Background

“Tax Day” is one of those dates that everyone knows, right? April 15th, every year…or is it?

The tax deadline for individual filers is typically April 15th of the following year. Which would mean that for 2021, the tax filing deadline should be April 15th, 2022…except that April 15th, 2022 happens to be a Friday, which also happens to be emancipation day, which is a federal holiday and puts the tax filing deadline all the way to April 18, 2022. No big deal right, just a couple of days, who is going to be thrown off by that?

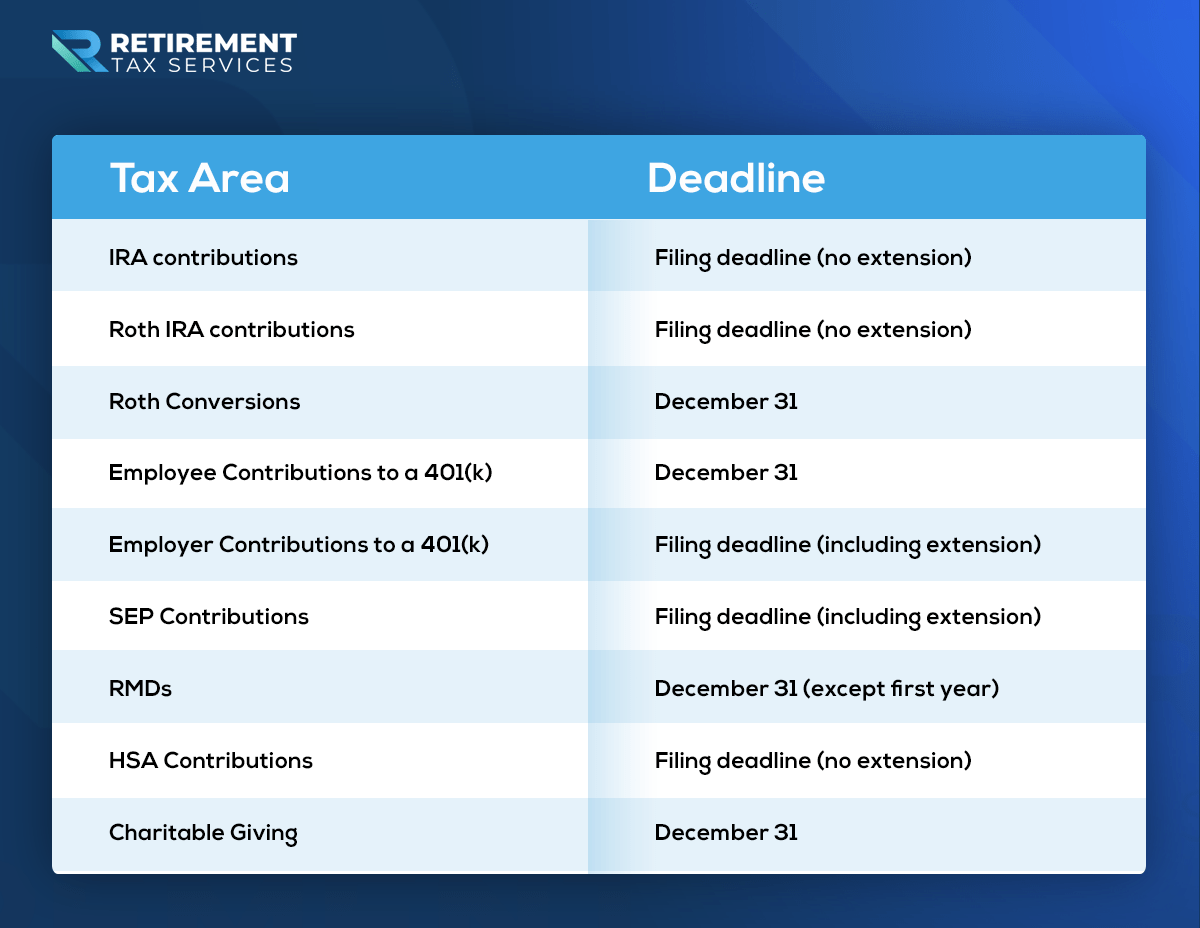

The tax filing deadline shifting a couple of days is unlikely to cause big issues for most taxpayers, BUT associating all things tax related with a single day can. April 15th may be the standard tax filing deadline, but that doesn’t make it the deadline for tax payments, retirement plan contributions, Roth conversions, HSA contributions or charitable giving (just to name a few). We’ve already written a whole article on the payment deadlines for taxes so in this article we are going to focus on the important dates for other tax planning strategies.

