“The tax code is complicated… boring and overrated… You don’t want that, you want a pro!!!!!!!”

Of course, we are very proud of how well those lyrics fit the music for our podcast theme song. In fact, the first part, in particular, resonates with most people who have to pay taxes.

“Complicated,” “boring” and “overrated” are just some of the descriptions taxpayers associate with taxes. The full list of adjectives we’ve heard people use for taxes wouldn’t fit here. Additionally, it may not be appropriate for all ages.

People tend to avoid things they don’t like. However, it’s hard to really understand something you avoid. So it should be no surprise that a lot of myths about taxes exist.

For tax-planning advisors, these tax myths create a great opportunity to deliver value to clients. So, in this article, we are going to cover some of the common myths we hear. I’ll also provide my thoughts on how to start demystifying these areas for clients.

“The great enemy of the truth is very often not the lie—deliberate, contrived and dishonest, but the myth—persistent, persuasive, and unrealistic. Belief in myths allows comfort of opinion without the discomfort of thought.” — John F. Kennedy

Common Tax Myths

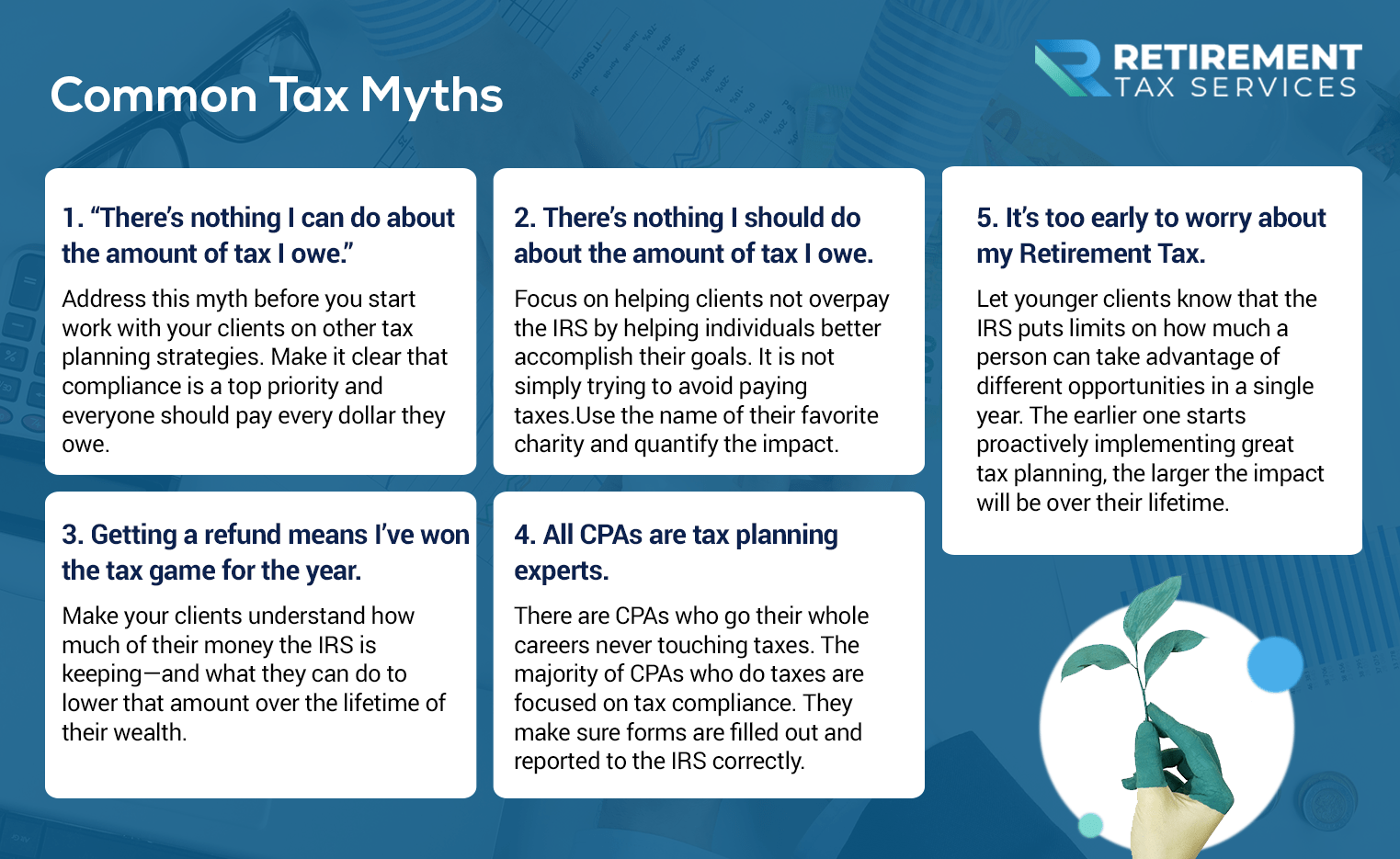

1. “There’s nothing I can do about the amount of tax I owe.”

The tax code, for most taxpayers, isn’t just confusing. It feels unknowable. The amount of tax they owe at the end of each year can seem like the result of a mystical black box that no one can possibly understand. This complexity makes many feel like there is nothing someone can do except pay their taxes and move on.

This is the first of the tax myths on the list because it is critical to change this mindset. Address it before you start work with your clients on other tax planning strategies. Make it clear that compliance is a top priority and everyone should pay every dollar they owe.

At the same time, the tax code gives us choices we can make to reduce the amount we legally owe. This is not tax avoidance. It’s proactive tax management.

