Financial advisors can have a favorable impact on client tax refunds every year. So, do you know how to take advantage of this opportunity to demonstrate your value on a consistent basis? In this article, we discuss key information to help advisors with the client tax refund conversation and provide actionable steps to help your client achieve their goals.

How Most Clients View Their Year-End Tax Result

At the end of the year your clients are going to land in one of two buckets, they owe the IRS (tax payment) or the IRS owes them (tax refund). This sounds like an oversimplification and skips right over how much a person pays in total taxes. Regardless of their end-of-year situation, whether they got a refund or had to make a payment is one of the only data points from a tax return your clients will be able to consistently give you.

Go ahead, ask them.

During your next round of client meetings ask your clients how much of a refund they received–or–how much of a payment they made. Then, ask them how much total tax they paid for the year. Some will think those are the same question and many of them will have no idea what the answer to the second question is. This is in no way an insult to your clients, many advisors (and even many CPAs), are the same way.

The likelihood someone knows their total tax bill definitely goes up is if they are self-employed and make estimated payments. But in general, there is a much stronger emotion in the final result, refund or payment, than the gradual withholdings or payments throughout the year.

How Financial Advisors Can Navigate Client Tax Refunds

Getting a client a tax refund is really simple, increase their withholdings. That’s it. Often taxpayers see a refund as having won the game or earned a prize. They don’t think about it in terms of the time value of money or how much total tax they paid.

Your job isn’t to force them to see the light. Instead, it’s to understand what is important to them and recommend the best course of action.

Advisor: “Mr. and Mrs. client, I see you received a refund last year of $5,000 on your tax return. That is great news! We are going to help you adjust your withholdings so this next year you owe just a few hundred dollars and don’t give the IRS an interest-free loan all year. Is that okay with you?”

Client: (out loud) – “Ok, I guess that makes sense.”

(thinking) – “That’s what I use to pay my property taxes each year. How am I going to address that now?”

This is just one example from talking to advisors, your clients will be all over the place.

Some people want to go out of their way to owe as much as possible without paying penalties. Some will want their return dialed in as much as possible regardless of whether it’s a refund or payment (you should be able to get within $1,000 one way or the other with any decent tax projection). And some, like the client above an advisor told me about, use the IRS as a piggy bank for the year.

Money is emotional.

As long as you are helping your client avoid any underpayment penalties (more on this below), your job is to understand their goals and help them accomplish those goals. Instead of leading with your solution, you need to start with their goals:

Advisor: “Mr. and Mrs. client, I see you received a refund last year of $5,000 on your tax return. Great job making sure you didn’t owe anything at the end of the year! We can work together to reduce that amount so you have the funds throughout the year. Is that something we should discuss or are you comfortable with how it is currently set up?”

You are providing value whether they make a change or not. By taking a fractional amount of time to let your client know you’ve considered their situation and there are options available to them if they are interested. Therefore, you’ve added to your service offering whether they want to make changes or not. And if they do want to make a change, it’s a great chance to do a tax projection for them to make recommendations on withholdings and look for other opportunities to provide tax value to them.

Technical Details Advisors Should Know To Assist Clients with Tax Refunds

If you are going to make recommendations on withholdings, there are a couple of areas you need to be comfortable with. These aren’t things you need to commit to memory. But, you need to know them well enough to realize what questions to ask. Or, know when you need to refer back to the IRS guidance or to a one-page reference guide.

After you know the client’s goals and feel confident your recommendations will help them accomplish their goals, the biggest thing you want to do is make sure you are helping the client avoid any underpayment penalties.

Money is already emotional–and taxes are exponentially more so.

Options For How Advisor’s Clients Can Pay Taxes To The IRS

The IRS has a pay-as-you-go system (IRS Topic 306). In simple terms, this means if you wait until the end of the year to pay all of your taxes, the IRS will charge you penalties on top of the taxes you owe. Taxes can be paid throughout the year as withholdings from wages, distributions or other earnings, or through estimated payments.

These options, however, are not created equal.

IRS Treatment Of Wage Withholdings

The IRS treats withholdings as received throughout the year, regardless of when they are actually received by the IRS. This means that if you are working with a client who is planning to take a distribution late in the year, you should review their tax projection with them to see if additional taxes should be withheld to cover any shortfall from earlier in the year.

While we are on this topic, if you are working on a distribution with a client and haven’t looked at their tax return with them to help determine their marginal tax rate (the rate at which the distribution will be taxed), you are doing them a disservice.

Simply asking the question isn’t enough. Do you have the tax brackets committed to memory well enough that you’ll know on the spot what tax brackets a distribution would hit? Take the time to review the detail with your clients. Make sure you are recommending withholdings that are accurate and in line with the client’s goals.

IRS Treatment of Estimated Payments Throughout The Year

The alternative to withholdings is making estimated payments throughout the year. This is most common for self-employed taxpayers. However, this is an option available to anyone.

