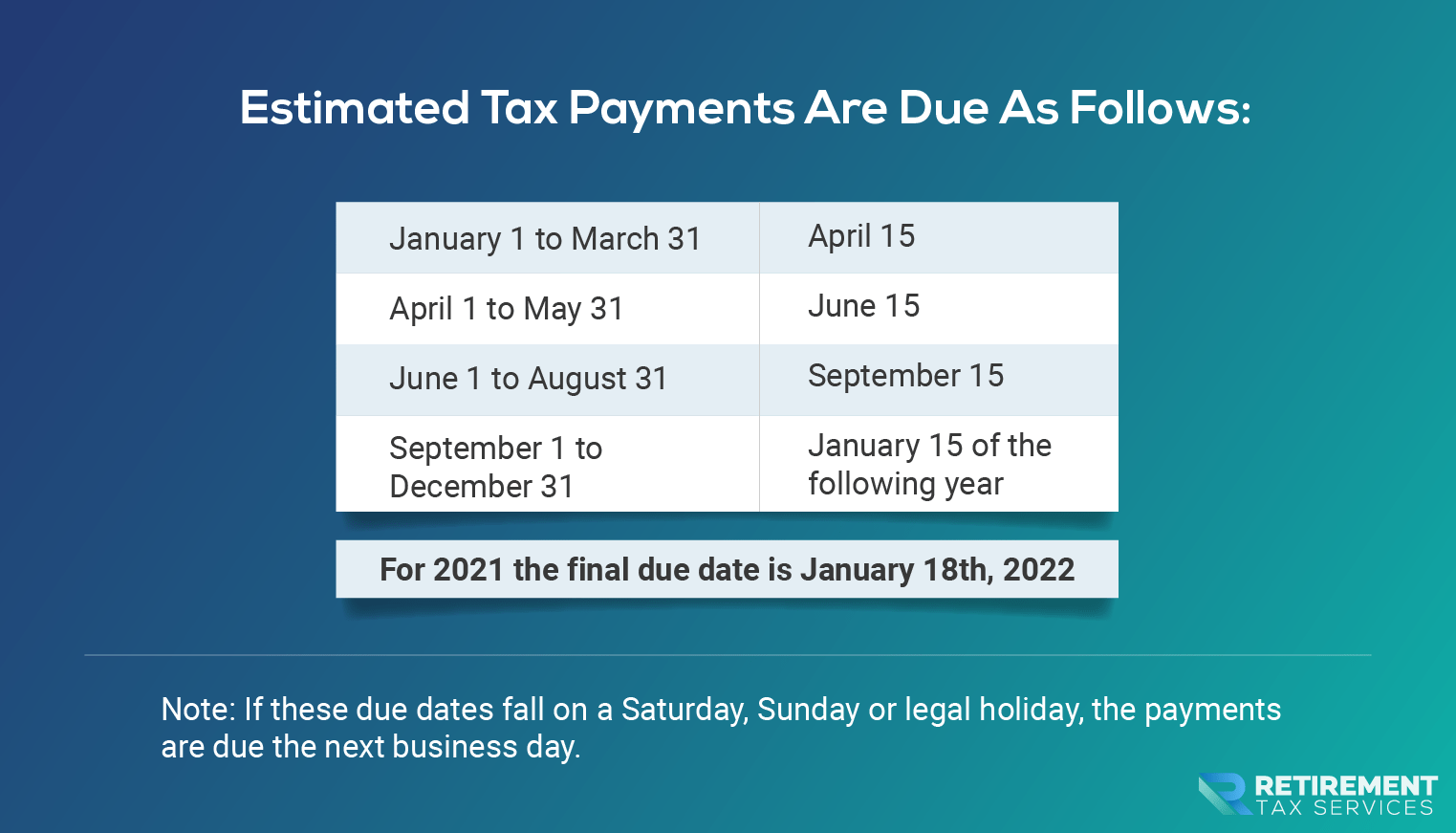

No, the IRS is not trying to balance out the last 2 years where the deadline to file was extended into July (2019) and May (2020). In fact, every year there is an important tax deadline on January 15th. In the case of 2022, it’s January 18th (because of a weekend and Martin Luther King Jr Day).

January 18th, 2022 is the deadline for Q4 estimated tax payments. It’s also the date after which the IRS evaluates whether you are subject to an underpayment penalty.

The IRS has a pay-as-you-go system. So, while many of us think of April 15th as tax day, that is really tax filing day. Taxpayers who wait until after the end of the year to see if they are on track may be in for an unpleasant surprise: Underpayment penalties.

