“Are you funding your IRA?”

This frequently-seen retirement question is an important starting point.

However, it can sometimes overshadow other opportunities to save and invest for the future in tax-advantaged ways. This article was prompted by questions we received—and covers one of those opportunities: Health Savings Accounts (HSAs).

HSAs were originally created in 2003, but they often go underutilized or misunderstood, even today.

As you know, an HSA allows eligible individuals to contribute pre-tax dollars for medical-related expenses.

Like any opportunity from the IRS, there are a lot of conditions and caveats. HSAs are sometimes referred to as “Triple Tax-Advantaged.” This is because the money goes in tax-free, grows tax-free, and—as long as they are used for eligible expenses—distributions are tax-free, as well.

This is also one of the few tax savings opportunities that have no income restrictions: There are zero income-related phaseouts for eligibility to contribute to or use an HSA.

Remember to explain to clients that unlike other types of investment accounts, HSAs are individual accounts. You CANNOT have a joint HSA account.

This is confusing, at times because contribution limits are different for individuals than for families. In fact, contribution limits are a separate determination from eligibility. An HSA is always going to be in an individual’s name, regardless of their marital or tax filing status.

Eligibility

The first step in using an HSA is determining if a client can contribute. Look for eligibility criteria whenever you meet with prospects. Watch for it when clients have major life changes, too.

An employer offering an HSA usually means that clients can set up their own. However, employer sponsorship is not the only avenue.

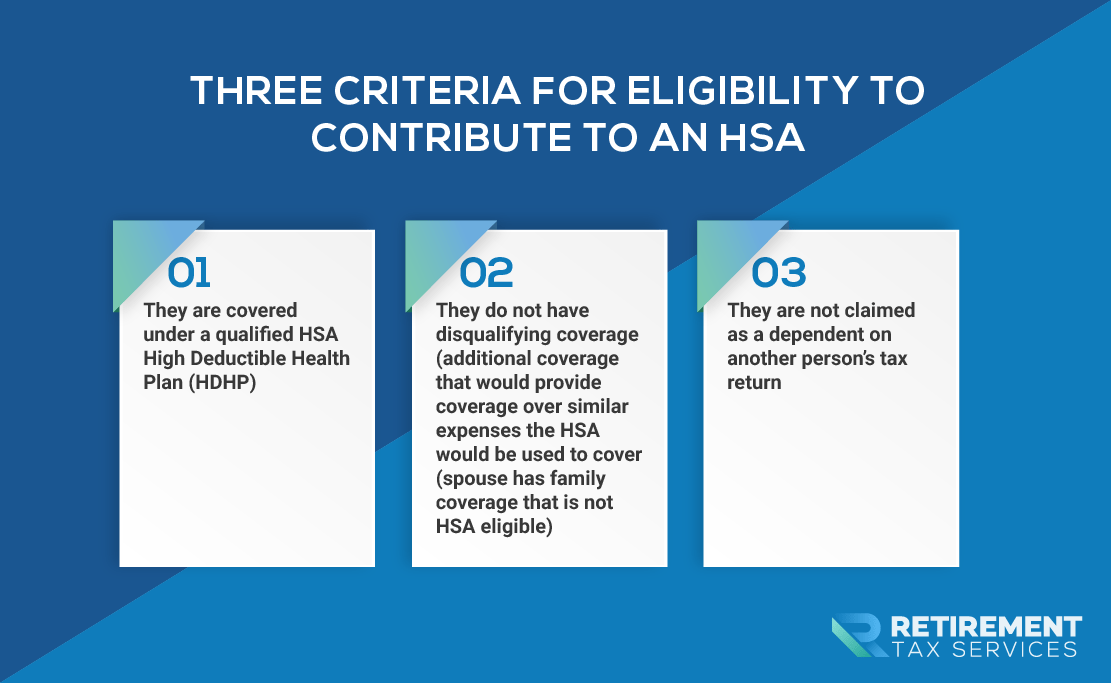

The IRS has established 3 criteria for eligibility to contribute to an HSA. An individual has to meet all of them:

Whether a client is a W-2 employee or self-employed, it is critical that they work with their benefits provider. Make sure that their HDHP qualifies for HSA eligibility.

There are thresholds for deductibles and out-of-pocket maximums for these types of plans. Regardless, it is best practice to double-check. Never assume a plan is eligible because the deductible seems high.

