The IRS is not shy. They want a cut of the action anytime money is involved.

Taxation doesn’t discriminate either: They will take their piece whether it’s cash, real estate, crypto, wire transfer, stocks… and the list goes on.

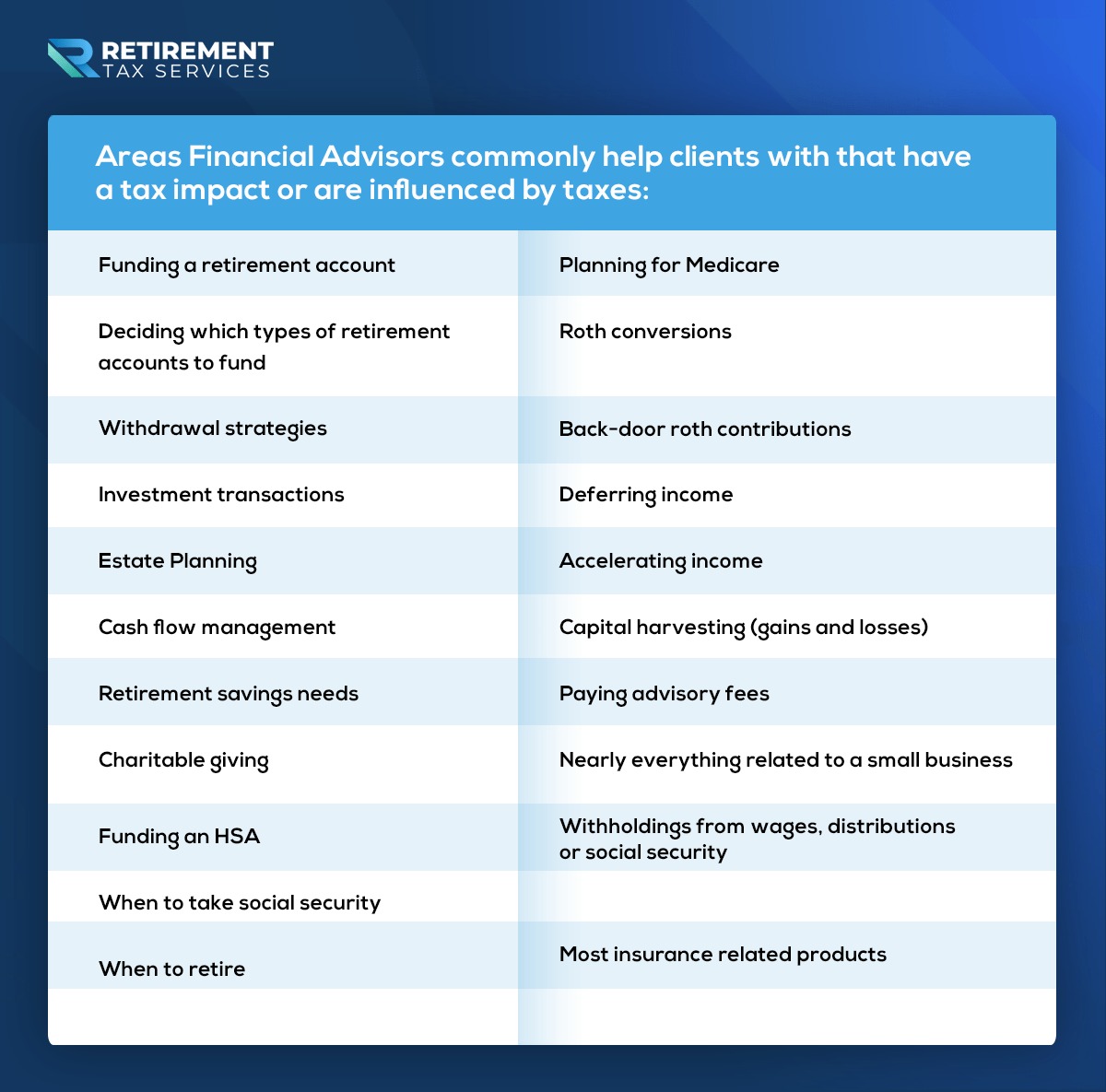

This means that if you are involved in any way with someone’s financial life, your recommendations have tax implications.

Your disclaimer that says “This is not tax advice, get a 2nd opinion,” might be on every communication you put out. However, that doesn’t change the fact.

Your clients are making decisions that affect their tax situation based on your advice.

