It wasn’t a secret this was coming. But, it may still come as a surprise to many taxpayers. Beginning on January 1, 2022, there was a MASSIVE reduction in the threshold for reported transactions by companies to the IRS. This includes payment processors.

Prior to passing the American Rescue Plan Act of 2021 (ARPA), third-party payment processors, like PayPal, Venmo, and Cashapp only filed Form 1099-K for transactions over $20,000 in one year. That is with at least 200 separate transactions.

Of course, IRS law still required taxpayers to report all income from any transactions. This was regardless of whether they received a 1099-K. However, some taxpayers omitted it because nothing was reported to them or to the IRS.

Under the new law, any individual or business that receives more than $600 in a calendar year receives a Form 1099-K. This is regardless of the number of transactions.

Why is this important for Financial Advisors and their clients?

Because there has been a significant shift in the way people make money.

Before 2020, many taxpayers only received compensation from an employer. Meanwhile, employers calculated and withheld employees’ portion of Federal, FICA, and State income taxes.

Now, more and more people participate in the “gig” economy. They are technically considered self-employed. It doesn’t matter if they think of themselves that way or not.

They are now responsible for paying the taxes that used to be withheld. Additionally, they must cover the portion typically paid by employers.

Without proper planning, many taxpayers face a larger tax bill for 2022 than in previous years.

The Deeper Details

The new rule took effect on January 1, 2022. Taxpayers who weren’t previously subject will receive their first 1099-K under the new law in early 2023 for the 2022 tax year.

It’s important to educate clients on what are reported transactions to the IRS and what are not. Help them understand the implications of this law on their cash flow. Similarly, show them their potential tax liability.

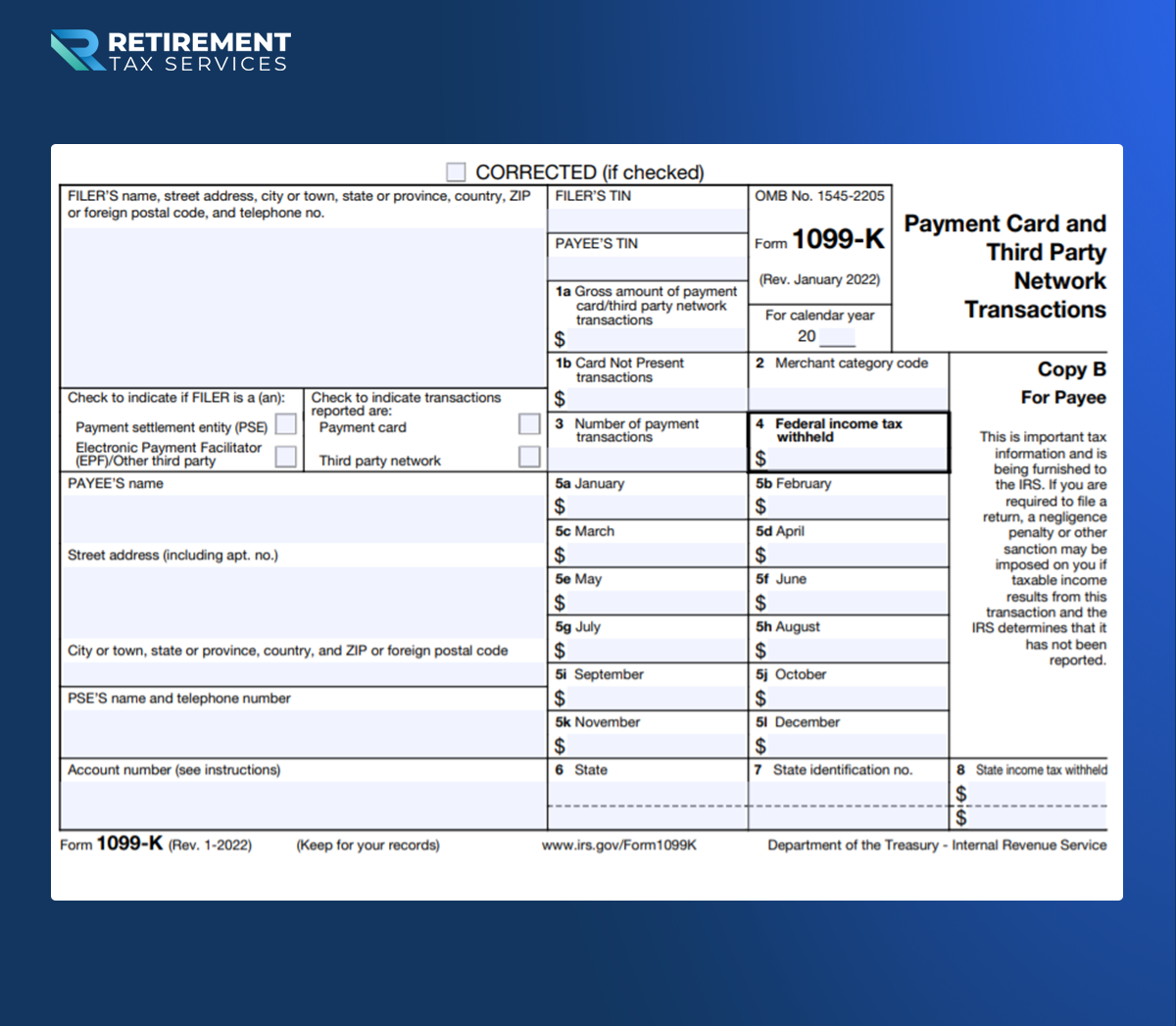

What is reported to the IRS:

- Gross receipts on behalf of the taxpayer.

- A breakdown by month of gross receipts.

- Amounts withheld for Federal Income tax (if applicable).

- Amounts withheld for state income tax (if applicable).

What is not reported to the IRS:

- Fees for processing electronic payments through the third-party payment processor.

- Fees paid to websites facilitating taxpayers’ business activities.

- Basis in any assets purchased for the business.

- Costs associated with the general operation of the business.

This means clients must keep good records of their expenses. Otherwise, they could potentially pay income and self-employment taxes on the total amount reported.

Action items for minimizing the surprise & potential pain:

1. Educate yourself on how each 3rd party payment processor is handling the new reporting requirements

-

- Processors like PayPal have released guidelines for the new requirements.

- They may present the option to choose whether the payment is a reimbursement to a friend/family member, or for goods and services. However, the payee has to make the selection—and it may only appear once (when the contact is first entered).

2.Educate your clients on the importance of good record-keeping

-

- Clients should keep a well-organized, detailed record of expenses incurred while operating their business. This helps reduce their taxable income.

- As of this article’s publication, the business expense rules have not been finalized for 2021 or 2022. However, IRS Pub 535 gives guidance on expenses that are deductible in the normal course of business.

3. Consult with a tax professional or use a tax planning tool

-

- Talking to a tax professional may help with planning for the additional liability and calculating quarterly estimated tax payments. Verify planning for other items that may be affected by an increase in taxable income, like tax credits, too.

- Maintain good communication with your client throughout the year. In conjunction with a tax planning tool, this may reduce unexpected tax liabilities on their 2022 return.

While these new reporting requirements may seem like all bad news, there are a few benefits as well. The additional self-employment income may be an opportunity to invest in tax-advantaged retirement or medical accounts.

And, by maintaining a line of communication throughout the year, you are demonstrating your level of commitment to them and their financial success.

Remember to tip your server (even if it means they pay more taxes), not the IRS!