Background

We all want life to be simpler than it actually is. Your clients are no exception when it comes to how their modified AGI is taxed.

Many people seem to think accountants make life unnecessarily complicated. In fact, if you’ve ever tried to walk through even the first page of a tax return, it’s hard to argue against that claim.

You’ve probably heard of Modified Adjusted Gross Income (MAGI). However, did you know it gets defined in several different ways depending on what tax area you are working in?

As a Financial Advisor, you inevitably get questions about different income amounts from the Form 1040. This is because they have impacts beyond the tax return. Common examples include:

Client: “Can I make contributions to my Roth account this year?

Advisor: “That will depend on your Modified Adjusted Gross Income.”

Client: “How much of my Social Security benefit will be taxable?”

Advisor: “We will need to figure out your combined income.”

Client: “You said my marginal tax rate is 22%, so my next dollar of income will be taxed at 22%, right?”

Advisor: “That depends on how the next dollar of income is created.”

You don’t have to commit the tax code to memory to deliver value to your clients. On the other hand, continually expanding your knowledge base around what is important to them is a great way to deliver value. It sets you apart, too.

This article is a reference guide to the different types of personal income on the 1040 and which tax rates apply to which buckets.

It’s also meant to show you the order in which they are applied: Yes, there is an order and yes it is very important.

