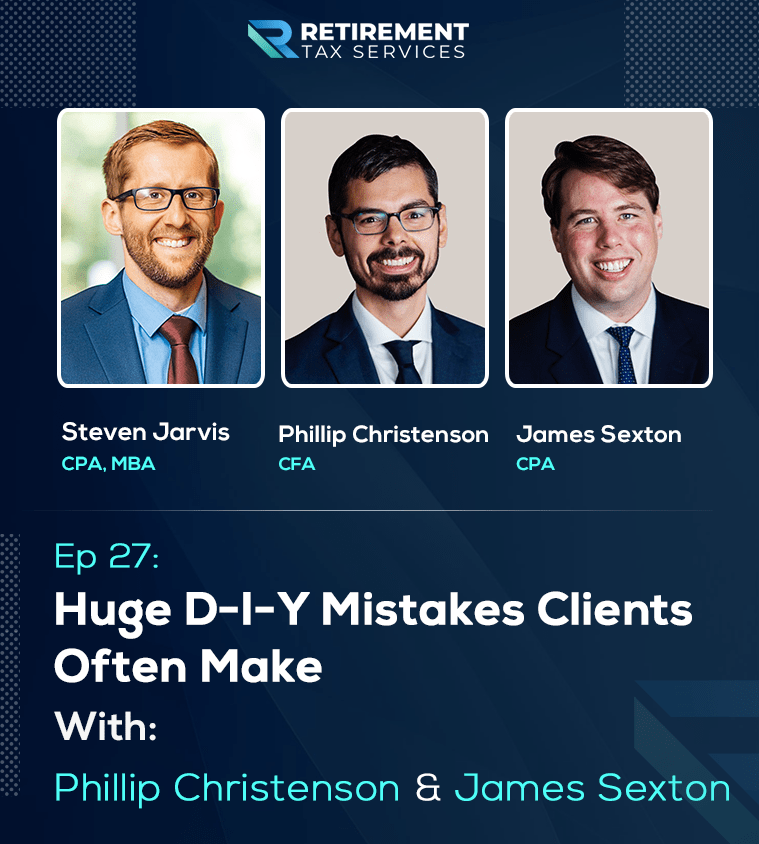

Welcome to the Retirement Tax Services Podcast! Steven’s guests for this Tax Q&A Friday are Phillip Christenson and Jim Sexton of Phillip James Financial. If you haven’t heard Monday’s episode with them, it’s well worth going back for. Today, Steven, Phillip, and James are focusing on the pitfalls of do-it-yourself tax preparation.

The question is “What do you typically see go wrong?” Between Roth conversions and other strategies, there’s a lot that financial advisors may have to fix.

Predictably, prospects and clients often fumble when converting Roth IRAs. An advisor would know to check their marginal tax brackets first. However, do-it-yourself-ers often don’t.

Instead, they confidently choose a round dollar amount (or an old 401k) to convert. As a result, they wind up converting $25,000 rather than, let’s say, $23,400. The latter amount could’ve pushed them up to the 22% tax bracket, but they miss the boat.

New clients sometimes aren’t fully utilizing tax-deferred accounts during periods of high-income earning, either. Most people have a 401k. Some employers offer Roth 401k options, too.

As a result, they’ve assumed that they should have a mix of accounts. However, if they’re in their top-earning years, they need to keep things tax-deferred. Until their income changes, that should be their sole focus.

Another area in which people get confused is tax loss harvesting. More to the point, some miss the chance to use it.

For example, let’s say someone has realized gains in one year. Maybe they’re reducing employer stock from a risk perspective: If there is market volatility that year, they could harvest losses and net them against the employer stock’s gains.

Many D-I-Y enthusiasts either miss that opportunity or don’t execute it correctly. They leave money sitting on the table, so to speak.

If someone is selling property, the same applies: They could offset a lot of that gain by harvesting the last couple of years’ losses.

Granted, tax loss harvesting is essentially putting off paying taxes by resetting the basis. Regardless, the potential benefit is significant.

Given a fortunate turn of the market, you could wind up with lower rates, once you actually pay. If nothing else, you could take the losses and offset up to $3,000 in ordinary income, too.

The average person might not consider listing that on their tax return. However, neglecting to, even out of ignorance, is leaving more money on the table.

The IRS’ wash sales rules are still out there, too. If loss harvesting is a ship, those regulations are rocks under the waves. Advisors may know to steer clear, but the uninformed still plow into them.

Consequently, there are a lot of moving pieces to this. In fact, there’s more than trendy headlines often suggest. Just because something is touted to work a certain way is no guarantee that it will every time. Do-it-yourself tax preparation can go sideways fast.

Don’t let this intimidate you away from expanding into tax planning. You just need to know the kinds of messes you could be cleaning up. It’s not enough to just skim those headlines.

