When is $500,000 not $500,000?

Conventional wisdom on preparing for retirement has often included refrains such as “become debt-free” and “defer, defer, defer”. There are situations where both of these statements can be valuable.

However, for many, “defer, defer, defer” actually creates a debt. In fact, this debt requires larger payments than they make on their physical houses over their lifetime.

As a result, it gets carried at a variable rate by a lender. This particular lender writes rules in pencil—and can change the amount owed whenever they please, if you give them the opportunity.

The debt we are talking about is federal income tax. Financial Advisors often help their clients defer it on retirement accounts. Sometimes it gets deferred through appreciated investments, too.

These can be incredible tools for preparing for retirement. At the same time, too often clients look at retirement or brokerage account balances the same way they look at their checking accounts:

“The balance in my account is the balance I can withdraw.”

That approach is unfortunately a lot like looking on Zillow and assuming the Zestimate is the amount of cash you could take home right now.

It might be, if the estimate is accurate… and you find a willing buyer… and you don’t have a mortgage… and there are no closing costs…

You get the point. This logic still holds true if we get a full appraisal and don’t just use a broad estimate.

Now none of that means that selling your house is something you should never do. It just reinforces the fact that we need to look at the whole picture when planning for a decision.

Help Them Understand

The same is true when we are working to help clients understand their investments and retirement accounts. As an Advisor, you likely look at a quarterly IRA account statement and intuitively know that taxes have to be paid, eventually.

More than that, you know that when taxes are deferred, the tax rate can (and likely will) change by the time the funds are used. However, do your clients understand that?

When you helped them set up their accounts, you undoubtedly explained all this to them, but how many years ago was that? How many years were your clients putting money into a 401(k) account before you worked with them?

When they get their annual statement for that 401(k) account—and see a $1,000,000 balance—has someone taught them enough to look past the gross number? Do they appreciate that the maximum amount they can withdraw is likely $800,000 (or maybe $750,000)?

In a presentation at the 2021 AICPA Engage conference, industry thought leader Michael Kitces advocated for Advisors including an “Embedded IRA Tax Liability” on net worth statements provided to clients.

Adding this one extra line to clients’ net worth statements is a great way to show the impact taxes will have. Additionally, it keeps this important element in mind during planning discussions.