Taxable Income & Modified AGI

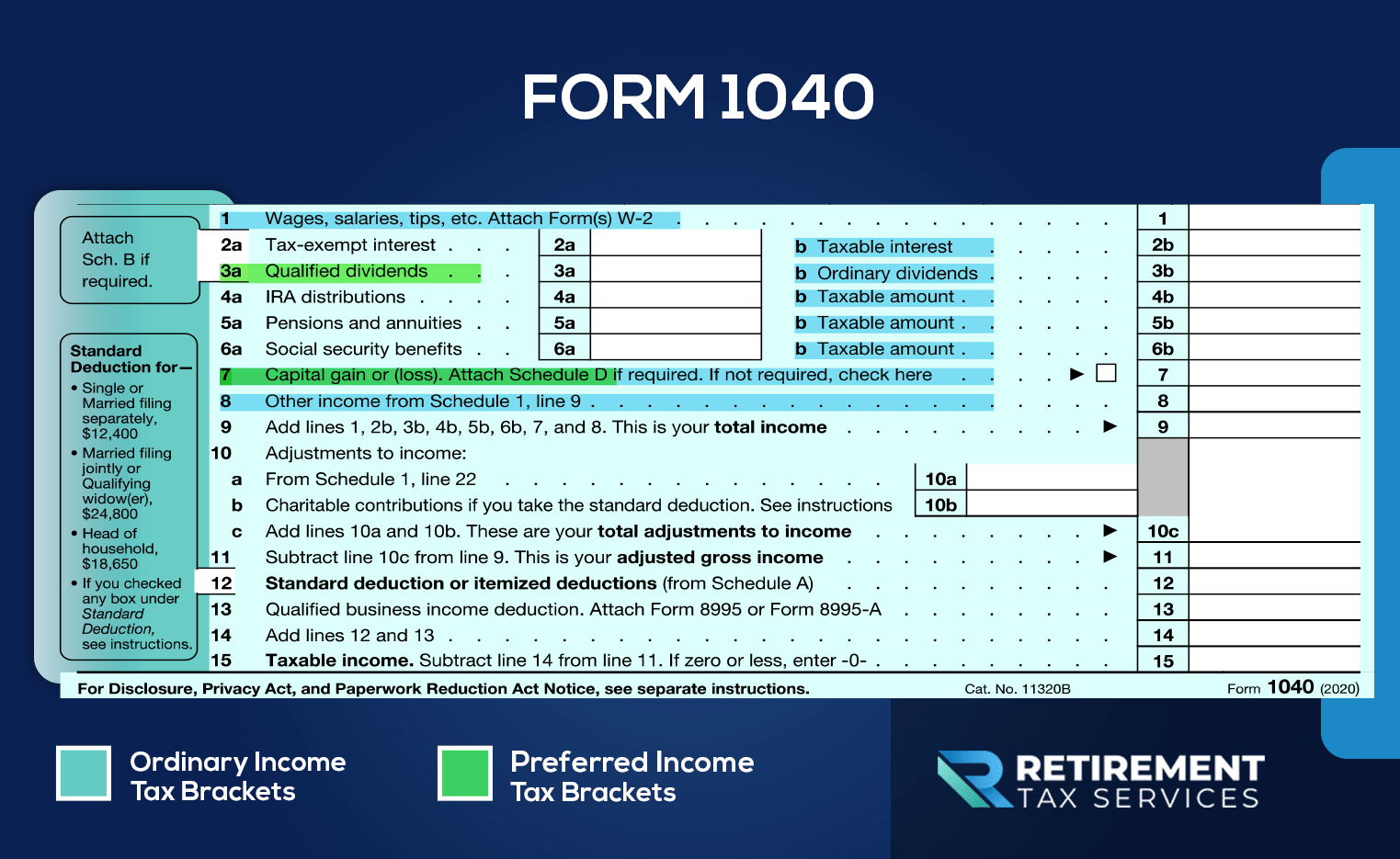

On the 2020 IRS Form 1040, taxable income is on line 15 at the very bottom of page 1[1] .

In a simple world, a taxpayer’s total tax liability would be their taxable income multiplied by their tax rate. As already noted, this is not a simple world. So, that approach doesn’t get us to where we need to be.

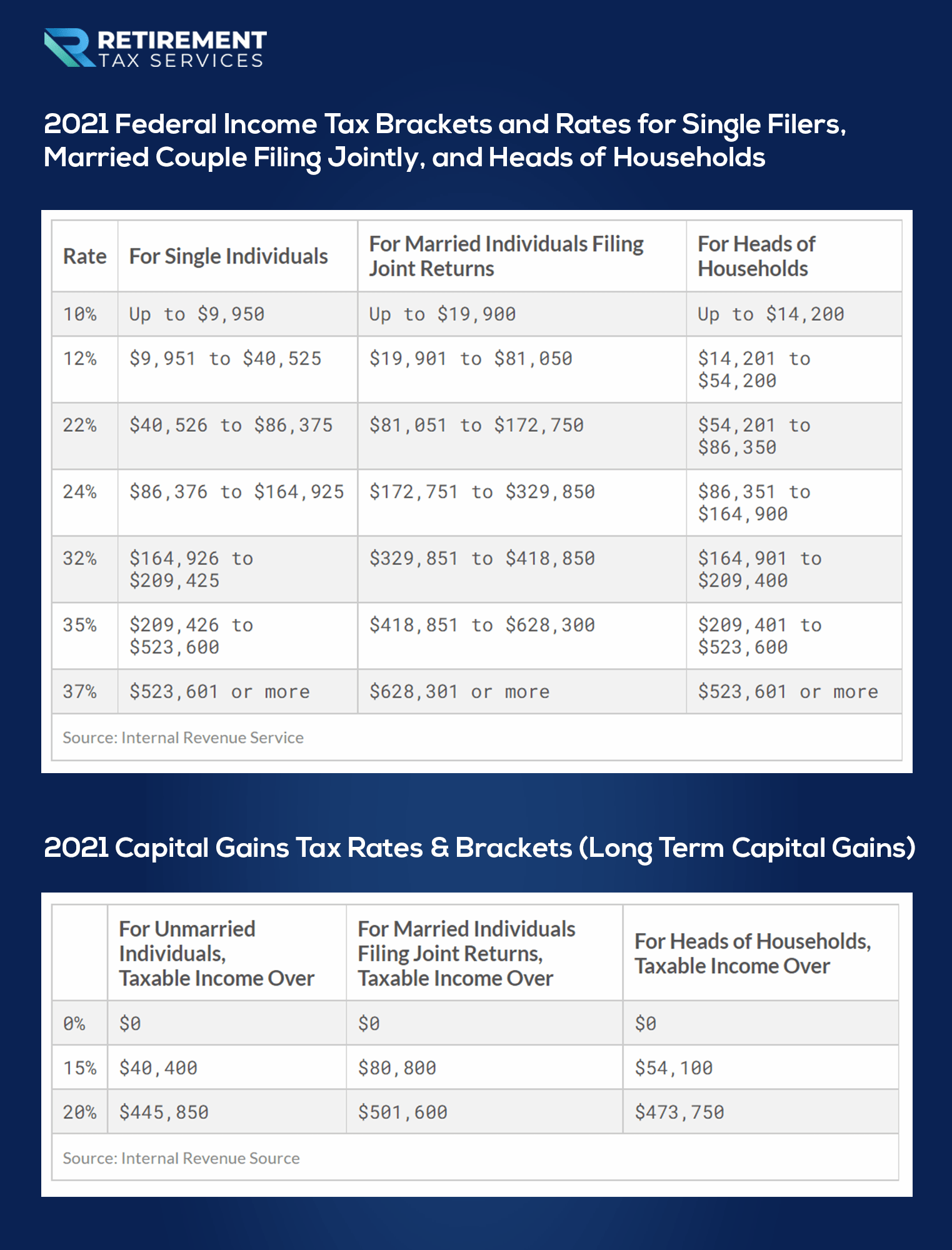

Since this is a tax world, it’s also not as simple as taking taxable income and applying the tax brackets that your clients might have Googled[2]. Of course, the problem with this approach is that not all income is created equal. Sorting out how different types of income are taxed will keep you on your toes.