If you or your clients routinely make estimated tax payments, it is definitely important to remember all of the payment due dates throughout the year.

Be Proactive

But as we approach the end of the year, it is crucial to evaluate whether there is an opportunity to not “tip the IRS” for all taxpayers.

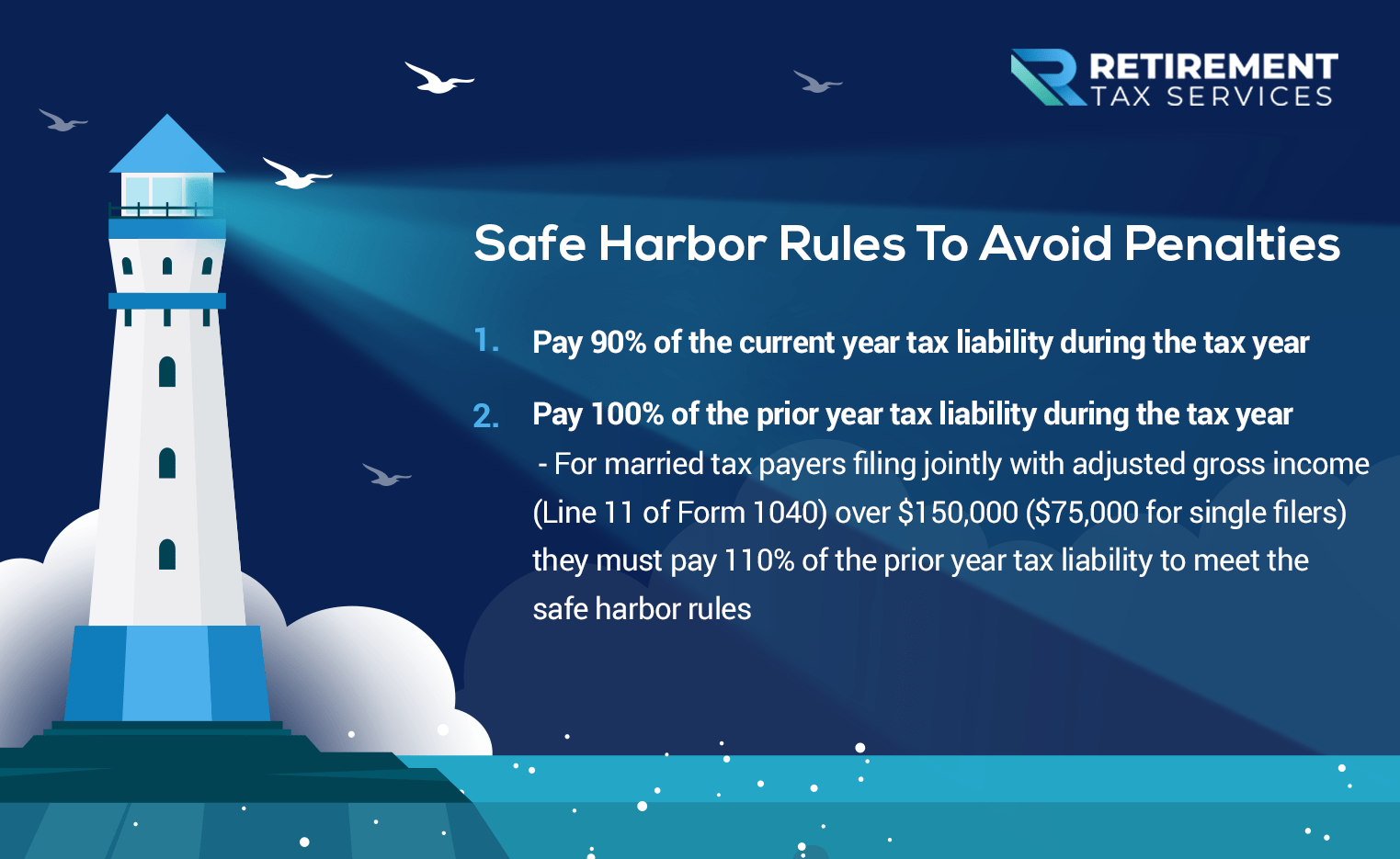

For many of your clients, this evaluation will be very simple. As a matter of fact, for taxpayers with fairly stable W-2 income, the IRS’s safe harbor provisions all but ensure that the risk of underpayment penalties is very low.

Even if no action is needed before the year’s end, do a projection for these clients. Making sure they are on track delivers value. Additionally, it gives them peace of mind because someone is looking out for them.

A large number of taxpayers don’t start talking to their tax preparer until February or March. At this point, the opportunity for being proactive is already gone.