That’s certainly not an exhaustive list, but it helps give us context.

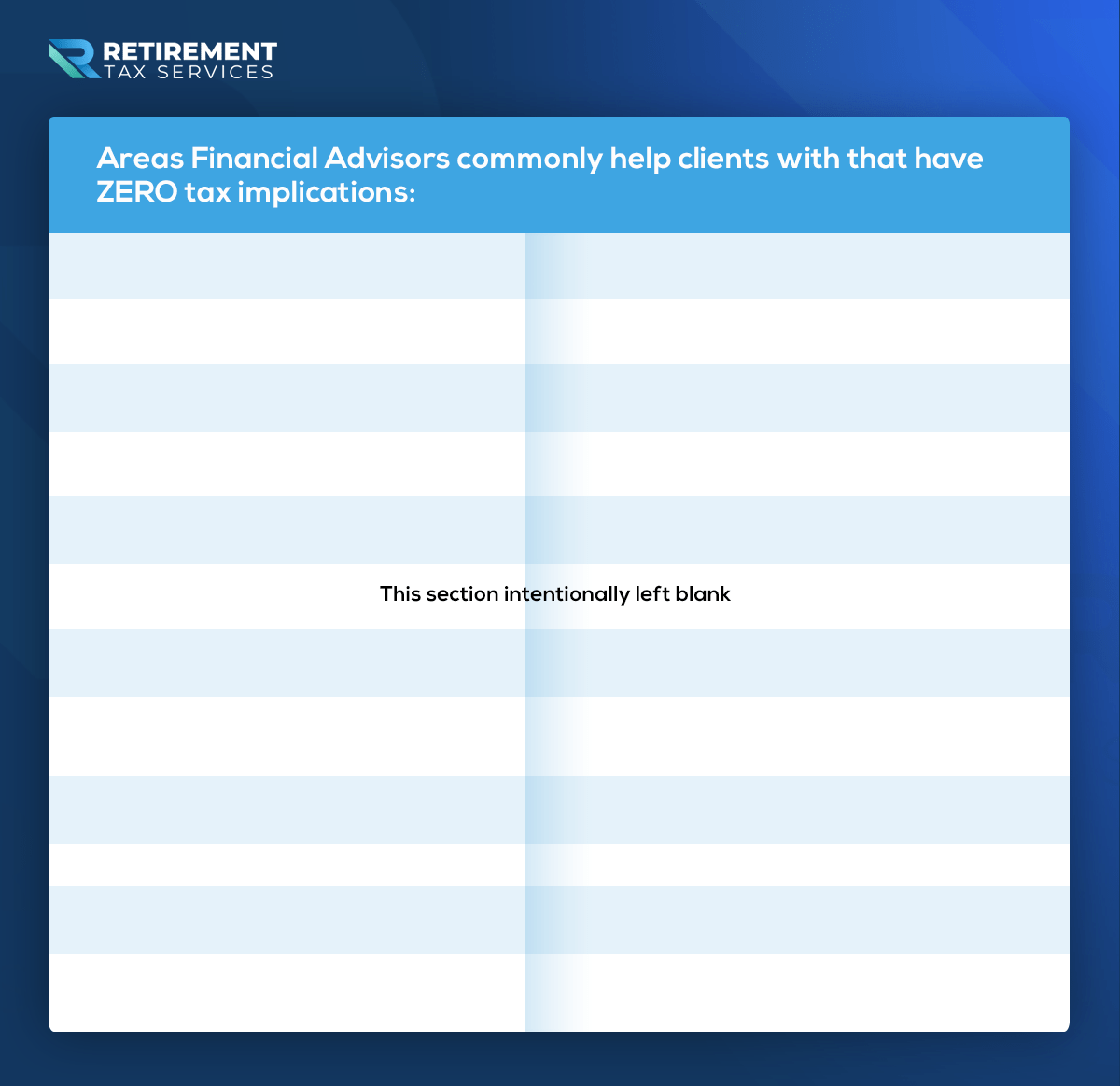

Now, here are areas Financial Advisors commonly help clients with that have ZERO tax implications:

To this point, no Financial Advisor has been able to provide us with an example of a planning service that does not have a potential tax implication. Maybe you have one to add to the list, but it won’t change the overall conversation.

Taxes impact everything you do with your clients. The question, now is “What are you doing about it?”