Retirement Tax Services Podcast has a growing library of information for members. This, paired with our growing community, can often help prevent headaches.

Regardless of where you get your tax-related education, embrace it. You don’t need to know the latest tax code line-by-line. At the same time, the more you understand beforehand, the more value your clients will receive.

Steven, Phillip, and James share lots more in today’s Retirement Tax Services Podcast.

Thank you for listening.

Are you interested in content that provides you with action steps that you can take to provide massive tax value to your clients? Then don’t wait to sign up for our powerful online training sessions. Click on the link below to get started on your journey: https://www.go.retirementtaxservices.com/rts-registration

Steven Jarvis:

Hello everyone. And welcome to the next episode of the Retirement Tax Services Podcast: Financial Professionals Edition. I’m your host, Steven Jarvis, CPA. And in this show, I teach financial advisors how to deliver massive value to their clients through retirement tax planning. Now I’m fortunate to have back on the show with me today, Phillip and Jim, from Phillip James financial, they were on the show on Monday, talked a lot about kind of their journey to where they’re at and a lot of great information about doing Roth conversions. So, be sure and go back and listen to episode if you missed it. But they were gracious enough to come back today, to answer a question that I definitely hear from advisors around clients who do their own taxes. So guys, what’s your response to the question of what do you typically see go wrong with DIY tax preparers?

Phillip Christenson:

Yeah, that’s a, that’s a big question, but, um, I guess I’ll start off kind of going back to our previous show that we did with Roth conversions, and what we see a lot is people say… they get this idea in their head that, yeah, everyone’s doing Roth conversions, so I should too. And they go out and they just choose a round dollar amount, or they have an old 401(k) and they say, ‘I’m just going to convert that.’ But you have to look at your marginal tax bracket! That is what’s going to tell you how much to convert. And if you’re working with a client, if you just say, ‘yeah, I think we should convert around 25,000.’ Well, they’re not going to buy into that, but if you can say, ‘we’re going to convert $23,400, because that’s going to bring you up to the 22% tax bracket.’ Well, bingo! Now they know why they can get on with that, it’s a much easier conversation. But another one that we see a lot when, especially with new clients, when we bring them on is they don’t fully utilize their tax deferred account in their high income. So a lot of times, obviously most people have a 401(k), and nowadays you have Roth 401(k) options. And people think that they should just have a mix of those different types of accounts. But if you are in your top earning years, it should be 100% all be tax deferred all day long until your income changes, right? So we see that all the time.

James Sexton:

Another DIY investor mistake that we see coming in is tax harvesting, or not. More so not doing it when one is available and kind of making that plan. So one of the things we like to look at for clients is, is tax loss harvesting is one – and especially in years we’ve got realized gains that are going on – and so for whatever reason, they may be reducing employer stock from a risk perspective and realizing that gain and paying taxes on it. But if the market, if there’s market volatility in that year, that you realize the employer stock gain, you can harvest any losses that you have and net those against the employer stock, right? Or your employer stock . So more or less you’re pushing that, that gain into a diversified portfolio. And a lot of DIY wires, at least we’ve seen, don’t do it, or don’t execute it correctly, right? Because a wash sale rules, but that’s definitely one where you’re leaving money on the table in my mind, because, you know, you’re trying to reduce that exposure to stock, but you have to, to a certain degree from a risk perspective, but you’re also not being mindful of, okay, well, I’ve got some market volatility. I can, I can reduce that game and really be more tax efficient.

PC:

And kind of along the same lines of that, or what if they’re selling like a second property or something? Well, if you’ve been harvesting losses over the last couple of years, they finally decided to sell a piece of property. Well, heck you can offset a lot of that gain!

JS:

Yeah. And I, and I know what tax loss harvesting that the idea of, I mean, you’re just resetting faces at the end of the day. And so they say, well, you’re just pushing up your taxes eventually.

PC:

Right. But you got to step up the basis too. So you may actually never pay those taxes.

JS:

Exactly. Yeah.

PC:

Um, and you know, again, if you’re in your higher income earning years, you could be realizing, you know, paying 20% capital gains, maybe net investment income tax and all the shadow facts that we talked from, the Roth pieces. Again, you may be exposed to those now, but down the road, you would never be exposed to those, right? So again, you’re pushing that gain and maybe you realize that gain down the road is 0-15, much less than what it would be today.

JS:

So, you know, that’s also important, you know, from the tax perspective there.

PC:

Yeah. I guess if nothing else, if you’re doing tax loss harvesting and you can take those losses and I’ll set up to $3,000 of ordinary account, which is higher tax rates. Right? So yes, you can use, uh, losses offset, different gains and things like that. But if nothing else take those losses and put them on your tax return.

