Background

One of the most commonly-searched phrases around taxes and retirement is “retirement tax brackets.”

Your clients want to know what to expect in retirement. However, when it comes to paying Aunt IRS, there is a good chance they are making the wrong assumption.

At 40,000 feet, it’s not hard to see how they land at this conclusion:

“Surely I will make less money when I retire? Tax brackets are based on how much I earn. I will definitely be in a lower tax bracket then than I am now.”

If only it was that simple.

Your Retirement Bracket Might Be Higher Than Expected

For many taxpayers, retirement is the first time they have the ability to make choices about their income.

- When to start taking social security

- How much to distribute from an IRA

- Whether to keep working after a pension has kicked in or they become eligible for social security

92% of tax filers receive a W-2. For most taxpayers, that means they have worked hard during their life. At the same time, they have never had significant control over their income until retirement.

When an employee is offered a raise or a bonus, they accept it with very little thought of the tax consequences. They likely realize they will pay more in tax because they earned more. Regardless, the idea of making proactive tax choices is new.

Paychecks always come on the 1st and 15th. But, in retirement, taking a distribution in January instead of December could increase the amount of tax the retiree pays.

This is all uncharted territory if they don’t have someone to guide them through it.

Troublesome Retirement Taxes

The tax code is complicated. Some might even say it’s boring and overrated.

Additionally, the tax code is not intuitive. There is no page that says “Bob and Sue Client will be in the 22% retirement tax bracket.”