The IRS Mortgage: Enlightened Liability

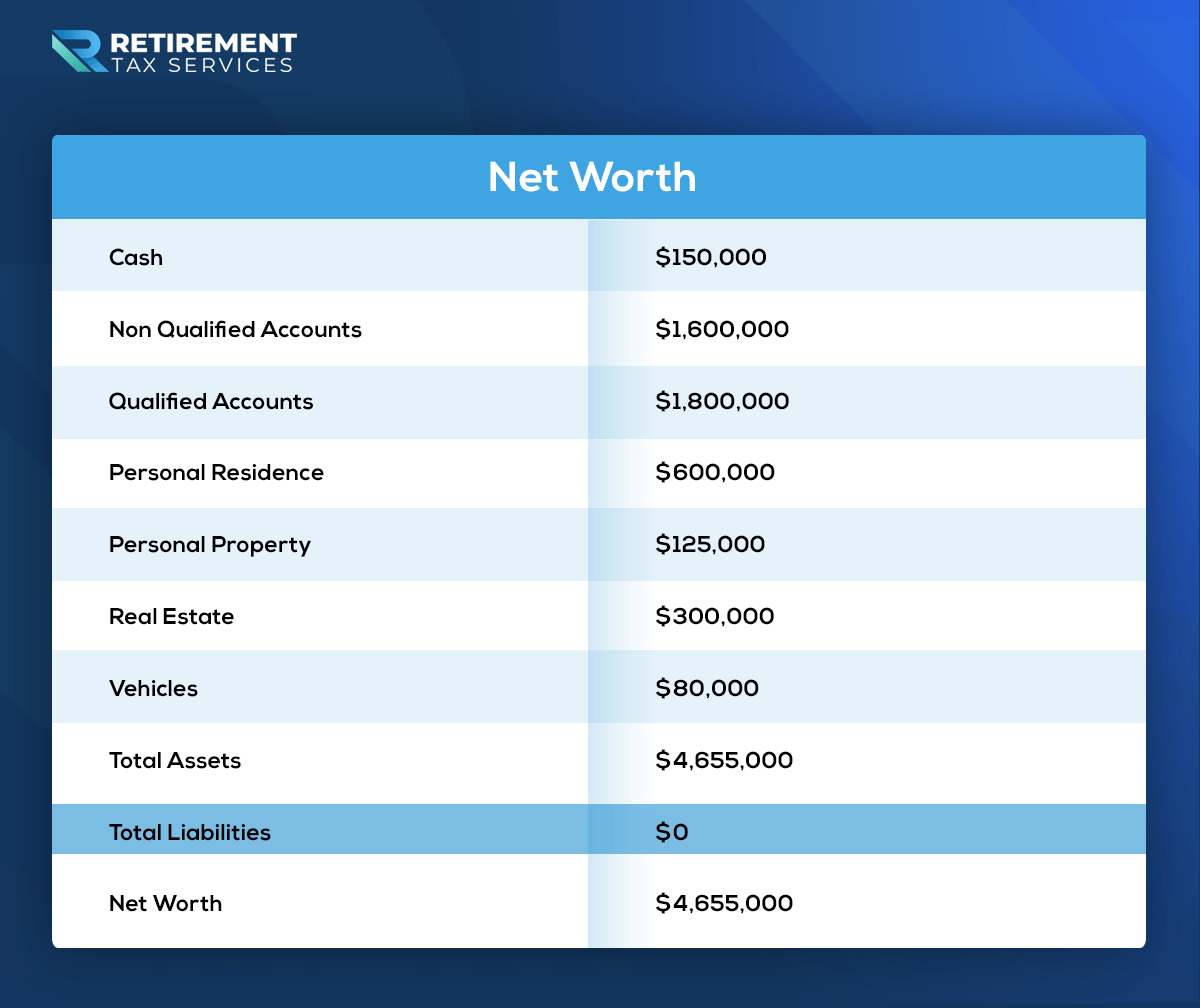

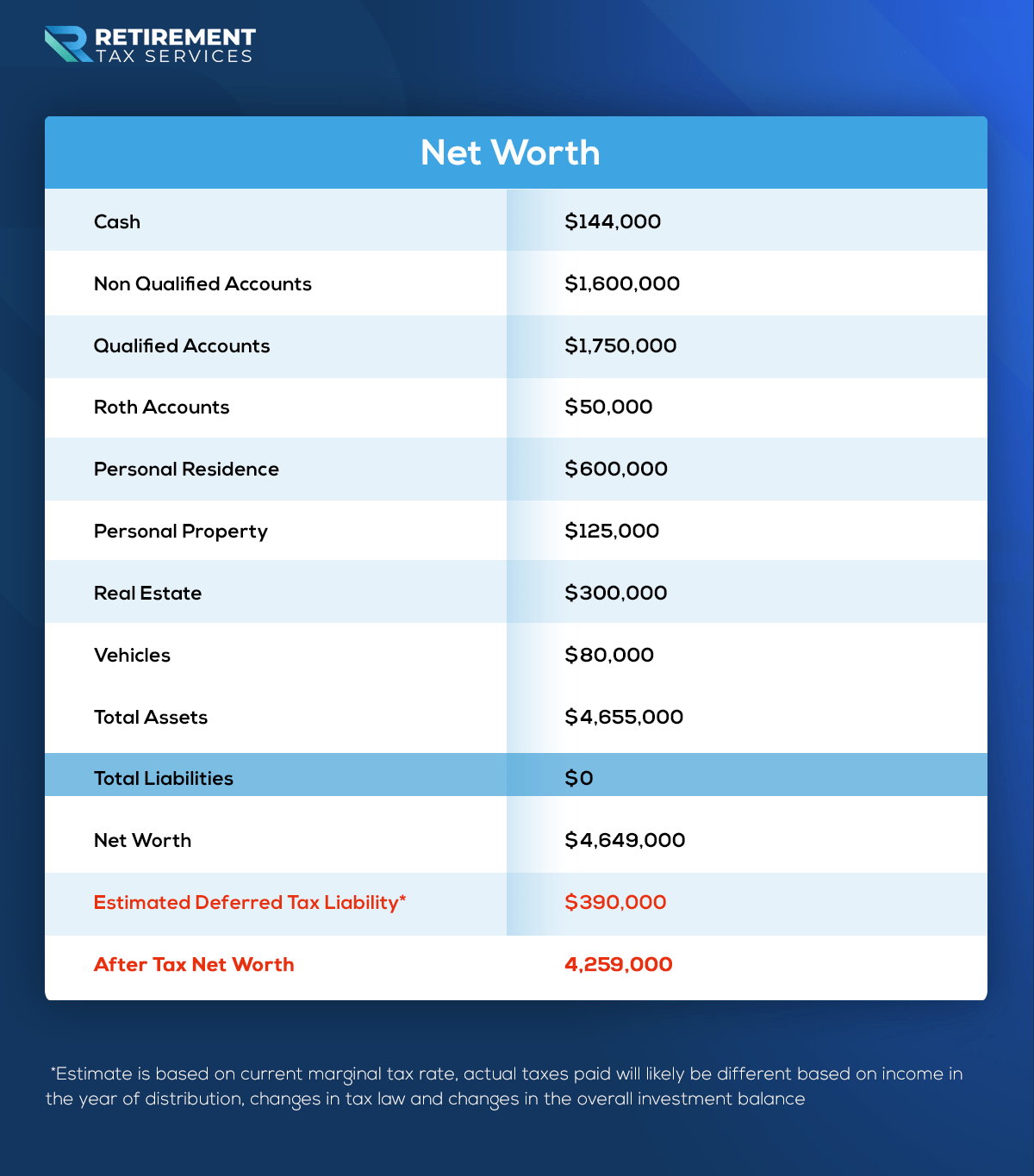

Setting aside the charts and graphs, many Advisors provide something like this to their clients:

This is a great summary of the assets that client has. Regardless, it leaves out the critical piece: Clients can’t see how much they will pay in taxes someday for their qualified accounts.

