Words matter. At times distinctions may seem trivial, but how we think about certain topics can influence the action we take. When it comes to being the beneficiary of an individual retirement account (IRA), Tom Gau may be the authority on using the power of distinction to help clients take full advantage of the opportunities available to them.

In a recent conversation with Tom, he shared how he frames the conversation with clients when they are going to receive IRA dollars as a beneficiary:

“Did you inherit an IRA, or do you have an inherited IRA?”

He admits that the initial reaction can be a puzzled look but he takes the time to show the clients the importance of knowing the difference. For advisors who don’t often work with inherited IRAs there is still incredible value to be taken from this example. Whether specific to inherited IRAs, or applied to other areas of tax planning, the approach in this example has the power to help clients take action.

“Inheriting” an IRA

After January 1, 2020 the rules on what someone is required to do with an inherited IRA changed. Under the current rules, in most cases the beneficiary will have 10 years to distribute the entire balance. There are exceptions for spouses inheriting the IRA but for this article we are focused on non-spouse beneficiaries.

Inheriting an IRA is when a client takes the full balance as a distribution and gets killed in taxes all at once because you didn’t educate them on their options. This is all too common. A client finds out they have inherited a large and potentially unexpected amount of money, they have no prior experience with this situation and they end up with a check for the full amount. The client now has money they didn’t previously but they’ve missed an enormous opportunity.

The much preferable alternative to simply cashing the check is to set up an Inherited IRA (no, you cannot put it into another existing IRA) and have a plan for not getting killed in taxes.

“Having” an Inherited IRA

Having an inherited IRA means creating a plan to take full advantage of the 10 years available to distribute the money. It means shrinking the slice of the pie the IRS is going to hold onto. The default option is that you kick the can down the road and take care of everything when you are up against a deadline. Instead, we can take a proactive approach and spread this out over time and lower the amount a client is going to pay.