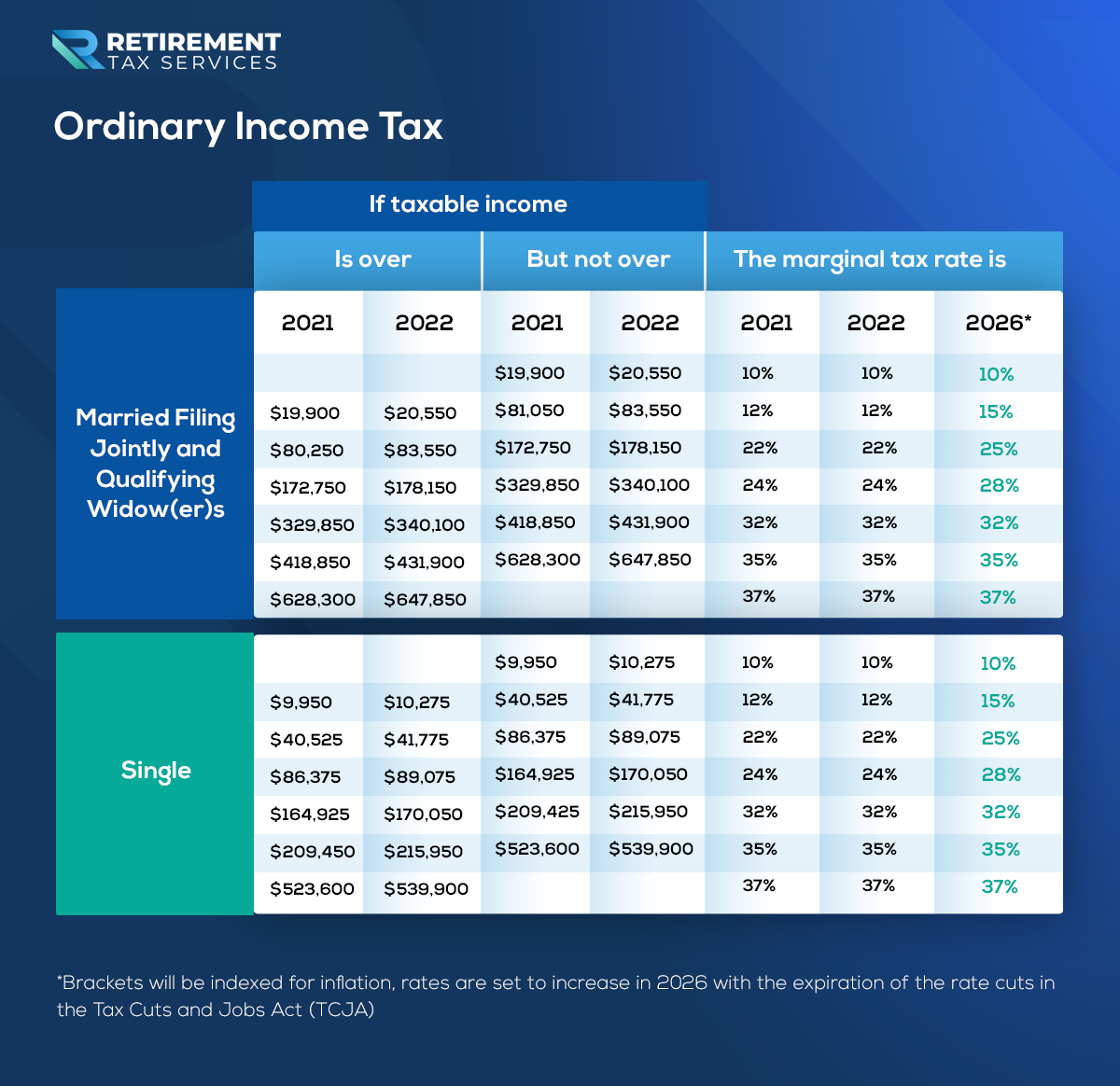

Even the pages that include tax brackets are not helpful to the average taxpayer. Looking at ordinary income tax tables, most taxpayers are not going to come up with the right answer to “How much tax will I pay on that?“

Specific to retirement, the tax rate applied to IRA and 401(k) distributions is a common area of confusion.

In fact, the IRA and the 401(k) are 2 of the most common accounts used to prepare for retirement. Taxpayers frequently misunderstand the tax implications of distributions from them.

It may seem obvious to Financial Advisors, but helping clients understand is critical: The tax advantage of these accounts is in the deferral; not the type of tax rate applied to distributions.

These tax-qualified accounts often lead taxpayers into a higher-than-expected tax bracket in retirement, as well. That happens as a result of required minimum distributions (RMDs).

Taxpayers who have saved well for retirement through tax-qualified accounts have a very real chance of this. In other words, RMDs may push them into an even higher tax bracket once they turn 72.

Deferring taxes can be a great strategy. On the other hand, the IRS is only so patient. They will eventually require that the income is recognized and the taxes are paid.

Many taxpayers will pay higher taxes in retirement because of having more income (social security, pensions, rental properties, side hustles, RMDs, et cetera). Meanwhile, we already know that tax rates are going up for everyone.

No, that is not a prediction about what congress is going to do to the tax code. We do not have inside information. The Senate has yet to call our tax team for input, either.

However, based on the current law in place under the Tax Cuts and Jobs Act (TCJA), rates will go up almost across the board beginning in 2026.

Another Upcoming Increase

Additionally, the standard deduction will also decrease significantly beginning in 2026. This will push even more income into higher tax brackets for many taxpayers.

As a result, clients with consistent income—or potentially even slightly lowering income—will still pay more in retirement taxes than they do currently.

The other very real situation to consider is for married couples. When one spouse passes away, the tax situation shifts dramatically.

For a married couple filing jointly, the first $83,550 of income only puts them in the 12% tax bracket. But, when one spouse passes away and the remaining spouse files as a single filer, that amount is cut in half.

As soon as their income exceeds $41,775, they are taxed at 22%. Effective tax planning is essential up to and throughout retirement.

Countless taxpayers who get to retirement are unpleasantly surprised because their tax situation isn’t less complex at all.

As a Financial Advisor, you have the opportunity to help your clients prepare financially for retirement. However, to add even more value, you educate them. Set realistic expectations for what will happen in their next chapter of life.

Take Action

- Include tax education in your client meetings at least annully. The goal isn’t to give them a crash course on taxes and then hope they remember. Reinforce the most applicable principles to their situation over the course of your relationship.

- Review tax returns for every client, every year. There is no better way for a Financial Advisor to understand a client’s financial situation than reviewing their actual tax return.

Remember to tip your server, not the IRS.