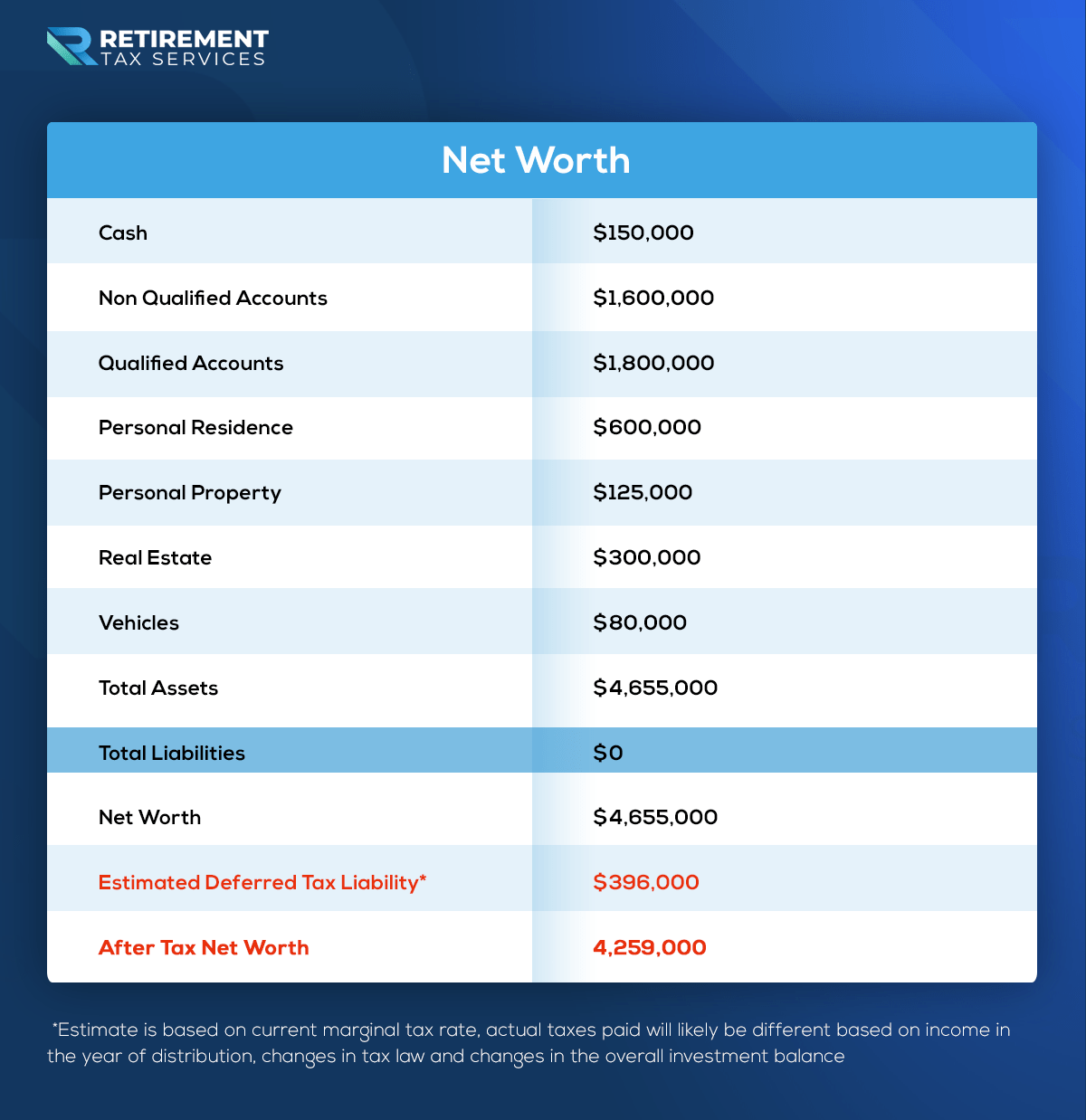

How much more powerful is this planning tool if it is updated to add the line below?

From there, you have a really effective tool for teaching and planning.

Let’s assume that the full amount in “qualified accounts” represents IRA dollars: You’ve determined that the client is in an ideal situation for performing Roth conversions.

Using this as a reference, we can have an impactful conversation with the client. We can discuss the effects of the conversion both now and in the future.

“Bob and Sue, you currently have a deferred tax liability on your qualified accounts of $396,000. This is almost like a mortgage you owe to the IRS on your qualified account balance.

One downside is that it’s a variable-rate mortgage and Congress has sole discretion on what the rate is going to be. If we were able to convert $50,000 of that balance to after-tax, or Roth, dollars next year, here is what that would do to your net worth:”

“Your assets obviously go down because the taxes have to get paid as we make the conversions, but there is no change to your after tax net worth because you are also paying down your ‘mortgage’ to the IRS.

This also does not show the expected growth over that time, which for the Roth balances, would be 100% tax-free. And we would significantly lower that balance that has a variable rate associated with it.”

Final Thoughts

Roth conversions are just one example of planning opportunities that you can probably make easier to explain with this type of net worth statement.

As you implement this with clients, use it consistently. You’ll have a reference point for many tax planning opportunities as you work with your clients, both to and through retirement.

Take Action:

- Update your clients’ net worth statements to show their deferred tax liability. REMINDER: work with your compliance department to make sure you have the appropriate disclosures. You are ultimately responsible for your compliance and delivering value to your clients.

- Find a community of Advisors you can learn from to keep improving your practice. The IRS mortgage analogy came from a great Advisor and RTS Member, Phil Putney. Phil is a CPA in addition to being an Advisor and was a recent guest on the RTS podcast.

Great advisors provide value in all aspects of their clients’ financial lives. CPAs do not have exclusive rights on all things tax-related. Many of them will thank you for taking these steps with your shared clients.

Even if you find yourself in a situation that is beyond your expertise, you can still serve your client and provide value through partnering with them.

Work with the tax experts. Don’t just sit back and say, “Sorry, I don’t give tax advice.”

Good luck out there and remember to tip your server, not the IRS.