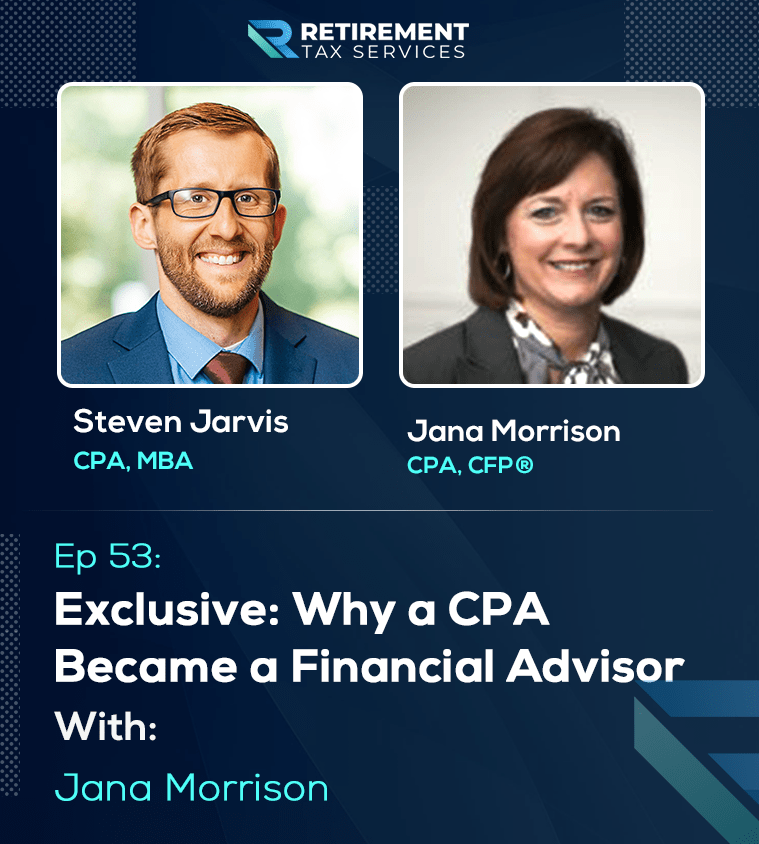

Welcome back to the Retirement Tax Services Podcast! Steven’s latest guest is Jana Morrison of Burkett Financial Services. She’s both a CPA and a CFP. In a male-dominated industry, she’s built a solid track record. Her achievements include a successful transfer from accounting into financial services, too.

Yes, you read that right: Jana was a CPA for years, after which she transferred into financial planning. It was mostly tax-related; frequently involving trust returns. She neared financial planning, but for about 11 years, it wasn’t her primary focus.

Gradually, she started taking CFP courses. As a result of clearing the exam, she started taking on wealth management.

She worked at a family firm, so it was fairly simple working with clients she already knew. Regardless, by her 21st year there, she was ready for a change.

Jana left, going to work for an investment services company affiliated with a financial institution. Despite her initial expectations, it wasn’t an ideal fit.

She enjoyed having more contact with clients, but she wanted to provide tax planning and other helpful services. However, the nature of investment services work rarely, if ever involved them.

So, she left the investment services company to join Burkett Financial Services, an RIA: Immediately, she felt more at home. For starters, Burkett is affiliated with a CPA practice.

Better yet, tax planning is a large part of the value they deliver to clients. In fact, one of their clients is actually an accountant.

This could partially be related to their attitude. Though they recommend the CPA they’re affiliated with to new clients, they also encourage those who’re happy with their own accountant to keep using them.

Like long-game tax planning, professional maturity pays more, the longer it’s in place. Working with people who understand this can be priceless because, sadly, sometimes it’s rare.

So are CPA-CFP combos. However, it turns out that Jana’s not the only one working at Burkett: Of all the places someone with her unusual skill set could have landed, she joined a firm at which it’s almost common.

That’s not all that keeps her there, though. The inherent fiduciary mindset at Burkett was—and is—a natural fit. Family is a strong theme among their clients and like integrity, it’s encouraged.

At the end of the day, she enjoys having advocated what was best for her clients. Pushy sales approaches aren’t always bad, but they were never her style. The RIA’s focus on providing value; not just a minimum service makes her feel at home the most.