Unlike withholdings, to be considered “on-time” estimated payments have to be made by specific due dates (found here). Basically, these payments result in quarterly payments. The IRS assumes that earnings, and therefore payments, occur evenly throughout the year.

Note: If your client has a seasonal business, they can apply to submit payments online with how their revenue is earned. You should refer to Form 2210 and the related instructions for more detail.

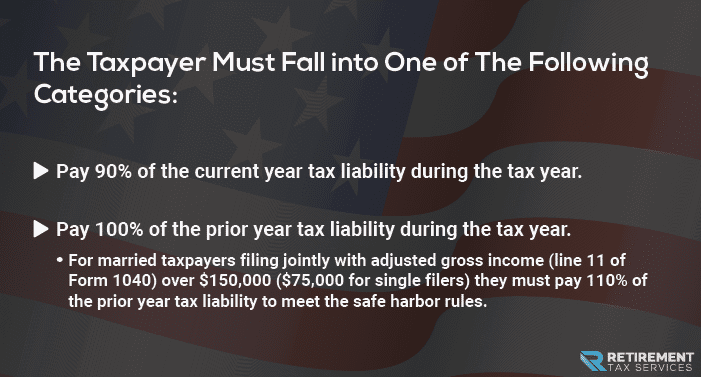

Safe Harbor Rules To Avoid Tax Penalties

Regardless of which type of payment (or a combination thereof) that a taxpayer uses, the IRS has safe harbor rules on how much the taxpayer must pay to avoid penalties.

The taxpayer must fall into one of the following categories:

Note: The IRS will also make exceptions for the first year a taxpayer retires after reaching the age of 62 or if the taxpayer becomes disabled during the year and the underpayment was due to reasonable cause and not willful neglect.

A Financial Advisor’s Perspective On Tax Refunds For Your Clients! Input from Matt and Micah from ThePerfectRIA

Some advisors want to leave everything tax-related to the tax preparers. Unfortunately, these advisors are not providing massive value to their clients.

As an advisor, you are already talking about taxes. You are making recommendations on withholdings when you advise on client retirement distributions. By looking at their withholdings for the entire year, you aren’t overstepping your boundaries. Instead, you are providing a higher level of service.

If your client works with a CPA or tax preparer this is a great opportunity to build a relationship with them at the same time! Good tax preparers are asking about these kinds of things as well but will potentially have hundreds of returns they work on in a year. So, they aren’t going to know your client as well as you can.

Before making withholding changes, work with the client to discuss the approach you are proposing with their tax preparer.

Proactively going to the tax preparer will set you apart from the abundance of advisors who make changes with the preparer’s input. This prevents the preparer from having to explain and correct any mistakes for your client!

Furthermore, be proactive about planning wage withholdings or estimated payments. Don’t force the tax preparer to be the one to tell your client that they have to owe taxes. Let’s face it—we seldom meet clients who don’t like to receive a tax refund at the end of the year!

These simple steps will help you become more referable from that tax preparer center of influence.

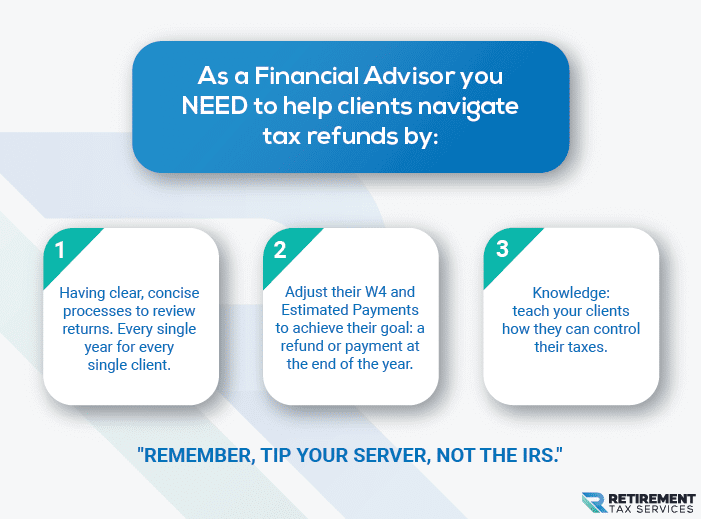

4 Action Items Financial Advisors Can Implement To Help Navigate Client Tax Refunds

- Establish a process to receive and review every client’s tax return, every year.

- During your next client meeting, ask your client how much they would like to get as a tax refund? Ensure you record this in your CRM.

- Determine your client’s withholdings or estimated payments to ensure they achieve this tax refund goal. (Make sure to ask about any upcoming life-changing events: retirement, marriage, divorce, kids moving out, large capital gains, one-time distributions, new income streams, loss of income streams, etc.)

- Educate your clients that the tax filing result is not the same as how much they paid in taxes.

Remember to tip your server, not the IRS.