Background: Tax-deferred Accounts

Tax-deferred retirement accounts, like IRAs and traditional 401(k)s, are only one piece of the retirement plan puzzle. While there are other important pieces, these accounts tend to be the most commonly known and used tools.

They can be wonderfully powerful tools, but here’s the problem: Most of your clients don’t actually understand what their account balance means.

This came up recently with a taxpayer who is trying to decide when to retire. As part of the conversation, the topic of unexpected major expenses came up.

One of the comments “Bob” made was:

“Well I have $200,000 in my 401(k) so anything less than that and I’m good.”

Financial Advisors reading this are going to instantly sigh. They know that Bob is in for a nasty surprise when Aunt IRS comes calling.

However, Bob is far from alone in thinking this way. Too often taxpayers think of their IRA or 401(k) the same way they do their bank account:

“My statement says $200,000, so I could withdraw $200,000 tomorrow if I wanted to.”

Which, of course, completely ignores the taxes due when that withdrawal is made. It likely skips over the potential for penalties if they are under 59 ½, as well.

Side note: This same fallacy happens all too often when taxpayers are thinking about social security and pensions.

Taxes are often the single largest expense individuals will face in retirement. Without your help, this will be ignored in their plan.

Bad News: Your $200,000 IRA Isn’t Really Worth $200,000

Help Bob understand that once the IRS takes their share, he will optimistically have $160,000 left. This is a crucial step in the planning process.

That piece of education doesn’t change how much he has access to. However, it helps set better expectations. It also identifies potential shortfalls earlier, hopefully when there is still time to adjust.

We like to refer to the taxes due on an IRA when the money is withdrawn as a client’s “IRS Mortgage.” Unlike a traditional mortgage, the rate on an IRS mortgage is variable—and completely up to the mortgage holder.

This is another key piece that is often missed by taxpayers. The IRS allows taxpayers to defer the taxes on their savings. Meanwhile, they make no commitment on how much someone will be charged in the future.

One of the seldom-cited benefits of using a tax-deferred account is that it gives taxpayers the ability to choose when to pay taxes. Your clients rightfully wonder what their retirement tax bracket will be, but the reality is no one knows.

