Yeah, I love that one.

So, in the same way, you kind of have to be relentless with your firms. And I think it really helps to kind of create your sphere of influence. Go and do some due diligence. Find CPAs, find attorneys, create relationships with them, not just for the education component, but so that you can refer clients to experts.

So, where that kind of where you approach that line and that boundary from application to interpretation, you can do that handoff and introduction, and yet as a service provider that you know is going to do a good job.

Because the last thing you want to do is take a relationship you’ve cultivated, worked really fricking hard to make a happy client and then turn them over to some like … I like to curse Micah so this is very difficult for me; some POS that treats them with disrespect, doesn’t communicate.

I’m in a law firm coaching group and they call it The Firm 100 — a hundred different service providers. So, if your client needs a boat contractor, you have someone in your “Rolodex.” I know I’m aging myself talking about Rolodexes, but I think I’m in good company.

Micah Shilanski: What do you mean aging yourself? You’re not old enough to remember Rolodexes, but whatever.

Leila Shaver: I have one, what are you talking about? I love the old school stuff. That’s how I know I’ve gotten old.

But yeah, I think it’s really important to go out and find these really key players that can be people that you refer business to, that you bring in for their level of expertise that A, helps you stand out from your cohorts and really makes you stand out when it comes to the pool of prospective clients that want to find a financial advisor.

But I think it’s really important to all the points we’ve made today of constantly being on your game and learning more and being able to provide that to your clients.

So, education piece is great, but I think doing the due diligence and having that core group of professionals that you can bring in and support your role as financial advisor is really key.

Micah Shilanski: And for our members of The Perfect RIA, keep in mind, we have checklists on how to interview COIs from attorneys and CPAs. So, if you’re going to meet with them and you need a checklist to go through it, take ours, modify it, tweak it, whatever. But at least, it’s a template to start with as you start working with these other ones.

Alright, Leila the other one I’m going to add to the action item because you had said some weird thing at the beginning. It just like blew my mind — that a financial advisor doesn’t have all of their clients’ assets. So, if that is still happening, as crazy as that may seem, boy, hard push on this one, you got to get your client’s assets.

And this isn’t from a revenue standpoint, this is from a planning standpoint. I truly believe in my heart of hearts if I do not have my arms wrapped around this entire package, I cannot give them good advice. And that is a deal breaker for me.

Now, I got a client who’s working in the TSP. No, I can’t transfer the TSP over under certain circumstances. I’m not saying that, but I got to have my arms around every single piece of their financial plan in order to give real advice. And when that asset is eligible, yeah, it needs to come over so that we can help do that financial planning.

Otherwise, you’re setting yourself up for a complaint and I’d rather have you chat with Leila about fun stuff that’s going on or maybe just ADV updates, less fun, but routine stuff. Than “Oh crap, I got a client complaint” and now, she needs to fight that for you.

Alright on that note, Leila, where can our listeners find out more about you?

Leila Shaver: Sure. So, we’re all over social media, myrialawyer.com is our website. And you can find us on LinkedIn, Twitter, and Instagram. You can pretty much find us anywhere. We also have some great videos on our YouTube channel. Again, it’s my RIA lawyer.

Micah Shilanski: Perfect. And Steven, our listeners already know a lot about Retirement Tax Services because you guys do such wonderful work, but tell us more; where can our listeners find out more about you?

Steven Jarvis: The Retirement Tax Services Podcast is a great place to hear tax-focused content for advisors. I’m very active on LinkedIn.

Micah Shilanski: No TikTok channel just yet?

Steven Jarvis: No TikTok.

Micah Shilanski: We’ll work on them. Some CPA, TikTok dancing. Alright, well this podcast is again all about these action items. It’s about taking it, it’s about learning and improving. Now, help us with our goals. We got some ambitious goals this year to get this information out to more and more advisors.

So, if you think this is helpful, jump in iTunes, give us five stars. Come on, you made it this far. Five stars on iTunes. Share this with your friend to get this content out. And until next time, happy planning.

We’re not overpaying. No, we’re not overpaying. We’re not overpaying anymore. The tax code’s complicated, boring, and overrated. You don’t want that, you want a pro. One thing that you should know: this is a radio show. It’s not tax advice, don’t take it that way.