JS:

Yeah. Yes, exactly.

SJ:

I mean, as, as I listened to you guys as different answers, to me, what’s standing out is – both for DIY tax preparers and for advisors who are still trying to build their tax knowledge – It’s really important to understand that there are a lot of different moving pieces to this, and it shouldn’t scare advisors away from embracing tax planning, but more just understanding that it’s not enough to read the trendy headlines of ‘you should do Roth conversions’, or ‘you should do capital loss harvesting’ or, or whatever it might be. The IRS, nowhere in their core values is simplicity included, right? This isn’t just, ‘Hey, it should work this way. So it’s going to work that way every time.’

JS:

If you are doing what you had said, you know, there, there are loss sale roads, right? You have to be very careful though, because if you think you have a bunch of losses that you think you’re going to have, when you file your tax returns, so you’re going to take some gains or sell a property or whatever. But if you have a loss sale, you don’t get to take those losses. And it might be a surprise when you file your taxes. So you’ve got to be aware of all the rules surrounding that.

SJ:

So I definitely work with advisors who have these clients, who it’s almost a point of pride for them that they prepare their own taxes. And what’s the dynamic like? When you have clients who are doing their own taxes and maybe you don’t think they should.

PC:

Yeah, because of the way we operate to a certain degree, DIYers generally are, you know, we don’t run across too many of them. But for those that kind of reach out, or we maybe, I mean, I’m trying to think of guys.

JS:

I think we probably do 90+ percent of our client’s taxes. They have someone that they know, like a family member or someone they’ve worked with for years. And they just don’t want to need that.

JS:

Yeah. But usually it’s not a DIYer, I mean, even the people that, yeah. We’re probably not that that’s probably not for us.

SJ:

Yeah. No, I mean, now it’s just, none of that makes sense. Since you’re generating a lot of your clients from that tax side, they’ve already got that tax preparer in their life.

JS:

Well, and they want us to be the person in there, preparing, right. Even if it’s not just from the tax side to start. Once they find out, you know, a person that comes in for planning, and once they find out that we do taxes, they’re like, ‘oh man, this is fantastic. It’s all in one room!’ Right? So we do the, I would say it’s very limited in the number of clients that we don’t prepare taxes. And it’s like Phil said, it’s either friend or family that they just don’t want to stop their relationship.

PC:

When they come to us, they might be DIYers. But just by the fact that they’re coming to us, they’re, they’re willing to give that up. So like, ‘Hey, we know we need this extra help here.’ Even if they’ve been DIYers for five years, something changed. And that’s why they’re coming to you, you need to identify what that is, help them. And then that’ll lead into obviously wealth management and things like that.

SJ:

Yeah. Yeah. I think you’re spot on with that. It’s helping them realize what additional value you can provide. This isn’t about convincing them, why they shouldn’t do their taxes. It’s, ‘here’s the value of partnering with someone who can help you look multiple years at a time help you see these complexities that are there, that you might not have considered.’

JS:

Yeah, exactly. Once you start laying it out, like here, we need to do a projection. So you need to make sure you have a projection. We need to make quarterly estimated tax payments for this. Given you may need to fund this by this date, you know. You certainly making the list for the client, for what they’re supposed to do. And they’re like, well, okay, they don’t want it here. I’m sorry. I just want you to know that has happened to hurt some people, you know, here’s just, here’s a list that needs to be done. Here’s what you need to do if you’re doing it. Yeah.

SJ:

I love that. Not a, “Hey, the only option is to work with us”. But just helping them realize what all goes into execution. And so that way what makes the most sense is working with you guys. Yeah, I really liked that approach. Any other thoughts on things you see with DIY tax perparers?

JS:

Preparers slash investors that aren’t doing it on their own, right? So somebody that is just in general doing it, asset location for clients, for people that are DIY-ers, right? Yeah. That directly has an impact on their taxes down the road. Right?

PC:

Right. Yeah. So like, it’s not, it’s not something we’d see on their tax return, but you do see it, especially when they send you, you know, here’s my 1080 minutes, things like that. And you’ll look at what’s in these accounts, right? And if you do asset location right, you’re going to add a lot of value because – especially when you have a good amount of time. So if you’ve got 10 years before you’re going to draw on the portfolio, well, you got 10 years of growth where you can hold your small caps and all that kind of stuff in any sort of tax free asset that they might have. Right. But if they’re coming to you the day after they quit working, you can’t do too much, you know, you might be able to do some Roth conversions and fix their asset location then and there. But, but the value isn’t as great because the appreciation doesn’t happen. Like a big mistake we see is people come in and they have a good mix – the tests for tax-free and abject assets. But the portfolio is invested the same exact way in each account. It shouldn’t be that way. And you’re missing out on tens of thousands of dollars down the road, because it’s limiting how you’re going to withdraw that money.