“Mr. and Mrs. Client, income tax rates get all the headlines and since they are set by Congress, it can feel like there is nothing you can do about the amount of tax you owe. The good news is that the tax code actually gives taxpayers like you choices in some situations. Knowing what those choices are and when we can make them gives us the chance to lower the amount of tax you owe over the lifetime of your wealth.”

2. There’s nothing I should do about the amount of tax I owe.

“Anyone may so arrange his affairs that his taxes shall be as low as possible; he is not bound to choose that pattern which will best pay the Treasury; there is not even a patriotic duty to increase one’s taxes.”

— Judge Learned Hand

Our friends over at The Perfect RIA like to say, “There are no patriotic awards for tipping the IRS.” Here at RTS, we simply encourage everyone to tip their servers, not the IRS.

It’s not often that taxpayers want to pay more taxes personally (regardless of their feelings on how much other people should pay). Regardless, at times you may have clients who are comfortable with the amount they’ve saved and aren’t motivated by simply paying less in taxes.

This is where understanding a client’s “why” is so important. It’s also a great reminder to make sure that ALL of the planning you work with your clients to accomplish is tied to their personal goals.

“Ms. Client, you mentioned that saving money in taxes is not the reason you give to charity, which I completely agree with. It is incredibly admirable that you share what you worked so hard to earn with your community. If giving to your favorite charities using qualified charitable distributions saved you $10,000 in taxes over the next 4 years—that you could then give to those same charities—would that be something you would be interested in pursuing?”

Use the name of their favorite charity and quantify the impact. Our focus on helping people not overpay the IRS is driven by helping individuals better accomplish their goals. It is not simply trying to avoid paying taxes.

3. Getting a refund means I’ve won the tax game for the year.

This is a very damaging myth because it keeps taxpayers focused on the wrong data point. Most taxpayers can tell you instantly whether they got a refund this last year or made a payment. But, how many of them can tell you how much of their hard-earned money the IRS kept?

Getting a refund is just a timing game. Everyone can get a refund every year. Just have your clients make a huge, unnecessary estimated payment in Q4 and the IRS will eventually send it back to them (that of course is an extreme example to make a point, please do not actually try this) .

Getting a bigger refund this year compared to last year gives you ZERO insight into whether anything has changed or improved in a client’s tax life. In fact, you can get a bigger refund while still having paid significantly more in taxes compared to prior years.

It’s important to work with clients on aligning their annual year-end refund or payment with their goals. But, it’s critical you also help them understand how much of their money the IRS is keeping—and what they can do to lower that amount over the lifetime of their wealth.

If your client is fixated on the $2,000 refund they get each year, proposing a strategy that will save them $5,000 in taxes each year for the next 5 years might seem outlandish to them. Help them understand the IRS has kept $30,000 of their income each of the last 3 years. Their commitment and excitement for the plans you are helping them with will shoot up when they have the right context.

4. All CPAs are tax planning experts.

“Mrs. CFP, I work with a tax preparer, so tax planning does not need to be part of the financial plan we work on together.”

There really are 2 important pieces to this myth: First, not all CPAs do taxes! Individual income tax is less than 25% of the material for the CPA exam. There are CPAs who go their whole careers never touching taxes.

Second, the majority of CPAs who do taxes are focused on tax compliance. They make sure forms are filled out correctly and that what happened in the past is reported to the IRS accurately.

This myth is simply an assumption that your clients make. It’s not even something that their CPAs are necessarily telling them. They just assume they have a tax preparer, so all things tax are covered.

“Mr. Client, that is great news that you have a tax preparer you like working with, we often encourage our clients to work with CPAs to get their taxes filed. Your preparer probably does an excellent job making sure your return is filed correctly and on time and that’s an important step. When we talk about tax planning, we are talking about looking forward over the lifetime of your wealth and looking for ways to make sure you are not overpaying the IRS.”

5. It’s too early to worry about my Retirement Tax.

Many tax planning headlines center around opportunities that are more applicable for taxpayers approaching (or in) retirement. Don’t let that be a deterrent to working with clients of all ages on proactive tax planning.

We define “Retirement Tax” as the 6 or 7-figure bill the IRS expects you to pay over the course of your retirement. Using that definition with your clients will make it easier to have a discussion about reducing taxes over the lifetime of their wealth, regardless of their age.

It can be particularly powerful to highlight for younger clients the fact that the IRS puts limits on how much a person can take advantage of different opportunities in a single year. As a result, the earlier you start proactively implementing great tax planning, the larger the impact will be over their lifetime.

Take Action

- Pick one of these tax myths to start dispelling for your clients. Whether that is through client meetings or newsletters you send to clients, help them start changing their assumptions. It’s important to remember that tackling these tax myths is not a one-time event. These are concepts you want to reinforce over the course of your work with your clients.

- Make sure tax education is part of your professional development. This article covers just 5 tax myths. The list is far from exhaustive. Whether that means regularly reading articles, attending webinars or conferences, or joining a community like RTS, make sure you are committed. Follow through on taxes as part of your professional development.

- Get tax returns for every client every year. This will help you better know what areas you should be focusing on with your client base as a whole and with specific clients.

Great advisors provide value in all aspects of their clients’ financial lives. CPAs do not have exclusive rights on all things tax-related. Many of them will thank you for taking these steps with your shared clients.

Even if you find yourself in a situation that is beyond your expertise, you can still serve your client and provide value through partnering with them.

Work with the tax experts. Don’t just sit back and say, “Sorry, I don’t give tax advice.”

Good luck out there and remember to tip your server, not the IRS.