It’s also a value-add for COIs you work with. One of the most common (sometimes earned) stereotypes CPAs have of financial planners is someone perpetually pressing a hard sell. No accountant wants that for their clients.

So, avoid assuming a client’s CPA knows what kind of value you provide. If you’ve ever wondered why they sometimes seem reclusive, bad precedents are one of the reasons.

Consequently, be patient and work respectfully to gain their trust. When clients brag about the value you provide to them, they’ll hear it.

Steven’s guest Jana Morrison shares more valuable insights in today’s Retirement Tax Services Podcast. Your tax-related questions are always welcome at advisors@rts.tax.

Thank you for listening.

Steven Jarvis:

Hi everyone. And welcome to the next episode of the retirement tech services podcast, financial professionals edition. I am your host, Steven Jarvis CPA. And in this show, I teach financial advisors how to deliver massive value to their clients through tax planning. My guest today on the show, I’m really excited to have- getting a little bit different perspective today- Jana Morrison, CPA and CFP from Burkett Financial Services is here with me. And Jana is going to share her perspective, both for making the transition from being a CPA into the financial services industry. And, uh, you know, speaking on behalf of women in an industry that is still very, very dominated by men. So Jana welcome to the show!

Jana Morrison:

Thank you so much, Steven, for having me today. I’m glad to be here. I enjoy your podcast.

SJ:

Thank you. Appreciate that. We love having people on to, to just hear different perspectives and different ways that people approach tax planning. So to start a little bit lets just talk about your background, as far as your kind of your journey to now you focus primarily on kind of the planning and advisory side, but you spent a long time as a CPA.

JM:

And actually just to let you know, I’m 55 years old, so I’ll say I’m a middle aged woman. And so I’ve had a lot of experience in different industries. I started out as a CPA with family office and we worked with high net worth clients. And I worked in the tax area and we had a lot of trust returns. We had probably about maybe 200 trust returns, you know, not primarily nine family members. And we had first, second and third generation family members and we did financial planning, but I worked there probably let’s see, uh, I would say about 11, 10 or 11 years before I decided to become a CFP. Took some courses and decided to study for the exam and then became a certified financial planner. And really my job didn’t really change that much, but we, you know, we just thought that that was a good fit for that industry because we did, they were our clients, but we just did the financial planning for the people that we already had as clients.

We didn’t have to go out and get our own clients, which was really pretty nice. But, I came to a point where after I’d been there about 21 years, I decided that I was at a midpoint in my career and I stopped. I decided to make a career change. And, I left the family office environment and I went to work for just an investment services company that was affiliated with a financial institution. And it just wasn’t really the best fit for me. I really did enjoy having more of the client contact, but I felt like I wasn’t using my CPA skills because we were primarily just focused on investment services. And that was pretty much it. I couldn’t do a lot of tax planning for the individuals. What I did was take the series seven exam, the series 63, the insurance exams, but I decided it just wasn’t for me. And so I left there and went to work for a RIA registered investment advisor firm, which is affiliated with a CPA firm. And I just really felt like I was more at home. You know, from the moment I stepped in the office, it just seemed like a more comfortable environment for me. And we really do use tax planning as a huge part of our financial planning process. I can talk a little bit more about that if you want me to.

SJ:

Yeah and we’ll get into that in just a second. I just want to highlight real quick that, I mean, this is a little bit of a unique journey. I think you see it more often that CPAs will make the switch to financial planning as opposed to the other way around. Although actually I think it was when you and I were together at the AI CPA engaged conference. I met my, I think the first person I had come across who was a CFP and getting their CPA license. But I think part of the reason you only see it in one direction is that on the CPA side, a lot of times the focus is more on the details than the technical nature. And part of the reason I share this with our listeners is so we can keep helping bridge this gap between advisors and CPAs. So when you kind of grow up in the more, the technical weeds of it, I think it’s, it’s so, so great that, that you saw the opportunity and wait, let’s, let’s do both sides of this because it’s all so interconnected, whether you’re on the CPA side or the CFP side, you’re really missing an opportunity for your clients if you’re not considering both. And before we get into how you, the firm you’re with now uses tax planning, as we were getting ready for this show, you had talked about kind of how your impression of what financial advisor is kind of changed over time. That’s one of the things that’s always really interesting to me working with CPAs is this ambiguity around, okay, what is a financial advisor? So maybe talk a little bit about the progression of your, your understanding of that.

