Background

Our team is continually reviewing tax returns for our Members. Believe it or not, we really enjoy it. We may be nerdier than most, but a tax return provides a wealth of information and it’s a treasure hunt.

Yes, a treasure hunt: Every time we review a tax return, we find ways to deliver value to the taxpayer (through their advisor).

There is tremendous value to be found for taxpayers from reviewing tax returns. For example, you can help them avoid penalties.

On the other hand, you could also help them understand any thresholds and phaseouts they might be subject to. Best of all is our personal favorite: helping them proactively make choices to stop leaving the IRS a tip.

Rather than write about why all great Financial Advisors should be reviewing tax returns, we decided to share an example of what this looks like in practice.

What follows is a real example of real taxpayers who work with a CPA for their tax preparation. However, they clearly need help with tax planning.

Fortunately, they work with one of the many great Financial Advisors who are members of RTS. This means their advisor is committed to helping with tax planning.

We refer to all clients as “Bob and Sue.” Similarly, the amounts have been changed slightly to keep things completely anonymous (but not so much that it would change the opportunity).

Let’s dive in. Bob and Sue are married filing jointly (MFJ), have W-2 income, and run a small business that files as an s-corp.

We’ve included just a few of the takeaways from our review to highlight the biggest opportunities for delivering massive value to the client. However, unless there are errors that need to be corrected, it’s important to be realistic about what can be accomplished all at once.

Coming to a client with a list of 30 tax ideas is going to be overwhelming. That will most likely result in nothing getting done.

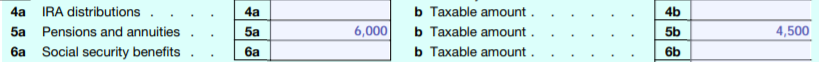

All screenshots are from the 2020 version of IRS Form 1040. Here is the first line that we highlighted.

FORM 1040 LINES 4-6

Bob and Sue are still in their earning years, so seeing amounts on line 5 immediately prompts a couple of questions:

- What is the strategy for taking distributions?

- Do Bob and Sue have sufficient cash flow to delay taking distributions from qualified accounts?

- Is the distribution from an account that the Advisor is aware of and including in their planning recommendations?

After some follow up with the Advisor, we learned that Bob and Sue have been doing Roth conversions. We would typically expect those to appear only in the “taxable amount” box on either Line 4 or Line 5. This becomes a follow up question for the tax preparer.

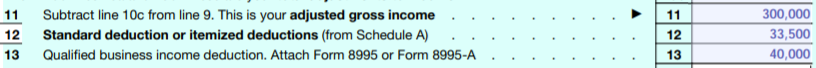

Moving down the first page of the 1040, we can see that Bob and Sue are itemizing deductions: line 12 is larger than the 2020 standard deduction of $24,800 for MFJ.

FORM 1040 LINES 11-13

While this is interesting, we have to go to Schedule A. That’s where we can see their itemized deductions to know if there are planning opportunities.

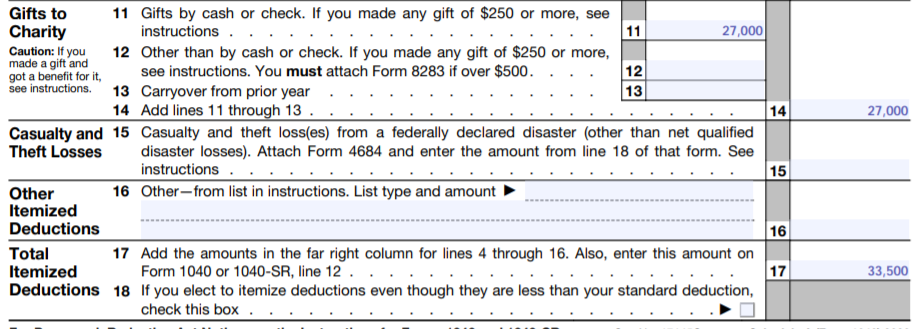

SCHEDULE A, LINES 11-18

Of their $33,500 in itemized deductions, $27,000 is from charitable giving. This is important because there is a lot of discretion over when and how these contributions are made.

If the bulk of Bob and Sue’s itemized deductions were from State and Local Taxes or Mortgage Interest, there might be less opportunity.

“Bob and Sue, you are doing a phenomenal job of supporting organizations you care about, congratulations. Right now, because of how high the standard deduction is for married couples like yourselves, of the $27,000 you gave to charity, only $8,700 is actually getting you a tax benefit.

Even though you aren’t giving to charity for the tax benefit, would it be alright if we discussed some options for you to give in a more tax-efficient way—so that you can have an even bigger impact on these great organizations?”

There are multiple ways for Bob and Sue to potentially give to charity in a more tax-efficient way. These include donor-advised funds and qualified charitable distributions (when they are 70.5).

On the other hand, they could also bunch charitable deductions and charitable giving. This can be done through a business instead of individually (and all these options were the topic of November’s RTS Newsletter, by the way).