JS:

You’re fighting an uphill battle to a certain degree, right? I mean, we’ve run into literally seen clients come in for prospects and say, ‘Hey, I’ve got, yeah, I’m converting 50 grand a year in Roth every year.’ I don’t know why that amount, but they, and, and he’s like, I can’t get any headway because my accounts just keep growing in my IRA. And then you look at, like Phil said, you, once you take a look at the account detail right, and the holdings in there, and it’s invested heavily in stocks and this tax deferred account that they’re trying to convert. Well, yeah. That’s, that’s the uphill battle – you’re fighting growth, you know, and bond sitting in their account. Tax-free roth. Yeah, exactly. So, you know, that’s, I think a DIY mistake that we see and run into every once in a while, and it has a direct impact on the conversion and has direct impact on the tax account.

SJ:

So is understanding where a client is coming from an intentional part of your discovery process, or is it just kind of happen naturally? Cause you, you both hit on really figuring out where it is they started from. And I’m just wondering if that’s informed by whether they come from another advisor or come from having done it themselves?

JS:

It just all happens through the process of the tax preparation. So it’s easy to say, yeah, we’ll prepare your taxes, but it’s a bigger conversation than that. And when we get a 1099, you ask the question, ‘Hey, how is this invested? Because I need to know for this, right? What income is going to be generated?’ All you, all these different questions that are helpful is maybe not necessary to prepare the tax return, but it’s going to help you get that tax advice, regardless of whether they’re a wealth management client or not. Your goal in handling a tax return is to prepare correctly and then give advice on top of that, give real tax planning. If the client wants to do it by themselves after that, then so be it. But more often than not, they say, “Wow, this gets complicated. I should have been thinking about this stuff. I’m not, do you help with that?” A perfect Segway!

SJ:

Yeah. I was going to say, that sounds like about the ideal screening process for new clients that you could possibly have.

PC:

And it is always things like that, you know, if someone is DIY-ing their own tax return, they’re going to miss things, right. They, they, they don’t look at the 1089 that closely, they maybe didn’t max out their HSA this year because they’re, they did with their employer and they don’t know they can do it outside of their employer. Right.

JS:

Or they missed a 1099 for a harvested loss or something like that, right, you’re not aware of it out there, you know? Yeah. Yeah. There’s many mistakes that DIYers can make. And again, it goes back to just in general – you got to have the knowledge, you’ve got to have the time and the drive to want to do it. And it doesn’t matter if you’re paying taxes, doing whatever it is. If you don’t have those three items, you got to pass it off to a professional. At that point, you’re not doing plumbing work anymore.

SJ:

Okay, guys, I really appreciate your insight on that question. For me, the biggest kind of takeaway or action item for advisors listening in, is to make sure that you’re taking the time to review these details of, you know, as one – as you’re describing one of those client situations. I mean, you’re talking about really only understanding what you can do to help with them after you’re seeing the documents, their, their statements, their tax returns, so that you know exactly where it is they’re coming from. So that really gets back to making sure you get those tax returns that you’re seeing their actual statements, that you’re not just taking their, uh, from the memory, uh, explanation of it. And then you’re again, building those repetitions. I mean, you guys are able to rattle off these mistakes you’ve seen and you learn from them and apply them to the next client. So for advisors who aren’t yet consistently reviewing tax returns, you’ve got to start getting those reps in and making sure that you’re getting those returns and reviewing them and ideally making yourself a checklist of these things that you see on a regular basis. So you know what to look out for.

PC:

Yeah. I would just add that the goal is not just to prepare the tax return, right. If you’re doing too many tax returns that you don’t have time to think about them, objectively and go through and think about them and provide advice, then why are you even doing it? You should just send them to HR block or something. Right. Right. So you’re not just preparing a tax return, your main value add is the advice that you provide. Yeah.

SJ:

Yeah. So, and really for a lot of the advisors who listened to this podcast, doing tax preparation themselves, it really isn’t the end goal, but that doesn’t have to be a prohibition on, on looking at these things and learning more, finding people you can strategically partner with, or it’s just slowly building on those, on those simple starting points that you guys talked about on, on the last episode really is incredibly valuable to your clients. Whether your end goal is doing tax preparation or not.

JS:

Tax planning is the key, right? I mean, preparation is nice, you know, clients like that, but like Phil said, you know, planning actions for next year, here’s things that we can adjust. And here’s what, here’s the results, right? Here’s the tax savings that we can have now or potentially in the future.

SJ:

Yeah, tax compliance is important. We need to check that box, but massive value to the client comes from tax planning from that forward-looking, right. I really appreciate you joining me for this. Thanks everybody for listening. Good luck out there. And as always remember to tip your server, not the IRS!