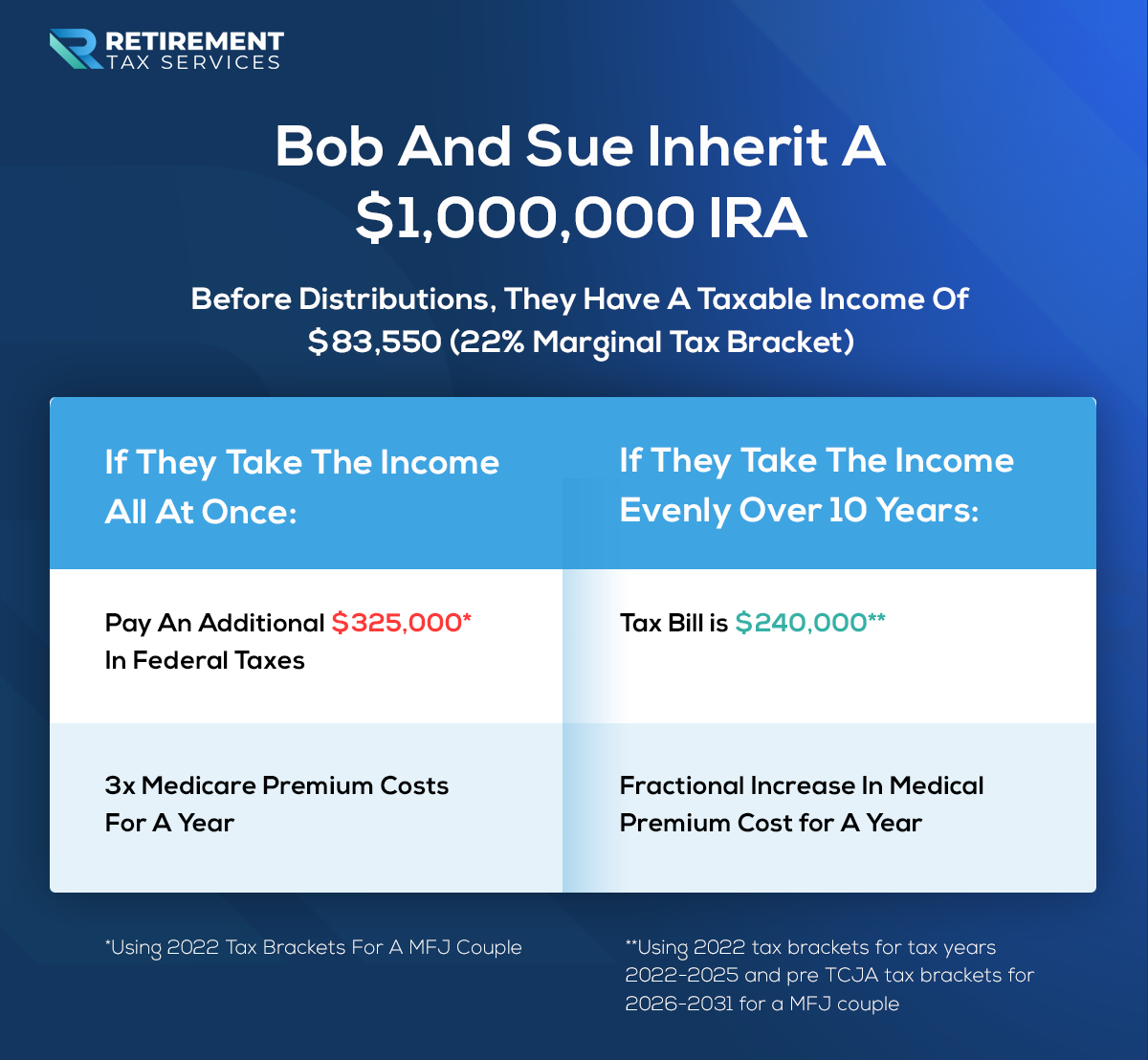

Here is a simple example to illustrate the power of spreading out the income. Bob and Sue inherit $1,000,000 IRA. Before taking any distributions their taxable income is $83,550, putting them in the 22% marginal bracket. If they take the $1,000,000 into income all at once they will pay an additional $325,000* in federal taxes. If they happen to be on Medicare their premiums will also more than triple for a year.

However, if they take the income evenly over 10 years the tax bill is only $240,000**, which includes the increase in tax rates when the Tax Cuts and Jobs Act expires in 2026. And with just a little bit of planning their Medicare premiums will only be impacted in a single year and by a fraction of what they would be in the first scenario.

“Mr and Mrs. Client, would it be alright if we worked together to save you over $80,000 in taxes on your inherited IRA?” Not many people are going to say no to that.

Proactive and not Reactive

For this to be successful in practice you have to build a relationship with your clients in which they come to you for everything in their financial life. If the advisor only finds out about an inherited IRA after the client has taken action, it might be too late. This is just one example of why it is so important to get tax returns every year and talk about taxes every year. Your clients need to know that they can, and need to, come to you for everything money related in their life. To deliver massive value on this topic, the first step is your client coming to you as soon as they find out they will be inheriting an IRA.

Take Action

- Make it easy for your clients: whether it’s something big like inheriting an IRA or something simple like buying a car, you want your clients to come to you for everything financial in their lives. This can’t just be something you offer once and hope they remember, you need to remind your clients you are there for them, make it easy for them to reach out and make sure you are always deliver value when they do (even if it is as simple as “based on what we can see it looks like you are on the right track”)

- Educate your clients: Make sure your clients understand the importance and potential impact of not proactively planning. They may not know whether they are the beneficiary of someone else’s IRA, when you are discussing the beneficiaries of their IRAs is a great time to be proactive so they know they can call you if it ever comes up.

- Be a resource to the next generation: you can deliver value on this topic when your clients inherit an IRA, but also in preparing for your client’s beneficiaries to inherit their IRA. Help your clients understand what will happen when their beneficiaries eventually inherit and how your team can help make sure they don’t get killed in taxes by taking everything all at once.

Taking advantage of the 10 years available under an inherited IRA is a great way to NOT tip the IRS.

**Post publication update: the IRS’s recent guidance surrounding the 10-year and inherited IRA’s does potentially add a layer of complexity but does not change the overall goal of this article. Even if a required minimum distribution has to be taken, there is the default approach, and there is the intentional approach. The intentional approach will always serve the client better. Here is a great article from the Nerd’s Eye Blog covering the recent guidance.