Each of these opportunities has its own requirements and limitations. But, if someone in Bob and Sue’s life is not identifying opportunities for them, the rest of the steps are irrelevant.

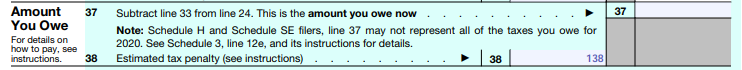

FORM 1040, LINES 37-38

Any tip to the IRS is worth avoiding but underpayment penalties reported on Line 38 of the 1040 are a particularly irksome way to pay extra. This is because they are avoidable.

In the example above, Bob and Sue paid an underpayment penalty even though they didn’t owe additional taxes at the end of the year (Line 37). Taxes are pay-as-you-go, but they didn’t make sufficient payments early in the year.

This is a line we always review. Even $138 is a win, if you help a client proactively avoid a tax penalty.

“We work with clients to avoid overpaying the IRS and want to make sure you also know your options for doing that. There are no patriotic awards for leaving a tip.

Tax penalties are one thing we always look for because if we are proactive, they are 100% avoidable. Would it be alright if we worked with your tax preparer to implement a strategy for avoiding this in the future?”

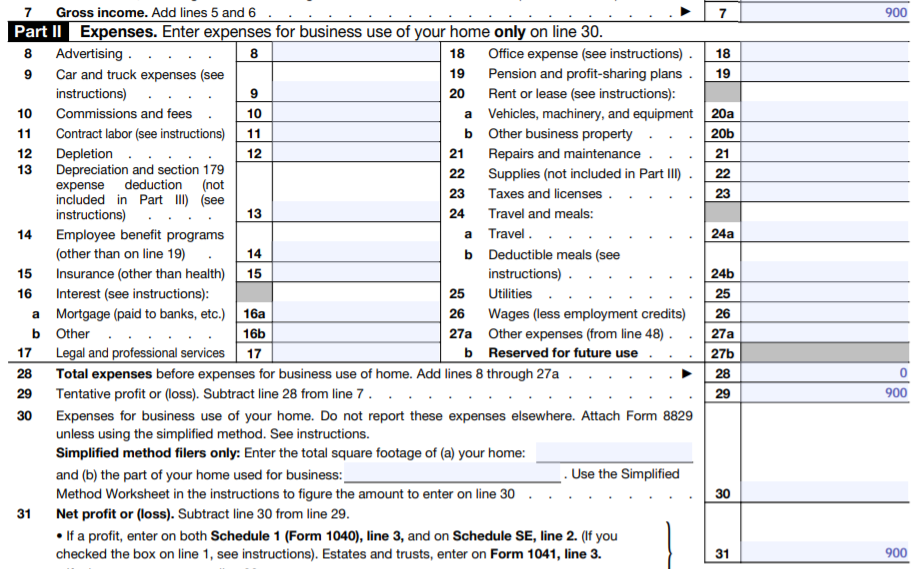

SCHEDULE C

Even though $900 on a Schedule C might seem trivial, taxes are emotional. You should already have a process for getting returns from your clients and reviewing all of the pages.

So, it isn’t extra work to flag a Schedule C like this and start asking questions. In fact, this schedule C happens to list the same business purpose as Bob and Sue’s s-corp.

“Is this really a separate business entity or should this be on the S-corp return? There are situations where income might be reported separately but are there also expenses we should consider?”

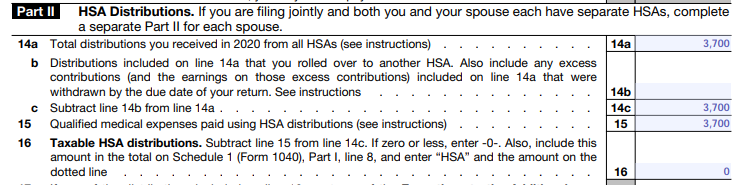

FORM 8889

It is great to talk to clients about HSA contributions. However, there are planning opportunities if you take the time to review HSA distributions, as well.

In part II of IRS Form 8889, you can learn whether Bob and Sue are using their HSA balance or investing it for the future.

“Health Savings Accounts are truly unique. Because the contributions go in tax-free, the growth is tax-free—and the distributions are tax-free, if they are used for medical expenses. If you have other funds available to cover medical expenses now, this is an opportunity to invest these triple-tax-advantaged funds for the future.”

Tip of the Tax Return Iceberg

We picked 5 examples for this article from a recent tax return review we’ve completed. However, that is barely scratching the surface.

Tax returns are a literal treasure trove of information and opportunities for Financial Advisors. You just have to take the time to collect and review them.

Take Action

- Get tax returns for every client every year. You need the document before you can start delivering value, so make sure you get all the pages.

- Find or start a checklist ( RTS Members can click here ) of common themes and opportunities observed for your clients.This will help systematize the process and make sure you are consistently delivering value.

- Commit to improving your process each year.If you are new to tax planning, the first step is easy: pick up a tax return. If you’re further along, the tax code changes and evolves constantly, so look for areas impacting your clients that you can keep learning in.

And of course, remember to tip your server, not the IRS!