Tax Strategies with important dates

IRA Contributions

Traditional IRA contributions must be made by the filing deadline (not including extensions) for your return for the year you would like to contribute. So for 2021, for most taxpayers that means that through April 18th, 2022, contributions can still be made and attributed to 2021. It is vital that between January 1st, 2022 and April 18th, 2022 you make sure to communicate to the custodian of the account which year the contributions apply to, so as to avoid issues the following year.

All other requirements for making contributions (including determining whether the contributions are deductible) still have to be followed regardless of which year the contribution is made in. IRS Publication 590-A is a great resource for all things IRA related, including contribution deadlines.

Roth IRA Contributions

Roth IRA contributions are also covered by IRS Publication 590-A and have the same contribution deadline, in other words the tax filing deadline (April 18th, 2022 for most individuals). While the timing is same there are additional income limitations on Roth IRA contributions that need to be considered when advising clients on making Roth contributions near the end of the year or between January 1st and April 15th of the following year.

Roth IRA Conversions

Roth conversions are treated as a distribution, and therefore included in the individual’s tax return, the day the conversion occurs. There is no option to make a Roth conversion between January 1st and April 15th and have it applied to the prior year. The amount of a conversion does not have an impact on the contribution limits for Roth or Traditional IRAs OTHER THAN the fact that if the conversion is from pre-tax dollars that amount will be included in adjusted gross income, which might impact a taxpayer’s eligibility for making deductible IRA contributions or Roth contributions.

The timing of the conversion is especially important when working with non-deductible IRA contributions (IRS Form 8606, Separating the Cream from the Coffee). For example, even though contributions can be made for 2021 through April 18th, 2022, the IRS looks at December 31, 2021 when applying the pro-rata rule and determining how much of the conversion is taxable. Dates matter.

Employer Sponsored 401(k) Plan Contributions

Unlike traditional IRA contributions, employee contributions to 401(k) plans have to be made during the calendar year for the year they apply to. “Employee” contributions is an important distinction here because the employer has until their filing deadline to make contributions. If an employee has not maxed their 401(k) contributions for the year they may only have their final paycheck (or two) to contribute any extra they are able (although this can be a great conversation starter for adjusting withholdings for the next year as well).

Simplified Employee Pension (SEP) IRAs

While SEP IRAs are also governed by IRS Publication 590-A, there is an important exception on the timing of when contributions have to be made. Unlike traditional and Roth contributions that must be made by the filing deadline, without considering extensions, a business owner who extends their business filing has through the EXTENDED deadline to make contributions. This can be a huge planning opportunity and allow greater flexibility on the timing of making contributions.

Required Minimum Distributions (RMDs)

Of course if we are going to talk about deadlines for contributions, we have to also talk about deadlines for distributions. For taxpayers who have reached the age of 72 the IRS requires a minimum distribution from their qualified accounts each year. In the first year a taxpayer reaches the required age they have the option to wait until as late as April 1 of the following year to take their first RMD. Every year after that the deadline is the end of the calendar year. We typically recommend that RMDs are taken care of in November or early December to avoid any issues at the end of the year. Late distributions can incur up to a 50% penalty, so it does not pay to put this off.

Health Savings Account (HSA) Contributions

Shifting away from retirement plan contributions, timing is still important for other tax qualified accounts. HSAs are often administered through payroll withholdings similar to 401(k) contributions, however the deadline for making contributions for a particular tax year is through that year’s filing deadline. Or in the case of 2021, contributions can be made through April 18th, 2022. Similar to IRA contributions it is very important to specify which year the contributions apply to and that requirements related to contribution limits and eligibility are still followed.

On the other hand, for HSA distributions there is no real distribution deadline if the funds are used for qualified medical purposes. A taxpayer could save their receipts/medical bills indefinitely and then years in the future take an HSA distribution for those amounts. The caveat is that you can only go back as many years as the account was open.

Charitable Giving

For charitable giving to be deductible it has to be completed during the calendar year. There is no option to give between January 1st and April 15th and have it apply to the prior year. This is important to keep in mind both for traditional giving as well as more advanced giving such as donor advised funds and qualified charitable distributions.

Action Items

- Review your clients for year end planning opportunities. For some of these areas you have until the tax filing deadline to help your clients but you need to be looking at this now and getting a plan in place.

- Get tax returns for all of your clients. That is the best way to know if these various areas are applicable and if there are opportunities that are not being addressed.

- Don’t assume clients who use a tax preparer already have this covered. Often clients are only going to their tax preparer after the end of the calendar year, at that point some opportunities have already been missed.

Remember to tip your server, not the IRS.