Background

What do CPAs, Bankers, Lawyers, Insurance Reps, and Financial Advisors all have in common? We’re all told throughout our careers to get referrals from each other.

In fact, to make it sound like we aren’t doing sales, we call it “networking.” Nevertheless, it still comes down to the same advice: Go to your chamber of commerce meetings, look for people with similar clients, and ask them to send their clients to you.

How often has that worked for you?

As a CPA, I’ve experienced both sides of this. I have asked for referrals—and I’ve seen that not work, over and over. I have also been the one asked for referrals. However, I have never once in my entire career given one out just because someone asked. Not once.

Those are both true statements. Still, I have received referrals from these different types of professionals. Additionally, I work with financial advisors who get referrals from centers of influence year after year.

Getting prospects from centers of influence can be done successfully. The following are major reasons why most financial advisors fall short.

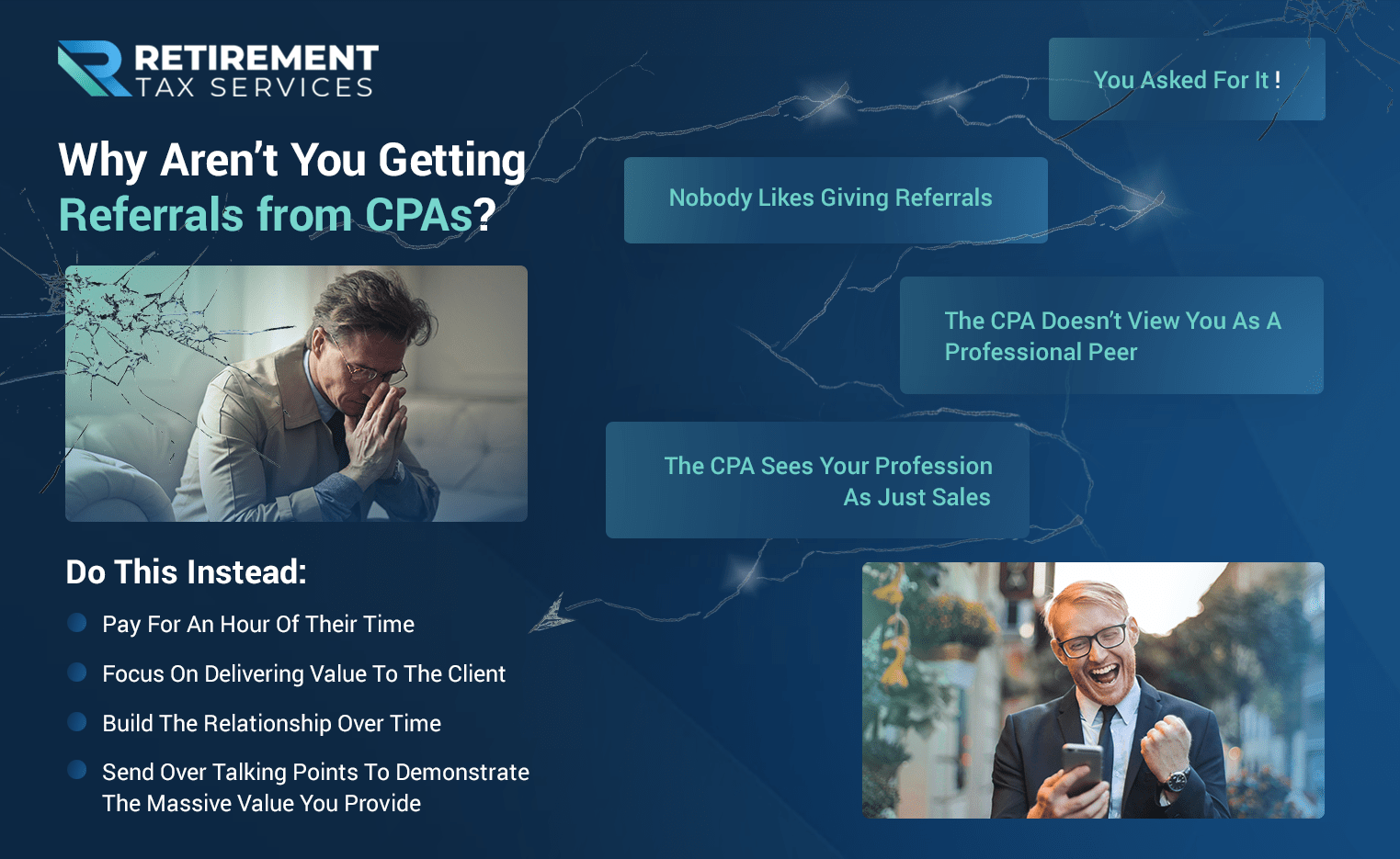

Why Aren’t You Getting Referrals from CPAs?