The 1040 gives you no indication of how much of the taxable income bucket should be run through the ordinary tax brackets. It doesn’t mention how much should be run through the lower capital gains rates, either.

Income Line by Line

The first 8 lines of the 1040 summarize all the types of income reported to the IRS on an individual’s tax return. However, they do not all receive the same tax treatment.

The image below highlights which income buckets go into the ordinary tax bracket and which go into the preferred tax bracket (included above).

Special Considerations For Certain Income Lines

There are 5 lines that have an “a” and a “b,” but take note that in the previous section, only line 3a is included in a tax bucket. The remaining “a” lines are not directly included in taxable income.

Lines 2a and 2b are completely separate amounts. Line 3a is a subset of line 3b. Lines 4b, 5b and 6b are all subsets of Lines 4a, 5a and 6a, respectively.

Line 7 is highlighted and linked to both brackets. This is because the face of the 1040 does not tell you which bracket this line item belongs in.

To know whether ordinary or preferred rates apply, you’ll have to review Schedule D of the 1040. Short-term capital gains are taxed at ordinary tax rates and long-term capital gains are taxed at preferred tax rates.

For business owners: capital gains of pass-through entities are still reported on Schedule D and then flow through to line 7 of the 1040. So, line 8 on the face of the 1040 all goes into the ordinary tax bracket. The complexity is the sheer volume of information, not any one piece.

Please Excuse My Dear Aunt Sally

Just like in algebra, the order of operations is important in taxes. When it comes to taxes, the IRS starts with income at ordinary rates before moving onto income at preferred rates.

This is both for reducing income through adjustments/deductions and filling up tax brackets for calculating a taxpayer’s tax liability. As an example, for 2021, the standard deduction is $25,100 for a couple that is married filing jointly.

Let’s say your client has $20,000 of Wages (Line 1) and $80,000 of long-term capital gains. Line 7 gives you total capital gains and Schedule D tells you whether they are long-term or short-term.

When the standard deduction gets applied, it reduces your ordinary income (the $20,000 of wages) to $0. The remaining amount of the standard deduction reduces your long-term capital gains.

Thankfully, this is reducing your income potentially subject to the highest tax rates first. In this situation, you’d be left with $74,900 in long-term capital gains, all of which would be in the 0% bracket.