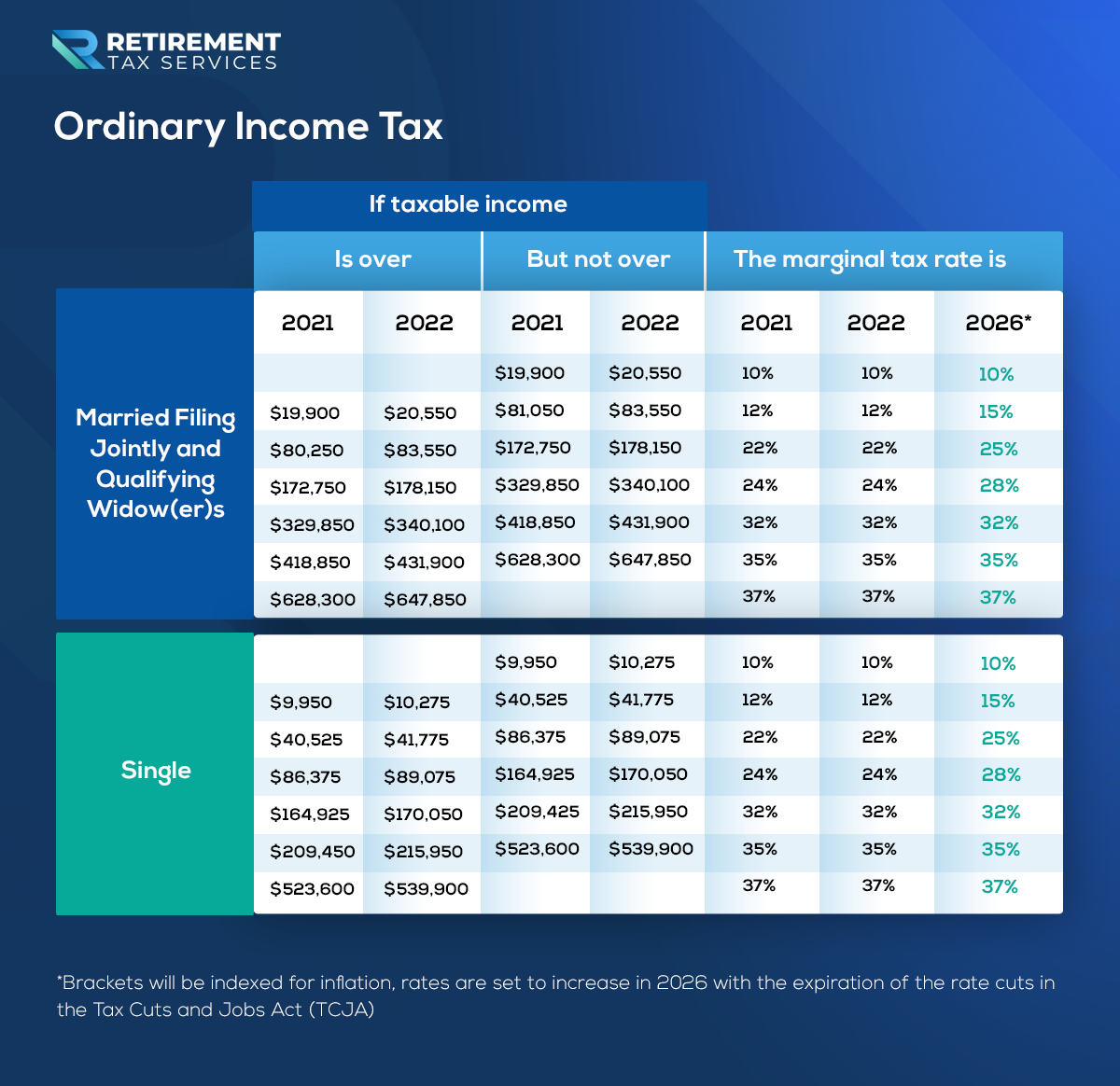

We do know that even without any proactive tax law changes from Congress, tax rates will go up in 2026 when provisions of the Tax Cuts and Jobs Act expire. This makes it incredibly important for taxpayers to know that they have a choice.

Tax-deferred Accounts: Helpful Income Tax Bracket Tables

Download the RTS Tax Reference Guide

Accelerating income, whether through Roth conversions or capital gains harvesting, can be an intimidating conversation. You literally have to tell your client, “I think you should go ahead and pay taxes now that you wouldn’t otherwise have to.”

It probably flies directly in the face of everything their tax preparer has told them for years. For great Advisors, this means having a better way to frame the conversation:

“Bob and Sue, no one knows what tax rates will be in the future when you need to take money out of your IRA. We do know that rates can do one of three things: go up, go down, or stay the same.

Would it be alright if we started moving money into an account that would take away the IRS’s ability to change the game on us later? We would have to pay the taxes on the money now, but from there, the money—and any growth—would be completely tax-free.

If tax rates go up or stay the same, we come out ahead, so the only question is are you worried that taxes might go down?”

The Real Math on the Value of Your IRA

Tax-deferred accounts can be great. Early withdrawal penalties incentivize taxpayers to save money for longer. Uncertainty about future tax rates provides great planning opportunities for advisors.

In the not-as-common-as-it’s-made-out-to-be scenario where a taxpayer is in a lower retirement tax bracket during their working years, the benefits can be even larger. The benefit that provides the biggest opportunity is the flexibility to choose.

Make sure you are working proactively with your clients to make a choice. For some clients, the best option will be to keep their savings in a tax-deferred account.

Even then the dishwasher rule applies. Make sure the client knows you’ve evaluated their situation and recommend that action not be taken. That is still a choice.

This may seem basic, but the basics, consistently applied, are often the most valuable planning an Advisor can help clients with.

On top of that, I can almost guarantee that most of what you think is basic when it comes to taxes is still Greek to your clients.

Take Action

- Educate your clients. Taxes should be included in client meetings every year they pay taxes. This means EVERY year. Don’t skip the basics.

- Get tax returns for every client. What’s that have to do with this article? First of all, if it’s not reported to the IRS correctly, it didn’t happen. Secondly, the tax return is one of your best tools for learning about your clients.

- Use the dishwasher rule. Evaluate this for all of your clients. Let them know you did it, even when no action is needed: “Great news Bob and Sue! We reviewed your retirement accounts to make sure your money is in the best location available for taxes purposes and no action is needed this year. Don’t worry, we will look at this every year for you and let you know if something changes”.

Remember to tip your server, not the IRS.