Watch for Red Flags

Even if the simple situation just described applies to the majority of your clients, there are potential red flags you should be looking for. As a result, identify opportunities to take some of the pain out of taxes for them.

Here are things you should be looking for. These might indicate a more detailed assessment is warranted:

- Significant changes in recurring income sources.

- Large one-time or nonrecurring income sources in the current or prior year. A spike in the prior year will have a huge impact on how much tax a client will need to have paid to meet the IRS’s safe harbor provisions.

- New or lost income streams.

- Change of job status or retirement.

- Change in filing status.

- Transition from W-2 income to 1099 and/or schedule C income.

Estimated Tax Payments: Prevent Problems

Any of these situations potentially put your client in a position of owing tax at the end of the year and incurring underpayment penalties. This means you have a great opportunity to add value if you have a process for doing so.

Start by doing a projection of what they will likely owe at the end of the year. Where possible, make sure you get copies of actual documents. Don’t just ask the client for their best guess.

Getting a copy of a pay stub is going to be much more accurate than a client’s estimate. How many people can tell you their gross pay and how much is withheld in taxes? Not many. Most of us just focus on our take-home pay.

If the client is projected to owe a large amount, don’t immediately have them write a check. In fact, you should NEVER have them write a check to the IRS again (more on that below).

The benefit of doing this exercise before the end of the year is that you still have options to avoid an underpayment penalty.

So what are your options?

1. Lower the taxable income for the year.

- You can lower the taxable income of clients who are charitably inclined through additional gifts. These can be direct or through a donor-advised fund (DAF). DAFs make the most sense when the client already itemizes. Remember that only the amount above the standard deduction represents a true tax benefit.

- Review the limits for pre-tax accounts (401k, IRA, HSA, 529, et cetera). See if there is an opportunity to increase contributions before the year’s end.

- Are clients expecting large distributions or capital gains near the end of the year? See if there are ways to spread the income and therefore the tax, over multiple years.

2. Increase withholdings.

- The IRS gives favorable treatment to taxes paid through withholdings over estimated payments. This is regardless of the source (W-2, IRA distribution, social security payments, or pensions) and the timing of the actual withholding. The IRS treats withholdings as having happened evenly throughout the year. Even though the payment deadline for the year is in January of the following year, the IRS expects payments to be made throughout the year. They will charge underpayment penalties if you wait until the end of the year to make estimated payments on income that was generated early in the year.

- Tax withholdings all go into the same pot. The IRS does not expect taxes on various income streams to be paid or withheld from that specific stream if the total tax bill is covered.

3. Increase payments.

- You can also have the client make an estimated tax payment. This ensures that no underpayment penalties are incurred when their taxes are filed in March or April.

- Help your clients make an online payment to the IRS. You should never process the payment on their behalf. However, walking them through the process is a great way to simplify the process for them.

- DO NOT have your clients write a check! Making online payments is more secure. They are processed and confirmed more quickly. Online payments can’t be lost in the mail, either. Especially right now, the IRS is incredibly backlogged on processing paper of any kind.

Closing Thoughts

You can incorporate this as part of your fall client meetings or a value-add sent out separately. It is a great way to deliver massive value to your clients as you approach the end of the year.

Some advisors and tax preparers will tell you that underpayment penalties are small; that there’s no need to worry. There is nothing wrong with helping your client make an informed decision. If the underpayment penalty is small enough, the effort to avoid it wouldn’t be worth it.

But, that is ultimately your client’s choice—and it has to be an informed decision. Don’t decide how much of your client’s money is worth doing something about on their behalf.

Take Action

- Implement a process for assessing whether your clients are on track for the January 18th, 2022 tax deadline. Do this through your fall meetings or as a separate value-add.

- Apply the dishwasher rule. Make sure your clients know this is something you are evaluating for them, even if no action is necessary.

- For RTS members, this can be a great point to highlight in the Yearend Tax Review Checklist.

- Get tax returns for all of your clients. This is critical for determining safe harbor levels. Additionally, it provides a great baseline for estimated tax payments for the current year.

- Mark your calendar for the RTS October Newsletter. It will be a deep dive on all things estimate-payment-related.

Great advisors provide value in all aspects of their clients’ financial lives. CPAs do not have exclusive rights on all things tax-related. Many of them will thank you for taking these steps with your shared clients.

Even if you find yourself in a situation that is beyond your expertise, you can still serve your client and provide value through partnering with them.

Work with the tax experts. Don’t just sit back and say, “Sorry, I don’t give tax advice.”

Good luck out there and remember to tip your server, not the IRS.