How formally you can tackle tax planning with your clients may be dependent on the channel you are in. HOWEVER, we personally know advisors—from the biggest wirehouses to the smallest RIAs—that deliver value through tax planning.

Proactively working with your compliance department is a topic for another day. At the same time, it is not a limiting factor for Financial Advisors committed to providing amazing service to their clients. The key is being intentional.

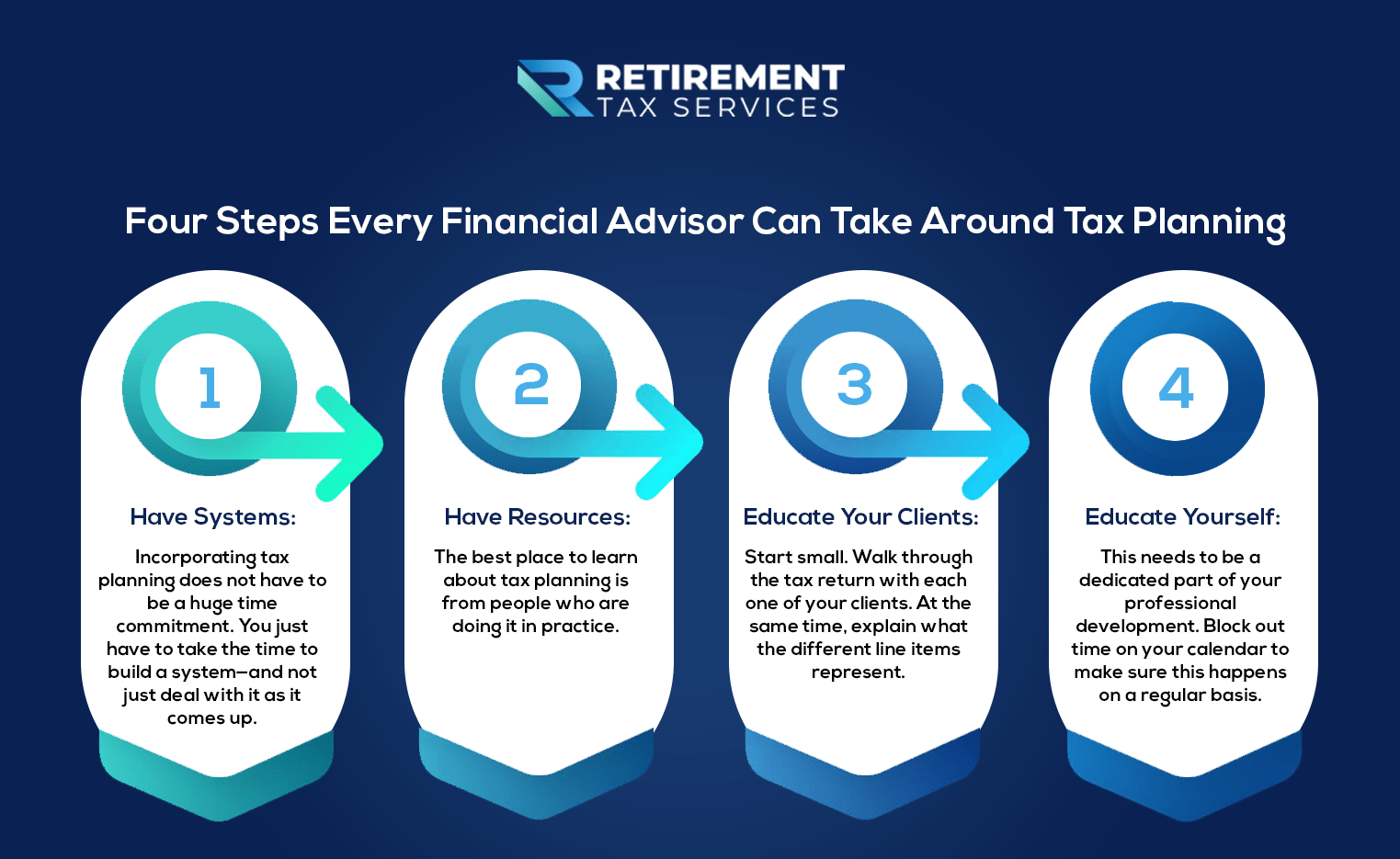

4 STEPS EVERY FINANCIAL ADVISOR CAN TAKE AROUND TAX PLANNING:

Have Systems

Give tax planning a place to live. For you to effectively deliver value through it, it can’t be an afterthought or something you just tell yourself to remember to bring up.

