RTS #005 – “It doesn’t hurt to ask, right?”

Tax planning can provide value in a lot of different ways, but being able to directly help a client pay less is one of the more satisfying. Last week we talked all about IRMAA and Roth conversions and how to evaluate the relationship between the two. Helping a client pay more in taxes now to save more in taxes over their lifetime is great, but with IRMAA, there are times where we can help right now.

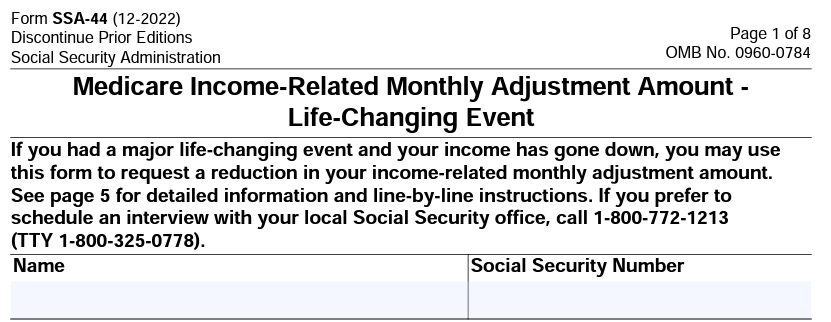

The two-year lag between income going up and Medicare premiums increasing might feel nice when it’s in a client’s favor, but when income drops and it takes two years for Medicare premiums to catch up, it creates a painful waiting game. Unless, of course, your client has someone helping them file Form SSA-44 with their local social security office.

This form allows a taxpayer to request a change in their IRMAA amount when their income drops. Being proactive and helping a client file this form can save them thousands of dollars over the 2 years they would otherwise have had to wait, and while the form is not a guaranteed “yes,” we’ve never seen a “no” bear any other negative consequences. There are, of course, a few things to keep in mind.

The most common scenario where we see this form filed successfully is when a taxpayer retires. “Work Stoppage” (retirement) is one of the life-changing events the SSA accepts on the appeal form. Especially for high-earning taxpayers or taxpayers who received large payouts in their final year of employment (this was the case for the most recent client the RTS team helped with this), that first year of retirement can mean a huge drop in income. If the SSA-44 isn’t filed, the corresponding drop in Medicare premiums will take 2 years to process.

To complete the form, you’ll need to estimate what their AGI in the year their income drops will be, but otherwise, the form is very simple and only takes a few minutes to complete.

The form does have to be submitted to the taxpayers’ local social security office, but that can be found on their website.

In our experience, most taxpayers are unaware that this is even an option. This means that you should be talking to every one of your clients approaching Medicare age about this potential strategy. Even if it isn’t a fit for them, you’ll be the first one who has brought it to their attention, and it will be another example of how you provide a premium service.

What can you do about it?

- This should be on your “Year of Retirement” checklist for every client. Ideally, it’s something you are planning for ahead of time, but if it gets missed, make sure you are reviewing your clients’ tax returns each year to watch for large drops in income.

- Make the process easy for your clients. They will need to sign the form themselves, but you likely have the information to do the rest of the work for them. It only takes a few minutes to complete, so it makes a great value add to just “hit the easy button” for them. This should include filling out the form and confirming their local social security office.

Happy Tax Planning!