JM:

When I first went to the investment services department for the financial institution, I didn’t know that there was a difference between broker dealers versus registered investment advisors. I really just thought it was all the same. And with the first institution we did have commissions, you know, we did receive commissions. We did have, I guess we were more of a hybrid because we did have some accounts where we were advisory and chose. And then we had fees for services, but I didn’t really understand that there was another institution out there that was RIA, which were more of a fiduciary. They had a fiduciary relationship with the clients, and I really wanted that because I wanted to be on the same side of the table as the client. And I didn’t want to be, you know, a sales type person. I’m not that my personality is not like that. I want to suggest the absolute best thing that I think will work for my client. I think that’s a better fit for me. So I was surprised at the difference between the two different types of businesses for financial planning. I think it doesn’t mean that one is better than the other. I think that one fits a certain type of client better than the other, another type of client that “this is a good fit for me.”

SJ:

Yeah and I, I want to dry out really quick. I mean, you talked about at least from your perspective, not really wanting to be in that salesy role and I won’t speak on behalf of all CPAs, but most of the ones I know if a CPA, isn’t sure what you do as a financial advisor, I can almost promise that their assumptions are way more on the, “You’re going to push things on my client. You’re going to sell things to my client. And this is why I don’t want to refer people to you.” And so we will circle back to this when we get to the end and talk about action items, but you’ve got to make sure, you know, for the listeners, you’ve got to make sure as you’re talking to centers of influence, you’re talking to CPAs that you don’t take for granted that they know what it is you do. Because Janet as you’re talking about even having, you know, spent years in the tax industry, which has a lot of overlap with financial planning, this was still a learning process for you because it is for all of us. Okay. What is it that the financial advisors do?

JM:

Yeah, it is, it is a different process because as a CPA, I think that we think that just normal CPAs, that they know all about IRAs and they don’t because IRAs are just so complex, all the different rules associated with traditional versus Roth and inherited IRA, you know, it’s very complex and most CPAs just don’t really put that together. And also with a typical CPA environment, they’re trying to save the client tax money for that particular year. They’re looking in the rear view mirror where we’re actually looking ahead and trying to plan for several years in the future. And so a lot of times we will actually get feedback for our clients where they’ll tell us that their CPA didn’t appreciate the fact that we did Roth conversions that year and cost their client more money. And they’ll, you know, second guess what we’ve done.

And we do explain it to the client and, and sometimes we’ll have conversations with the CPA just to let them understand what we’re doing and get them on board, or when we might want to do, you know, capital gain harvesting as in this year, which we’re doing to try to bring, uh, gains in under the lower tax structure. They may not understand, you know, why we’re doing that at all. I think they’re probably on board with that, but yeah, it is a different, it is different that the things that we look at when our perspective as to looking at that particular year versus, you know, planning for several years in the future.

SJ:

Yeah. Let’s use that as a segue to start talking about how you actually incorporate tax planning, uh, in your practice now, because this is a really a common theme that comes up with advisors of, “Hey, here’s this tax planning strategy I tried to implement with my client and I got pushback from the CPA.” So in, in your situation, you’ve actually, you’ve got a team that does tax prep kind of it’s under the same affiliation. So, you know, it’s a little bit different situation than a lot of advisors might find themselves in, but there’s still these critical communication pieces. So I still think there’s a lot to learn. So maybe talk about how, or what approaches you take to try to take away some of that friction when you’re doing these tax planning strategies that both have a planning element as well as a tax preparation element.

JM:

Okay Sure. When I first came to the firm, I actually did a lot of tax prep for our clients. You know, I did it from start to finish and I just felt like I was a tax person for about four months out of the year instead of a financial planner. And so, you know, as I went from doing that until now, I’ve been in this firm going on seven years now. And so we kind of transitioned from, you know, doing the input for all of our clients to actually just reviewing that information, to make sure that everything that we’re planning for our clients that use the CPA firm that we’re affiliated with to make sure that our plans are actually put into process because we can do a lot of great planning techniques, but if they don’t put that into the tax return properly, then it just undoes everything that we tried to do.