When you build your calendar for the year, make sure you have at least one value add for clients that is tax-focused. Whether that is a piece of content you send them (see “Educate Your Clients,” below) for their benefit or something to make their life easier, like a Year-end 1099 letter, commit to it ahead of time.

Plan for it. By default, most taxpayers only think about taxes at tax time. They try to avoid it for the rest of the year, if possible.

Asking your clients to provide a copy of their tax return once during a meeting is not a system for success. Make sure it is on your pre-appointment reminder list.

Put it on your meeting follow-up, as well. Additionally, provide a simple, secure way for your clients to send their returns to you.

Once you have it, you should have a checklist you (or a member of your team) uses to do a thorough and efficient review.

Incorporating tax planning does not have to be a huge time commitment. You just have to take the time to build a system—and not just deal with it as it comes up.

Have Resources

Think of this in 2 buckets: “Community” and “Partners.”

Who do you go to when you have questions about tax planning? Quite often, the best place to learn is from people who are doing it in practice.

Having a community of professionals willing to share their experiences and answer questions can be an incredible resource. This will help you to get timely answers to the situations you are dealing with.

At the same time, it will allow you to learn from other advisors’ experiences. This means you can continually elevate your game.

With this in mind, RTS Members can click here to access the Members Forum.

Even if you don’t have the final answer on a tax situation for a client, you can still deliver massive value by helping to coordinate the resources they need. Pre-screening professionals for them is something they will appreciate on its own.

In fact, helping to manage this relationship can take that value even further. Either way, the better network of centers of influence you have, the better positioned you will be to help.

If you are looking for ways to expand your network in this area, here is an article we recommend.

Educate Your Clients

For most of your clients, taxes are both their largest expense and the expense they least understand.

In addition to finding tangible tax savings, focus on tax education with your clients; pulling back the curtain takes away some of the mystery. That is a huge value-add.

Mysteries might be fun in movies, but tax mystery equals tax worry. There are many tax-related headlines in the news and on the internet.

Meanwhile, most taxpayers don’t know where to turn for reliable information. They know they will have to keep paying taxes, but the details are a black box.

So, start small. Walk through the tax return with each one of your clients. At the same time, explain what the different line items represent.

Pro Tip: practice doing this upside down, so the return is facing them as you sit across the table from them. If you’ve recently done this with your clients prepare short, relevant tax information you can share with them, too.

Topics like common tax myths, information on an upcoming life change like retirement, the sale of a home, or claiming social security make good standbys.

For this to be effective, you need to be intentional and consistent. Don’t try to give clients a degree in taxes during the first meeting. Instead, help build their comfort over time.

Educate Yourself

We are, of course, partial to the content that Retirement Tax Services puts out through our website, the Retirement Tax Services Podcast, and our membership.

However, there is a lot of great content out there that is continually being updated. Jeffrey Levine and the team at Kitces.com are a great resource, along with the fine folks at IRAhelp.com.

If you prefer live learning, the AICPA Engage Conference has sessions specifically for Financial Advisors. The Gear Up seminars by Thomson Reuters are great for advanced topics, too.

Regardless of where you get your tax education from, this needs to be a dedicated part of your professional development. Block out time on your calendar to make sure this happens on a regular basis.

Congress is kind enough to change tax laws with some regularity, so—regardless of your current tax knowledge—committing to tax education is crucial.

There are nearly endless different tax topics you could focus on. So, take the time to identify which ones are most applicable to your specific client base. Consequently, you can better direct your attention.

Look for common themes as you review client tax returns and have client meetings. Let these topics drive what you dedicate your tax education time to.

Take Action:

- If you haven’t already implemented the 4 steps above, start there. Add a deadline to your calendar for taking action in each of these areas. It might just be one per quarter. You have to fit in more than just tax planning, but put a time frame for when you will focus on it.

- If you already are doing the 4 steps, evaluate how effective they are. Verify each one’s benefit through your service model. Take the time to make sure they are all still delivering value to your clients.

Great advisors provide value in all aspects of their clients’ financial lives. CPAs do not have exclusive rights on all things tax-related. In fact, many of them will thank you for taking these steps with your shared clients.

Even if you find yourself in a situation that is beyond your expertise, you can still serve your client and provide value through partnering with them.

Work with the tax experts. Don’t just sit back and say, “Sorry, I don’t give tax advice.”

Good luck out there and remember to tip your server, not the IRS.