- You asked for a referral! This question is counter to what you’ve always been told: Nonetheless—if all you do is ask—what possible incentive do they have to actually refer someone? You are one of the hundreds of people who have asked them for referrals. Have you demonstrated how you are going to provide value to your clients? How have you differentiated yourself in any way?

- Nobody likes giving referrals. Think of all the places you are asked to give a referral (e.g. car dealerships). Now, when was the last time you actually gave one out? When you give a referral is an important distinction. Accordingly, you probably have recommended a particular professional or service to plenty of your friends or clients. They needed it and you knew you could trust the provider. It was not because the provider asked.

- The CPA doesn’t view you as a professional peer. This point isn’t about objective facts or logic. In all honesty, I’m giving you the inside scoop on conversations I’ve had with other CPAs: In the public eye, the designation of “CPA” carries a lot of weight. Meanwhile, the title of “financial advisor” can be used by anyone who fancies themselves an expert. For many accountants, introducing themselves as a CPA feels like 100% of why they can be trusted. In contrast, they don’t extend this presumption to other professionals. You have to clearly demonstrate how you provide value for clients. Don’t expect a referral from CPAs if you don’t.

- The CPA sees your profession as just sales. By the way, you SOUND like you just do sales when I hear…

- “I see we serve the same types of clients.”

- “Would love for you to keep me in mind the next time you are meeting with your clients.”

- “Do you have any clients that are nearing retirement?”

You may think these are clever ways to hide the fact that you only want their clients. However, no one is fooled. Consequently, when you say these kinds of things, you get polite smiles and vague “I can’t think of anyone right now” responses.

And you never end up with a referral from CPAs. Start with the value you are offering, instead. Overtime (months; not days or minutes into the conversation), you’ll see results.

- You haven’t demonstrated massive value for them or their clients. When you lead with “Here’s what I want from you,” what you’ll get is usually nothing. Start with “Here’s what I do for my clients,” so the CPA wants to get the same value for theirs. Additionally, you can offer value to the CPA directly. Try serving common clients or doing things for the CPA (like providing CE events). Get creative.

A referral from CPAs is not a lost cause. As a matter of fact, I work with advisors who effectively and consistently get referrals from them.

They get referrals because they know about these pitfalls and take a different approach. The overarching theme for advisors who succeed is “Lead with value, not with asking for clients.”

How To Get A Referral from CPAs

With many problems, simple solutions are often the most effective and replicable. Therefore, if you want to elevate your referral game with CPAs, do this: Offer to pay for their time.

Let’s imagine you’re calling a CPA you’d like in your network as a center of influence.

Say, “Mr. or Mrs. CPA, I’m a financial advisor in your area and I’m always looking for great CPAs I can send my clients to. I’d like to schedule a one-hour introduction so I can ask you some questions about your approach—to know if you’ll be a good fit for my clients. Just let me know what your hourly rate is and I will gladly pay it.”

They will say “Yes” every time.

Why? Because you are immediately showing you value their time. Moreover, you’ve separated yourself from every other professional they have worked with.

None of them take this approach. We’ve discussed this fact in the Retirement Tax Services podcast.

The next step is equally important. Above all, when you go to the meeting, come prepared with a list of questions for the CPA.

Don’t ask for a referral at any point (under any circumstances). You’re not there to make a sale. You’re there to ask questions demonstrating the level of service you provide to clients:

“Mrs. CPA, every year we review our clients’ situation to evaluate whether a Roth conversion would be a good idea. What information do you like receiving from an advisor before tax season related to Roth conversions for shared clients?”

Take the opportunity to explain to them what happens when they refer a client to you. Describe your onboarding process.

In other words, share how you serve clients. There should be no mystery for them regarding what happens next if they were to refer someone to you.

Meanwhile, remember: You’re not asking for referrals in this meeting. This approach is all about building a relationship and starting the process of showing how you add value.

End the meeting by asking if it’s okay to keep in touch. Certainly, you need a process for including CPAs and centers of influence on any value adds you provide clients during the year.

Is there something you’d send clients adding value throughout the year, like a 1099 letter? Send it to the CPA as well, with an added note. Let them know that you send this to all your clients and thought they might be interested.

Take Action

- Make a list of 10 CPA firms in your market (geographically or specialized in your niche). Add them to your CRM.

- In the next week, call all 10 CPA firms. Offer to pay for an hour of their time.

- Prepare the list of questions you are going to ask ahead of time. Focus on demonstrating the value you deliver.

- Take a systematic approach to following up with them. Check-in every other month to stay in mind.

- Track where you receive referrals from. Don’t just guess; know where they are coming from. As a result, continually refine your process based on where you are getting the best results.

Remember to tip your server, not the IRS.