You know, we don’t require that our clients use the CPA firm that we’re affiliated with. We actually tell them that if they’re happy with their CPA to definitely keep using them because we can use our tax projection software with the returns that they provide to us, but for the clients that do bring their tax returns over to our affiliated firm, it’s really easy. I mean, we, we go in and we make sure that we provide the information to the CPAs such as QCDs and we make sure that they have all the 1099s, 1099 Rs, 1099 composites. We make sure that, you know, they have all that information that they need for our clients. And sometimes it’s a little difficult to communicate to outside CPAs where it’s a lot easier internally because our internal CPA’s know to reach out to us.

And in some cases we’ll actually get that information. We have actually had that information and posted it to a drive that CPA firm can access so that whenever they need that information, they just go pull it up and they don’t have to interrupt us and they don’t have to wait on us to provide it. So that’s worked well in the past where we just put that out there, send them emails and touch base with them so they know everything going on with the return. So then we look at the return in most cases, the ones that I’m involved with I’ll review the returns before they call the client, just to make sure everything was put into place. And then when we’re preparing for next year, we use Ultra Tax which is a creative solutions product and it has a feature where you can export it into their planner, uh, as planner CS. And so when the return has been finalized, we’ll go in and just export it into that so that we have the current year and then we’d build the next year off of that. And it’ll let us do different alternatives for like Roth conversions or different things that we want to plan to do. And, you know, I think it works really well. We have in our software, our client services software, we use Juncture for that, and we will put a task in there so that we will remind our support staff to reach out to the clients for which we don’t prepare the return, that they’ll reach out to that client and they’ll actually ask for the tax return, you know, on the first of the year, so that we can scan it into our system. We can go ahead and input it in planner so that we can start doing the projections.

Honestly, I probably do the projections for all of our clients. You know, there’s very few that I don’t enter into the projection software and they really love the way that we can manipulate it live in our meetings. They love to sit there in the meeting and they’ll say, “well, what happens if I take out this much more money?” Yesterday, I did an analysis where I did like seven different alternatives with Roth conversions because we’re doing those so heavy this year. And, you know, do you want, and we also incorporate Irma, the Medicare premium adjustment. We’ll say, what if we do like 500,000, in a Roth conversion, which is really pretty large for a lot of our clients, or what if we just stay in this tier of Irma? What if we stay in the second, third, fourth tier of Irma, or what if we stay on the 24% tax bracket or the 22% so we can manipulate it live and make the decision in the meetings and move forward that way. So I really love the feature of being able to export the tax return into planner for our clients that were affiliated with the CPA firm, but really, I mean, it just works almost as well, just to input it from outside people who have outside CPAs.

SJ:

I love that you’re spending so much time on that and really with the softwares you have it’s probably not even that it’s really that much time it’s having a system in place and that you’re doing it consistently really, really love that you’re getting for all of your clients, whether they’re with the affiliated CPA firm or not. Now, I’m going to make a little bit of an assumption here, but you correct me if I’m wrong, because for a lot of the advisors listening, they don’t have affiliated CPA firm they work with, at least not yet and they’re probably thinking, “oh, that’s great that this works for Jana, but when I’ve got a dozen different CPAs, I work with my clients work with, it’s never going to work for me”, but you’re this affiliated CPA group that they’re their own team. So it’s not like you have a planner who’s also doing the preparation and so you have this overlap in knowledge and only have one person working with the client. Really where you’re getting a benefit is because you’re all working on the same team that there’s clear lines of communication, that there’s clear expectations. And ultimately you’re all working towards serving those same clients. So while it might be easier because it’s an affiliated group, to me that doesn’t make it impossible to have that with a completely unrelated third party if you take the time to build that channel.

JM:

That’s right. And you know, as long as you have a copy of the tax return, you know, complete tax return, I mean, you have a lot of the information that you need anyway, even if you don’t have the work paper files. Sometimes it’s so much easier to have the work paper files because you can see exactly what they have for social security, if they have withholding on their different IRA distributions. But if they don’t, I mean, it’s just a few more questions that you have to ask. And so I would say probably 50% of our clients use our CPA firm and probably the other 50% use outside CPAs. And like I said, we don’t push it and it really works well in both cases. And, you know, if we have a really complex client, we will talk with the CPA. They’ve been really good to work with. You know, we actually have a CPA. This is interesting, we have a CPA that is a client of ours. And, you know, I love that because they don’t feel like they can’t use us because we might try to steal their clients. We don’t want them to feel like that at all, because, you know, we just want to get the tax return so that we can do the financial planning part of it.