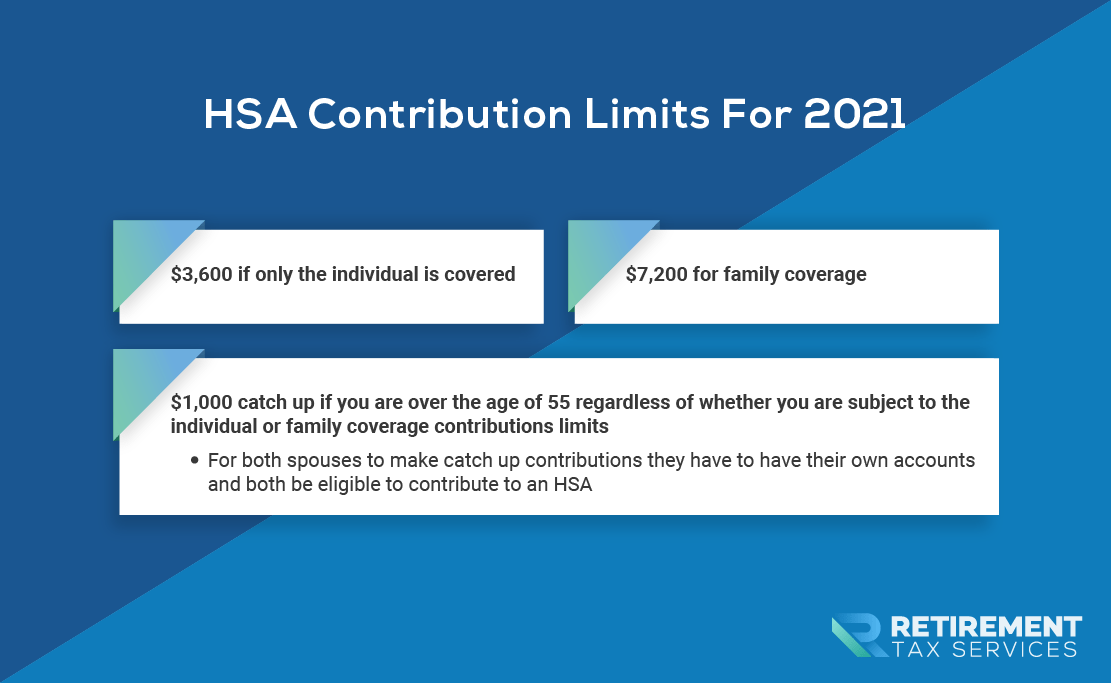

Contribution Limits

Once eligibility is determined for an individual, look at how much they are allowed to contribute in a year. Remember that eligibility and contribution limits are separate determinations. This is absolutely critical.

For married clients, it is possible that one spouse could be ineligible to contribute—though the other can still contribute up to the family’s coverage limit. See the Medicare example below for more on how this works.

Eligible individuals’ contribution limits are based on the type of coverage provided by their HDHP. This is what makes them eligible for the HSA.

The important distinction is whether they have individual coverage or family coverage (family coverage can be a spouse, children, or both).

Some employers contribute to their employee’s HSAs. The above contribution limits are the total for both employee and employer contributions.

So, for individual coverage, if the employer contributes $2,000 the employee can only contribute another $1,600 to get to the limit of $3,600.

Using HSA Funds

They are referred to as Health Savings Accounts, but most HSA providers facilitate investing to create greater growth opportunities. This is a chance for Financial Advisors to add value through tax planning. Some HSAs have minimum balance requirements to be able to invest but they are typically low (~$1,000).

Even if a client already has an HSA set up, make sure you are reviewing their investment allocations. Verify that they are investing; not just earning a negligible amount of interest.

One limitation of HSAs is that the rules are very specific on what the funds can be used for. “Medical” expenses are a good rule of thumb. On the other hand, that does not limit an individual to prescriptions and doctor’s visits.

You can review the full list of eligible expenses from the IRS here. More and more retailers going out of their way to make it easy to identify HSA-eligible products. In fact, Amazon.com has a shopping selection for “FSA or HSA Eligible Products.”

If you are over 65 and use HSA funds for an ineligible expense, you must include the amount in your taxable income that year. HSA distributions are reported on IRS form 8889, along with HSA contributions.

If you are under 65, you will pay a 20% penalty for ineligible expenses. That’s in addition to your taxable income for the year.

This penalty is a good reminder: HSAs should be part of the overall planning process. In other words, don’t relegate them to being a stand-alone consideration.

It does not replace a general emergency fund, either. Monitor the overall balance over time. While you’re at it, make sure it doesn’t grow beyond practical use for medical expenses.

Beneficiaries

HSAs can (and should) have beneficiaries assigned to them. Which, of course, prompts the question: What are the rules for HSA funds received by a beneficiary?

For a spouse, there is no change. The HSA account will be in their name, but the funds are still 100% tax-free, provided they are used for medical expenses.

Additionally, if the spouse is over 65, there is no penalty for using the funds for non-medical expenses. They just have to pay income tax at their ordinary rate in that year.

If the spouse is younger than 65, they cannot use the original account holder’s death as a distribution event. This will only incur the 20% penalty. However, there are no time limits on how long they have to use the funds.

Non-Spouse beneficiaries have 12 months within which to distribute the funds. They must include, in ordinary income, any amounts outside medical expenses during that time.

Only a non-spouse beneficiary is immune to the 20% penalty, regardless of age.

Should a client use an HSA?

If you have a choice between an HSA-eligible plan and a non-HSA eligible plan, look at the individual circumstances. They determine the right course of action.

Typically, premiums are lower for plans that are eligible for an HSA. Your client’s medical situation or that of their family could influence finding their best option.

HSA’s can be a superior way to efficiently pay for medical expenses. Consequently, any eligible clients should strongly consider them.

Take Action

- Include HSAs in your annual beneficiary review. Make sure a beneficiary is named. Verify that they are still consistent with the client’s wishes.

- Include HSA eligibility as something you explore for prospects. Review it for ongoing clients on a regular basis, as well: Statuses can change over time.

- Review your clients tax returns. HSA contributions are reported on Schedule 1 of the 1040 and Line 12 of the 2020 return. Details of the eligibility of contributions are determined on form 8889

If you are an RTS Member, add to the forum discussion on this topic. We look forward to hearing from you.

Great advisors provide value in all aspects of their clients’ financial lives. CPAs do not have exclusive rights on all things tax-related. Many of them will thank you for taking these steps with your shared clients.

Even if you find yourself in a situation that is beyond your expertise, you can still serve your client and provide value through partnering with them.

Work with the tax experts. Don’t just sit back and say, “Sorry, I don’t give tax advice.”

Good luck out there and remember to tip your server, not the IRS.