No one goes to an urgent care center complaining that the Family Doctor can’t also do open-heart surgery. We all understand that “doctor” is a general term.

Depending on your situation, you may need a whole team of doctors to address all your medical needs. The same holds true in a taxpayer’s financial life, but they typically don’t see it the same way.

Reviewing tax returns is a great way for Financial Advisors to learn about their clients. Even better, it’s a great way to find opportunities to deliver more value to their clients.

One of the objections taxpayers have, when their Advisor asks for a copy of their tax return, is:

“I have a tax preparer, why would you need to see my return?”

And the reason why is that tax preparers are only focused on what the client has already done. They don’t consider planning opportunities that might be available in the future.

A tax preparer is not inherently a tax planner—and everyone should have a tax planner working on their team.

This isn’t a criticism of tax preparers. They are doing what they were trained to do.

They are also doing what their clients ask them to do. Which, more often than not, is “get me a huge refund right now”.

Refunds feel good when you get them, but they are poor planning in the short term. Not only that, but refunds provide a false sense of “winning” without telling us whether the taxpayer is overpaying the IRS.

Having a tax planner on the team doesn’t have to mean a whole other person. An advisor committed to tax planning can fill this role.

Where Tax Planning’s Value Shines

On the other hand, advisors can partner with a tax preparer who is willing to go beyond simply filing a Form 1040 each year. The question is, “What is the value to the taxpayer; the client, of having a true tax planner?”

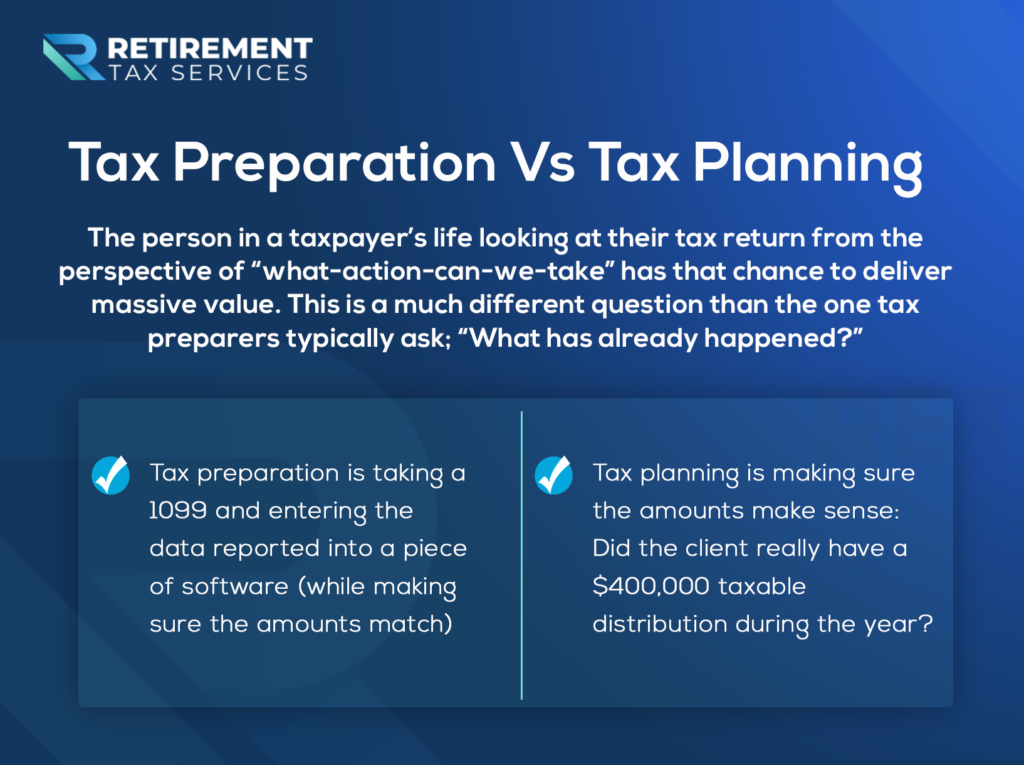

Let’s cover some examples. Tax preparation is taking a 1099 and entering the data reported into a piece of software (while making sure the amounts match).

Tax planning is making sure the amounts make sense: Did the client really have a $400,000 taxable distribution during the year?

Does it make sense that the client’s tax bill jumped $80,000 in a single year?

In one client’s case, just asking those questions would have saved months of time and immeasurable stress and frustration. The 1099 was wrong (an all too common occurrence) and reported a rollover as a taxable distribution.

Because the tax preparer was only focused on what happened last year, the return was filed and the taxes paid, all in error.

Thankfully for this taxpayer, they worked with an Advisor committed to tax planning. They reviewed the filed tax return and saw the issue immediately.

The error was corrected, but amending tax returns takes months. With the IRS’s backlog in 2021 and 2022, there have been cases where even a simple change has taken 18 months to fully process.

Beware of Inaccurate Expectations

What about Medicare? There is a two-year delay between crossing into a new Income Related Monthly Adjustment Amount (IRMAA) and the increased premiums being paid.

Warning a taxpayer the increase is coming won’t change the fact that they have to pay it. However, setting clear and accurate expectations reduces unwelcome surprises.

Even still, for the Advisor committed to tax planning there are times when this can give us a chance to change the outcome. Take, for instance, a taxpayer who is going to have significant one-time income, like the sale of a house.

If there is a $100,000 gain pushing the client into a new IRMAA bracket, a tax planner will step back and ask, “Would it be possible to split the timing of the sale and have half in December and half in January?”

Spreading the sale across two years has the potential to save a taxpayer thousands of dollars.

Who is in the best position to know whether a taxpayer is maximizing retirement plan contributions? If it didn’t get reported to the IRS, it didn’t happen.

The person in a taxpayer’s life looking at their tax return from the perspective of “what-action-can-we-take” has that chance to deliver massive value. This is a much different question than the one tax preparers typically ask; “What has already happened?”

Everyone should have someone in their financial life who is proactively looking at their tax situation to make sure the IRS isn’t winning by default.

Not taking action is still a choice, but is it the right one?

Hint: the answer is nearly always no!

Take Action

1. If you are the tax planner in your client’s life, good! Make sure you have a clear process for continually improving your skills and the value you are offering to your clients. What is one thing you are going to add to your process for tax planning this year to make sure your clients are taken care of?

2. If you aren’t the tax planner in your client’s life, good! You have an opportunity to deliver more value to your clients. As you work to become the expert in tax planning for the niche you serve, you can deliver value along the way. Commit to having taxes on your client meeting agenda at least annually.

Start by getting and reviewing tax returns. If you aren’t sure what to do once you have the tax return, there is no time like the present to start practicing. If you really don’t know where to start, find a CPA you would like to have a better relationship with. Offer to pay for an hour of their time in walking you through a Form 1040.

3. If your client has a tax preparer that they always go to (before you) for tax advice, good! Tax preparers are really great at what they do. Accurate reporting to the IRS is essential.

It’s up to you to build that relationship so that your client has a team working in concert for their benefit. Otherwise, they are left with two conflicting opinions to sort out.

My crystal ball works just as well as yours. So, while I can’t guarantee it, I am confident that taxes are not getting easier anytime soon.

Commit to being part of the solution in your client’s life to help them stop overpaying the IRS.

Remember, we tip our servers, not the IRS.