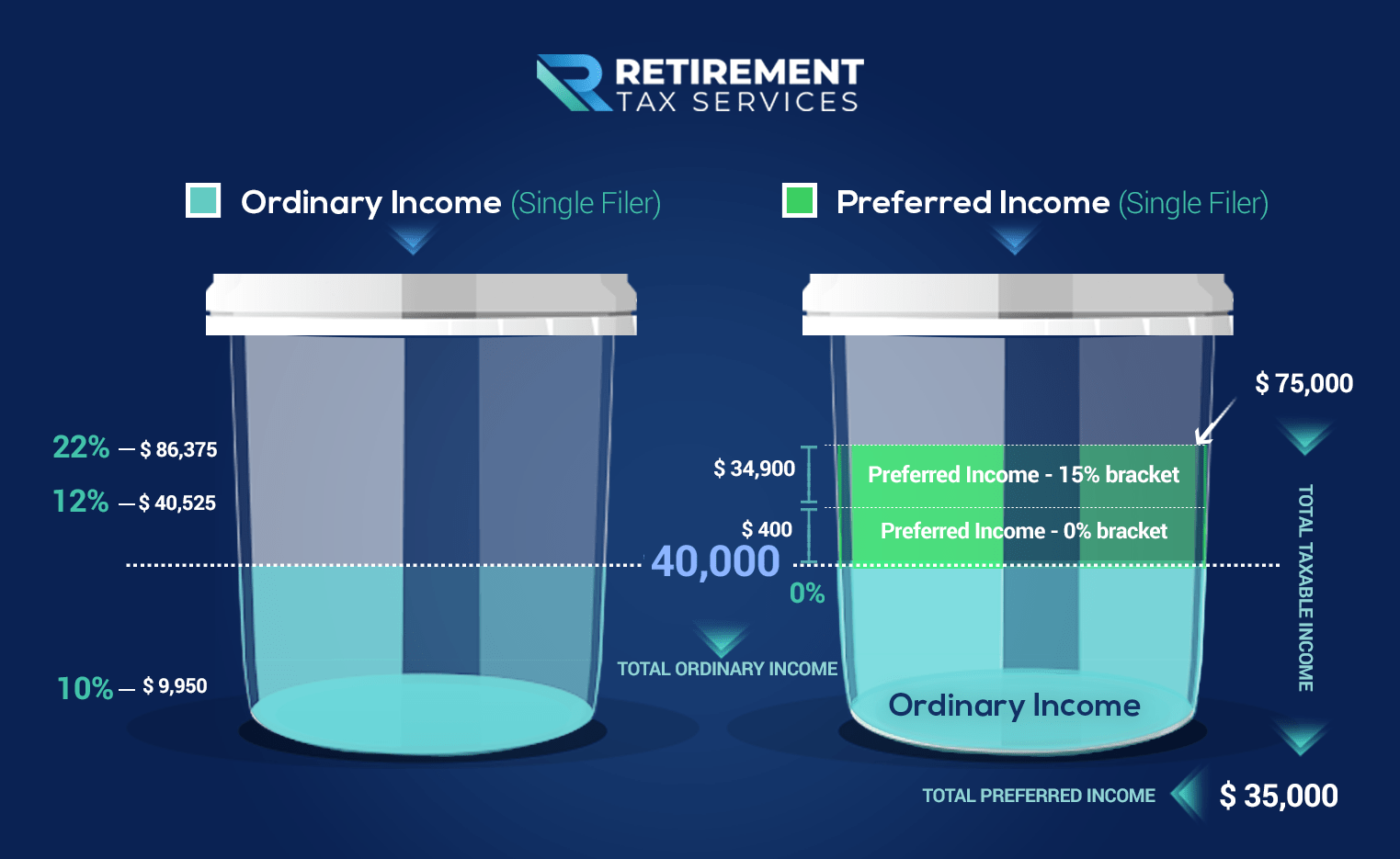

Let’s consider another fictitious taxpayer to demonstrate how the tax brackets fill up. In this case, let’s look at a single filer who has $47,550 in wages and taxable interest, $5,000 in short-term capital gains, and $35,000 in long-term capital gains.

The standard deduction in 2021 is $12,550 for single filers. All of this would be used to reduce the ordinary income bucket (which includes the $47,550 of wages and taxable interest and $5,000 of short-term capital gains).

This would leave $40,000 of income taxed at the ordinary rates and $35,000 taxed at the preferred rates. Even though these are two separate buckets with different tax rates applied, they still have to be considered together.

Know Your Numbers by Income Source

Referring back to the chart in the article for ordinary income for a single filer, the first $9,950 would be taxed at 10% and the remaining $30,050 would be taxed at 12%.

We don’t get to start over when we go to the preferred income bucket. Add onto the amount that was already used in the ordinary brackets.

So, of the $35,000 in long-term capital gains, $400 would be in the 0% bracket:

- $40,400 (top of 0% preferred rate bucket)

- $40,000 (amount of ordinary income)

- $ 400 (remaining amount applied to 0% bracket)

Note that the remaining $34,600 would be taxed at 15%.

As you’re reading this, you may be wondering “Why should I care, doesn’t the software do all this for me?”

Yes, any good tax software will figure all of this out for you. On the other hand, the point is being able to help your clients. Telling your clients to ask the software (or to simply trust the software) is not adding value. While there are many great tax softwares out there, they are not flawless.

Be able to explain to them in crayon what is going to happen to their income. This is a great way to set yourself apart.

This article didn’t cover the difference between marginal and effective tax rate. However, it helps illustrate why there is a difference between what bracket your client is in and how much they paid in taxes.

Your client has come to you because they want someone to simplify the complex financial world we all live in. Be prepared to do that.

Take Action

- Practice. Whether you use buckets or some other analogy, make sure you can explain to your clients what is happening to their income. Helping them understand this framework gives you a foundation for explaining the potential impacts of different tax planning strategies as they come up. “Mr. and Mrs. Client, the reason I think capital gains harvesting would be great in your situation is because we have ______ left in your 0% bucket.”

- Get your client’s tax returns every year. This makes practicing easier, as you’ll have more real-life examples. It also prepares you for specific client meetings.

We have a growing library of articles here at Retirement Tax Services. You can hear Steven’s insights for advisors in the Retirement Tax Services Podcast.

Remember: Tip your server, not the IRS.