SJ:

Yeah. It’s such a critical part to doing effective financial planning to have those tax returns. Yeah. And, you know, just, just really reinforces that this can be done if you make it a concerted effort. I mean,if half your clients are not affiliated with a CPA firm, but you’re still getting returns for nearly all your clients. Like you can do this, you just need to make it a priority.

JM:

Exactly it’s, it’s real easy to do. And when they see the benefit that you provide, they’ll be more than happy to bring you the tax returns. I mean, when we only have problems with maybe honestly, probably only like 10 clients getting their tax returns. Most of them are more than happy to bring them in and we just scan it into our system, takes just a few minutes to get it into the system. And a lot of times I’ll use our support staff. We have, we’re not a big firm. I mean, we have, like, we have three full-time advisors, one part-time and then we have two support staff. So we’re a small firm, but one of the support staff, she has become really good at entering that information off the tax return so that I don’t have to, she ties it into the return. I just have to help her with problems and I can focus on the future years and the different alternatives that we use. So I think that that’s been working really well.

SJ:

Good. And are the other two full-time advisors were they previous CPAs as well, or was it just you?

JM:

They are and they are both CPAs.

SJ:

Oh okay!

JM:

We do have a third one that is, he’s very unique. He’s a 78 year old. He was one of the first CFPs in the state. He’s not a CPA, he’s the only one that we have, but that isn’t a CPA, which is interesting, but he brings a lot of banking background to our firm. So I really do like the fact that we are CPAs and CFPs. I think that’s a little unique in our space and I’ve had a lot of people comment on how much more value they think that we can provide, because we do bring in the tax implications into tax planning. You know, we have even had clients that, you know, we do look at Irma. I’m not sure how many other advisors look at that when they’re planning on doing Roth conversions and things like that. We definitely look at Irma for our clients that we’ve had a really long time and they may not have a lot of money in their accounts here. If they have, if their taxable income is, you know, less than a certain amount, we’ll do capital gain harvesting so that we can have capital gains tax to 0% rates. You know, that’s just really rewarding for us when we can do stuff like that and not cost them any tax.

SJ:

Yeah. I say all the time that, uh, you know, obviously money is emotional for all of us, but taxes are even more so. There’s just something about saving tax dollars that you otherwise would have been obligated to pay if it weren’t for your proactive planning decisions and for your clients, those recommendations are obviously coming from you. You made a comment a minute ago about how once your clients see the value that they get from providing their tax returns, that they’re happy to do it. Are there other things that we haven’t talked about yet that really highlight for you what resonates with your clients as far as value of bringing in their tax return?

JM:

Well, I will say that sometimes when we do, we, we do a lot of Roth conversions. And so I’m sorry if I’m talking about that too much. Cause we do a lot of it, but whenever we do a Roth conversion, a lot of times the client will not like you that year because they know that you can withhold taxes. You know, that makes it a little bit easier if they’re over 59 and a half, we can call taxes so that not all of it goes to the Roth, but we really don’t like to do it that way. But when they get that tax return and they see that additional tax, they’re not really happy with you, but when we show them how much it has grown, you know, then that’s when they’re really happy. And then they love bringing in the tax return, especially if you’re doing the conversions like last March, you know, when the market went down so much, we did some conversions at that time and they just worked out beautifully because they regain their value, you know, inside the Roth, you know, some of our clients, they were so happy, they were like, “Hey, can I do it again? You know, can I do, you know, twice as much?” And we’re like, well, it may not work out quite that way this year because we haven’t had the decrease in value, but we do show them, we show them each account how, you know, it has increased in value, what it may have cost them in tax. And so we, we try to let them see the value in it. We try to show that to them.

SJ:

Yeah. I liked that approach, even though the clients are obviously coming to you as the professional, they want your expertise. The more we can kind of pull back the curtain a little bit and help them understand how this all fits and give them context for where those savings and that long-term growth is the more it’s gonna be clear to them, why it’s so important to not only work with a financial planner, but to bring those tax returns, provide that other information,

JM:

Right that’s true.

SJ:

Jana, as you kind of reflect on your experience and really this, this emphasis on tax planning, do you have any recommendations for advisors out there who are either debating whether they should be doing tax planning or trying to enhance how they provide tax planning to their clients? What are some things they should be keeping in mind or if they should be doing?

JM:

I would just encourage them to just take that extra step and to request the tax return early on and just make it a part of your annual task for that client is that you just make it a priority to request the tax return. And, you know, we’ve gotten a lot of value out of doing the projections. It doesn’t take that much time to enter it into the software, but I think it’s definitely worth it. And I will say one other thing, you know, my background was working with a family office for like 20 years. And so we actually concentrated on giving a high level of service to the family. I feel like as part of an RIA office, I feel like in a way it’s like having their own little family office because we do a lot of the very same things that we did before.

When I worked with the high net worth clients, you know, we do financial state, you know, net worth statements. We did that with a family that we worked for. We do tax planning. We did that. I mean, we took care of all kinds of, we went above and beyond and I do feel like a lot of times with an RIA, you kind of have that same mindset as you do in working with a family. It’s really that fiduciary mindset. So I thought that was interesting. I think that’s why I may be, I felt more comfortable here and it was a better fit. I just always wanted to work on their behalf and for their best benefit.

SJ:

Yeah. I totally can relate to that. We do get questions quite often about what planning softwares people are using. So just to make sure I got it right. I mean, you said you’re using planner CS and that’s what it was. You talked about doing projections and the different comparisons. That’s what your firm uses.

JM:

That’s what we use on planner CS. Okay. And when I was at the family office, we use DNA tax planner and maybe something else now, it was still affiliated with processed on tax software at that time. And they’re very, very similar because I was familiar with B and a and you know, it didn’t take anything for me to get used to planner CS. So I think it works great.

SJ:

Jana, I really appreciate you coming on the show today. You already hit on some, some steps that advisors can take as they really embraced tax planning. I just want to highlight a couple of other things from our conversation as action items for our listeners. Going back to early in the conversation as an advisor, as you’re working with CPAs, as you’re trying to build those relationships, this really want to reinforce this step of making sure it’s clear that the CPA understands what it is you do for your clients. So that there’s total transparency and really clear expectations. If that CPA was ever to refer someone to you or had a client in need that they, that it’s not just, Hey, I know this person who a financial planner, but that they can associate that with specific services you offer. It might seem obvious to you what it is you do, but it’s not always obvious to the CPA crowd.

So do all of my fellow CPAs a favor and make sure it’s really clear what it is that you’re offering to your clients. And then we only spent just a second on it, as you mentioned at Jana, but you talked about reviewing the draft returns before your tax team is calling the client to, to finalize them. And again, that might be easier in a situation where you have an affiliated CPA firm, but I know other advisors who do this as well, that they ask their clients to, as they’re doing their spring meetings with their clients before the tax deadline, they have their clients bring in draft tax return. So you have a chance before it’s been filed before. It needs to be amended to review, especially for clients where you’ve done proactive tax planner of the year. I mean, Jenny, you, you hit it right on the head of it. If it doesn’t get reported to the IRS correctly, it may as well not have happened. So make sure that you’re getting tax returns and take it a step further and ask for that draft return. It might take a while to get to the point where your client’s providing that, but that can be a really valuable step.

JM:

That’s true. And, you know, especially a port it with qualified charitable distributions, you know, they don’t break that out on the form 10 99 R that can be really confusing for your client and the CPA involved when they’re getting acknowledgement letters for charities. But they have actually used IRA checks to pay those charities. I really wish that was something that the IRS would take a look at and change, but you can provide a lot of value just with that.

SJ:

Yeah. That’s a great reminder. Yeah, you’re exactly right. That’s not marked on a 10 99, anywhere that one gets missed all the time. So a great reason to be reviewing tax returns and to especially be reviewing those draft returns before they’re finalized. So, yeah, Jana thanks again for being here today. Really appreciate it. Thank you everyone for listening. And until next time, good luck out there. And remember to tip your server, not the IRS.